Ghana Central Bank's Crypto Clampdown: New Laws to Control Digital Remittances

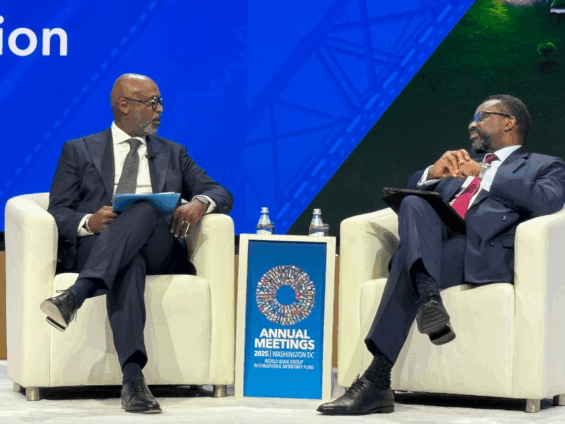

Ghana's financial landscape is experiencing a significant shift, with diaspora remittances increasingly flowing through cryptocurrency channels, bypassing traditional banking systems. Dr. Johnson Asiama, Governor of the Bank of Ghana (BoG), confirmed this trend during the IMF/World Bank Spring Meetings in Washington, D.C., noting a discernible diversion of funds towards virtual assets and stablecoins. “Crypto is one area. We always knew that the phenomenon was there,” Dr. Asiama stated, likening cryptocurrency to “the air we breathe” due to its pervasive, often unseen presence.

The central bank first became aware of this shift when official remittance inflows through regulated financial institutions saw an unexpected decline. This coincided with a period of appreciation for the local currency, the cedi. Dr. Asiama explained that the strengthened cedi meant that senders from the diaspora were receiving lesser amounts in local currency terms, prompting them to seek alternative channels for transfers. This led to a substantial portion of remittances being routed outside conventional banking channels.

Further investigations by the Bank of Ghana revealed that parallel market dealers were actively utilizing stablecoins and other virtual assets to facilitate these cross-border transfers into the country. This confirmed the central bank's earlier suspicions regarding the widespread and active use of virtual assets for terminating remittance inflows within Ghana’s financial system. Dr. Asiama underscored that this development solidified the BoG's understanding of cryptocurrency's importance, indicating that it could no longer be ignored.

In response to this evolving financial ecosystem, the Bank of Ghana has taken decisive steps toward regulation. With crucial technical assistance from the International Monetary Fund (IMF), the BoG has drafted a comprehensive new Virtual Assets Bill. This legislation aims to provide a robust regulatory framework for cryptocurrency operations in Ghana, thereby safeguarding the financial system from emerging risks and ensuring transparency. The bill is currently on its way to Parliament and is anticipated to be enacted and take effect before the end of December.

However, Dr. Asiama cautioned that the mere passage of a law is only the initial step. He emphasized the critical need to effectively track and monitor digital flows to maintain financial integrity and ensure compliance. To this end, the Bank of Ghana is actively developing the necessary expertise and manpower. It is also in the process of establishing a new department specifically dedicated to regulating and overseeing Ghana's rapidly evolving digital finance ecosystem. The Governor reiterated the central bank’s determination to build institutional capacity and establish proper oversight for virtual assets, asserting that cryptocurrency has become too significant to be overlooked.

Recommended Articles

Ghana's Groundbreaking Crypto Legalization Set to Reshape African Digital Economy by 2025!

Ghana is set to legalize and regulate cryptocurrencies by December 2025, marking a significant policy reversal driven by...

Ghana Central Bank Fires Back: Governor Defends FX Market, Assures IMF Exit

Ghana's foreign exchange market is experiencing significant pressure due to a combination of large energy sector payment...

African Lending Revolution: AGI Boss Predicts Interest Rate Plunge as Banks Brace for Change

The Association of Ghana Industries is optimistic that recent policy rate cuts by the Bank of Ghana, reducing the rate t...

Ghana's Economy Gets a Shot in the Arm: BoG Slashes Key Policy Rate!

The Bank of Ghana's Monetary Policy Committee has reduced the policy rate by 350 basis points to 21.5%, citing forecasts...

Fintech Freeze: Regulators Suspend Major Remittance Players Over Breaches!

The Bank of Ghana has suspended eight companies and UBA Ghana Limited for violating remittance guidelines, effective Sep...

You may also like...

Digital Portfolios Are the New Business Cards; Here’s How to Build One That Gets Seen

In today’s digital-first economy, your online portfolio is your handshake, résumé, and elevator pitch rolled into one. H...

Career Pivoting: Why Changing Paths Might Be the Smartest Move You Make

In a world where stability often overshadows fulfillment, career pivoting may be the smartest move for professionals se...

Why Your First Failure Might Be the Best Thing That Ever Happened to Your Business

Failure isn’t the end of entrepreneurship, it’s the education success never gives. Here’s why your first business collap...

Consumerism vs Culture: Is Africa Trading Values for Trendy Lifestyles?

Is Africa trading its cultural values for trendy lifestyles? Explore how consumerism, foreign brands, and social media p...

The War on Boys: Are African Male Being Left Behind in Gender Conversations

Why are African boys and men often left out of gender empowerment programs? Explore how emotional suppression, lack of m...

Pay Slip, Motivation Slips: The Silent Crisis Among the Working Class

Across Nigeria, millions of workers are trapped in jobs that pay just enough to survive but too little to live. Beneath ...

Premier League's Unsung Heroes: Bournemouth, Sunderland, and Tottenham Shockingly Exceed Expectations

This Premier League season sees teams like Bournemouth, Sunderland, and Tottenham exceeding expectations. Under Thomas F...

El Clasico Fury: Yamal Controversy and Refereeing Blunders Ignite Post-Match Debates

)

Real Madrid secured a 2-1 El Clasico victory over Barcelona amidst significant controversy surrounding a late penalty de...