Ghana's Central Bank Unleashes Sweeping Reforms & Bolsters Confidence

The Bank of Ghana (BoG) has implemented a series of strategic measures aimed at strengthening the country's financial sector, encompassing a significant diversification of its gold reserves, a commitment to its own recapitalization, a comprehensive overhaul of regulatory frameworks for microfinance institutions and rural banks, and a proactive approach to monetary policy easing to stimulate economic growth.

One key initiative involves the deliberate diversification of the Bank's gold reserves. Governor Dr. Johnson Asiama explained that this move was a strategic decision to improve returns and rebalance the reserve portfolio. Assessments revealed that the central bank was over-exposed, with gold holdings exceeding 40% of its reserves, compared to a peer average of 20-25%. Following this decision, Ghana's gold holdings were reduced to 18.6 tonnes, with proceeds redirected into foreign exchange assets. These foreign exchange assets are already yielding positive results, contributing to reserve accumulation, enhancing liquidity, supporting external buffers, and bolstering Ghana's capacity to manage global economic shocks. Dr. Asiama emphasized that this repositioning reflects a balanced and prudent reserve management strategy, rather than a signal of weakness.

Simultaneously, the Bank of Ghana is undergoing a critical recapitalization process following severe balance sheet pressures incurred during the Domestic Debt Exchange Programme (DDEP). While Finance Minister Dr. Cassiel Ato Forson had initially ruled out using taxpayer funds and pointed to a ¢53 billion recapitalization package under the previous administration, Governor Dr. Johnson Asiama confirmed positive engagements with the government. Speaking at the 128th Monetary Policy Committee (MPC) press briefing on January 28, 2026, Dr. Asiama stated that the government has shown a clear commitment to recapitalizing the Central Bank. He stressed that restoring the BoG’s financial position is vital for rebuilding policy credibility, safeguarding its operational independence, and ensuring its effective delivery on core mandates such as price stability, financial sector supervision, and broader macroeconomic management. The Governor also noted encouraging resilience within Ghana’s commercial banking sector, with 21 of 23 licensed banks meeting capital adequacy thresholds by December 2025, and the remaining two granted until March 2026 to comply.

Further strengthening the financial system, the Bank of Ghana has introduced a major overhaul of regulatory requirements for microfinance institutions (MFIs) and rural banks, effective January 29, 2026, with a compliance deadline of December 31, 2026. These reforms aim to enhance depositor protection and reduce sector vulnerabilities by introducing higher capital thresholds and clearer supervisory structures. Existing Microfinance Banks are now required to raise their minimum capital to GH¢50 million, while new entrants need GH¢100 million. Operators have transition options including independent recapitalization, mergers, portfolio transfers, or regulated winding-down, with progress reporting deadlines in June and September 2026. All Rural Banks are to convert into Community Banks by March 31, 2026, requiring existing Community Banks to maintain GH¢5 million in capital, and newly licensed urban Community Banks GH¢10 million by the end of 2026. The ARB Apex Bank Limited will also be restructured with an expanded mandate to provide centralized banking services for the sector. Additionally, credit unions with assets of GH¢60 million or more will fall under direct BoG supervision from the second quarter of 2026, with smaller cooperatives designated as Last-Mile Providers. The Central Bank clarified that these measures are focused on reform, not closures, and customers will be protected during any consolidation.

In a move to foster economic growth, the Bank of Ghana’s Monetary Policy Committee announced a 250-basis-point cut in the Monetary Policy Rate (MPR) at its 128th meeting on January 28, 2026, reducing it from 18% to 15.5%. This follows a previous aggressive cut of 350 basis points in November 2025. Governor Dr. Johnson Asiama reported that this easing has led to improving liquidity conditions and renewed confidence in the banking sector. Commercial banks are now proactively approaching customers with loan offers at significantly reduced interest rates, some as low as 15% per annum. The decision was based on inflation forecasts indicating that headline inflation is likely to remain within the medium-term target, coupled with expectations of strong GDP growth in 2026. This rate cut underscores the central bank's commitment to supporting credit expansion and economic activity while diligently safeguarding price stability. The BoG emphasizes that sustaining Ghana’s macroeconomic gains will require disciplined fiscal policy, strong coordination, and targeted agricultural interventions to contain food inflation, alongside vigilance against geopolitical tensions.

Overall, the Bank of Ghana is implementing a comprehensive strategy across various fronts—from optimizing its international reserves and strengthening its own financial health to reforming critical segments of the financial market and easing monetary conditions—all designed to ensure a robust, resilient, and growth-supportive financial ecosystem for Ghana.

Recommended Articles

GoldBod Debacle Deepens: Trillions in Losses Feared as Critics Slam Gold-for-Reserves Program

Ghana's Gold-for-Reserve (G4R) programme is at the center of a national debate following an RTI request by Philip Osei B...

Royal Intervention: Asantehene Pushes BoG to Slash Rates, End Political Meddling for Ghana's Economy

Asantehene Otumfuo Osei Tutu II visited the Bank of Ghana to deepen engagement and understand its role in economic stabi...

Ghana Gold Scandal: Multi-Million Dollar Losses Rock Gold-for-Reserves Program Amidst Heated Debates

GoldBod CEO Sammy Gyamfi has strongly refuted claims of US$214 million losses, asserting the institution is set to decla...

Explosive GoldBod Scandal: Calls for Probe into Unlicensed Firm's Shady Dealings!

An analysis of GoldBod's operations reveals significant financial losses stemming from its gold purchasing and selling m...

Ghana Embraces Crypto Boom: New Law Aims to Protect Investors Amidst $10 Billion Transaction Surge

Ghana has officially enacted the Virtual Asset Service Providers (VASP) Bill, regulating its rapidly growing digital ass...

You may also like...

NBA All-Star Weekend Delivers Blockbuster Headlines from Los Angeles

The recent NBA All-Star Weekend in Los Angeles saw a resurgence of competitive spirit, with Anthony Edwards winning MVP ...

Sensational Transfer Saga: Atletico Madrid Enters Race for Super Eagle Victor Osimhen

Atletico Madrid is reportedly pursuing Nigerian striker Victor Osimhen, with Galatasaray demanding a €100 million fee. S...

Lagos Dazzles as AFNAN’s 9PM Night Out Perfume Unveils in Global Spectacle

AFNAN officially unveiled its 9PM Night Out fragrance in Lagos, Nigeria, on February 11, 2026, marking a significant ste...

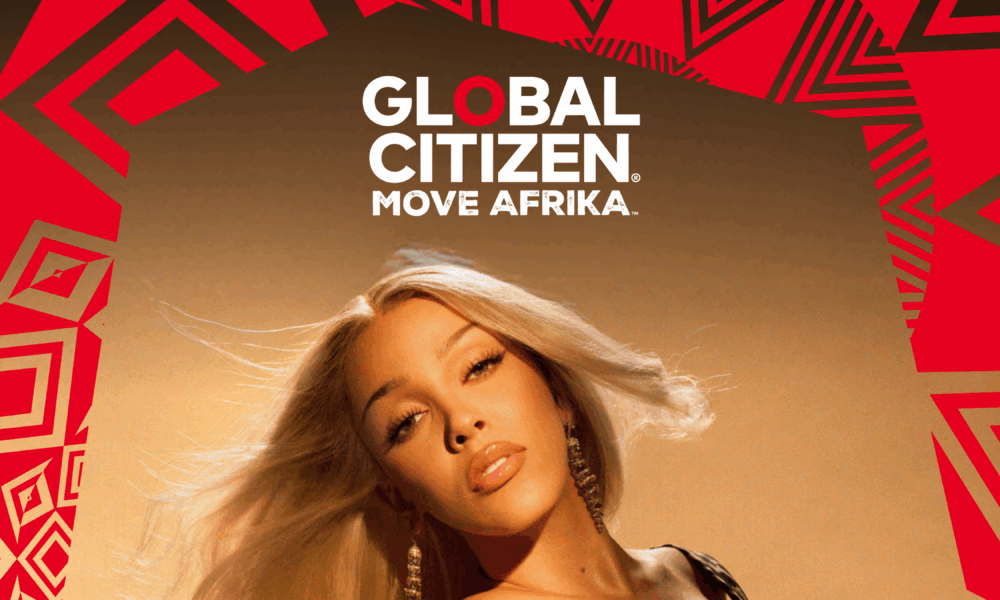

Doja Cat to Electrify Africa: Mega Headlining Role for Global Citizen ‘MOVE AFRIKA’ 2026

Global Citizen announces Doja Cat will headline Move Afrika 2026, expanding the music touring circuit to Rwanda and Sout...

Ethiopia Crowned Among World's Fastest-Growing Tourism Destinations with Staggering 15% Surge

Ethiopia emerged as one of the fastest-growing global tourism destinations in 2025, recording a 15% increase in internat...

Kenya's Aviation Authority Scrambles to Clear Backlog Amid Worker Strike Chaos

The Kenya Civil Aviation Authority (KCAA) is actively working to restore normal flight operations at Jomo Kenyatta Inter...

Measles Outbreak Grips London: Schools Hit, Vaccine Fears Rise!

London is facing a significant measles outbreak, with health officials urging parents to vaccinate their children amid a...

California Braces for Monster Winter Storm

California is bracing for a potent winter storm bringing heavy snow, high winds, and severe thunderstorms, prompting wid...