Fintech Freeze: Regulators Suspend Major Remittance Players Over Breaches!

The Bank of Ghana (BoG) has taken stringent action by suspending the remittance partnerships of eight companies, comprising five Money Transfer Operators (MTOs) and three Payment Service Providers (PSPs), along with United Bank for Africa (UBA) Ghana Limited. This significant enforcement move, effective from Thursday, September 18, 2025, comes as a direct consequence of repeated violations of the central bank's regulatory framework.

The affected entities include Flutterwave, Cellulant Ghana, Tap Tap Send, Afriex, Halges Financial Technologies, Top Connect, Remit Choice, and Send App. The primary reason for these suspensions is the breach of the Updated Guidelines for Inward Remittance Services by Payment Service Providers, 2023. Specifically, Flutterwave and Cellulant Ghana were identified for violating Paragraphs 5 and 7.1–7.3 of these critical guidelines. Paragraph 5 details the application requirements for Dedicated Electronic Money Issuers (DEMI) and Enhanced PSPs seeking to offer remittance services, while Paragraph 7 outlines the necessary operational modalities for conducting these services.

For most of the suspended companies, the prohibition on remittance services will last for one month. However, Halges Financial Technologies faces a more severe, indefinite suspension, being barred from providing such services until it secures fresh approval from the Bank of Ghana. The BoG explicitly stated that any bank or MTO intending to engage the affected PSPs for remittance services in the future must re-apply for approval once the initial suspension period has concluded.

The regulatory clampdown extends beyond the PSPs and MTOs. United Bank for Africa (UBA) Ghana Limited, which served as the settlement bank for the suspended companies, has also had its foreign exchange trading license suspended for one month, effective from the same date. This parallel action underscores the BoG's comprehensive approach to ensuring compliance across the entire remittance ecosystem.

These enforcement actions are part of a broader, intensified oversight effort by the Bank of Ghana, prompted by recurring compliance failures within the financial sector. Recent directives issued by the central bank mandate all DEMIs, PSPs, and banks to submit weekly transaction-level reports, including daily logs and foreign exchange inflows, in adherence to the Payment Systems and Services Act and the Banks and SDIs Act. Authorities have identified and flagged frequent misuse of unapproved remittance channels, unauthorised foreign exchange swaps, and the application of irregular exchange rates as systemic threats that undermine transparency and stability.

While these heightened measures are anticipated to lead to increased compliance costs for regulated entities, the Bank of Ghana asserts that they are essential for fostering a more dependable and transparent remittance ecosystem within the country, ultimately benefiting consumers and the national economy.

Recommended Articles

Ghana Central Bank's Crypto Clampdown: New Laws to Control Digital Remittances

Ghana's diaspora remittances are increasingly flowing through cryptocurrency channels, bypassing traditional banks, as c...

Ghana's Groundbreaking Crypto Legalization Set to Reshape African Digital Economy by 2025!

Ghana is set to legalize and regulate cryptocurrencies by December 2025, marking a significant policy reversal driven by...

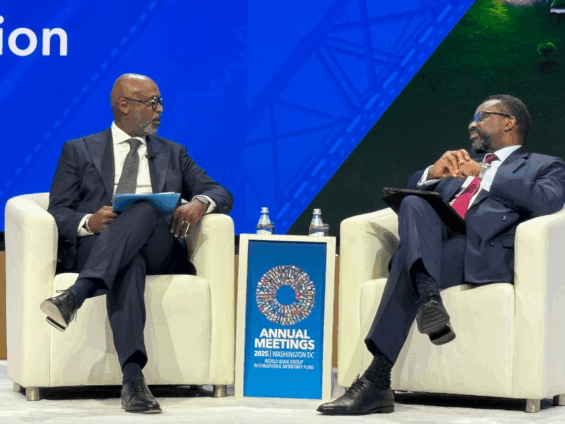

Ghana Central Bank Fires Back: Governor Defends FX Market, Assures IMF Exit

Ghana's foreign exchange market is experiencing significant pressure due to a combination of large energy sector payment...

African Lending Revolution: AGI Boss Predicts Interest Rate Plunge as Banks Brace for Change

The Association of Ghana Industries is optimistic that recent policy rate cuts by the Bank of Ghana, reducing the rate t...

Ghana's Economy Gets a Shot in the Arm: BoG Slashes Key Policy Rate!

The Bank of Ghana's Monetary Policy Committee has reduced the policy rate by 350 basis points to 21.5%, citing forecasts...

You may also like...

Digital Portfolios Are the New Business Cards; Here’s How to Build One That Gets Seen

In today’s digital-first economy, your online portfolio is your handshake, résumé, and elevator pitch rolled into one. H...

Career Pivoting: Why Changing Paths Might Be the Smartest Move You Make

In a world where stability often overshadows fulfillment, career pivoting may be the smartest move for professionals se...

Why Your First Failure Might Be the Best Thing That Ever Happened to Your Business

Failure isn’t the end of entrepreneurship, it’s the education success never gives. Here’s why your first business collap...

Consumerism vs Culture: Is Africa Trading Values for Trendy Lifestyles?

Is Africa trading its cultural values for trendy lifestyles? Explore how consumerism, foreign brands, and social media p...

The War on Boys: Are African Male Being Left Behind in Gender Conversations

Why are African boys and men often left out of gender empowerment programs? Explore how emotional suppression, lack of m...

Pay Slip, Motivation Slips: The Silent Crisis Among the Working Class

Across Nigeria, millions of workers are trapped in jobs that pay just enough to survive but too little to live. Beneath ...

Premier League's Unsung Heroes: Bournemouth, Sunderland, and Tottenham Shockingly Exceed Expectations

This Premier League season sees teams like Bournemouth, Sunderland, and Tottenham exceeding expectations. Under Thomas F...

El Clasico Fury: Yamal Controversy and Refereeing Blunders Ignite Post-Match Debates

)

Real Madrid secured a 2-1 El Clasico victory over Barcelona amidst significant controversy surrounding a late penalty de...