Ghana Embraces Crypto Boom: New Law Aims to Protect Investors Amidst $10 Billion Transaction Surge

Ghana has officially enacted the Virtual Asset Service Providers (VASP) Bill, a landmark legislative move that brings the nation’s burgeoning digital assets sector, including cryptocurrencies, under a comprehensive regulatory framework. President John Dramani Mahama signed the Bill into law, marking a pivotal moment for Ghana’s financial landscape, aimed at bolstering investor protection and ensuring market integrity.

The decision to regulate the virtual asset space was prompted by a significant surge in cryptocurrency activities within the country. According to Mensah Thompson, Deputy Director-General of the Securities and Exchange Commission (SEC), Ghana recorded over $10 billion in cryptocurrency transactions as of November, encompassing both inbound and outbound flows. This figure represents a substantial increase from approximately $6 billion in the previous year, underscoring Ghana's considerable exposure to virtual assets. Recognizing this growth, the government, in collaboration with the Bank of Ghana, SEC, and other key stakeholders, chose to implement a legal framework rather than a complete ban, allowing for proper oversight and safeguarding financial stability.

The development of the VASP Bill was a meticulous and highly consultative process, spanning over a year. Mr. Thompson highlighted it as one of the most consultative bills ever passed by the government. Extensive deliberations involved a wide array of stakeholders, including the Bank of Ghana, Financial Intelligence Centre, Cyber Security Authority, Ministry of Finance, Ghana Revenue Authority, as well as market operators and financial institutions. This collaborative effort ensured the identification and closure of potential loopholes in the virtual asset space, garnering bipartisan support in Parliament and technical contributions from regulatory staff.

Under the new legislation, the usage, trading, and provision of services in the virtual assets domain are now legalized. Regulatory oversight for these activities will be shared among core institutions, primarily the Securities and Exchange Commission and the Bank of Ghana, alongside any other regulatory authority designated by the Minister of Finance. A crucial aspect of the law mandates that all individuals and entities engaging in virtual asset activities obtain appropriate licenses or official registration from either the SEC or the Bank of Ghana, depending on the nature of their operations.

The SEC’s regulatory remit under the Act is broad, covering a diverse range of virtual asset services. This includes licensing and oversight of virtual asset exchanges, trading platforms, virtual asset issuance and tokenisation, virtual asset exchange-traded funds (ETFs), virtual asset managers, investment advisers, brokerage services, and advocacy activities related to securities. Furthermore, the SEC will supervise virtual asset mining and validation activities pertinent to securities, as well as virtual asset sandbox operations within its jurisdiction. The Commission, in conjunction with the Bank of Ghana, is poised to issue detailed guidelines and regulatory instruments to effectively operationalize the Act.

The overarching objectives of the VASP law are multi-faceted: to legalize cryptocurrency usage, establish a robust regulatory framework, protect investors, uphold market integrity, and safeguard Ghana’s financial system. While supporting innovation in the rapidly expanding digital finance sector, the law aims to ensure that crypto activities are conducted safely, transparently, and without compromising financial stability. This strategic move aligns with Ghana’s broader vision to modernize its financial system, foster innovation, and cultivate a secure environment for both local and international participants in the digital financial ecosystem. Analysts anticipate that this will significantly boost investor confidence and reinforce Ghana's standing in the evolving global digital economy. The SEC has reaffirmed its unwavering commitment to maintaining a safe, efficient, fair, and transparent virtual asset ecosystem for all stakeholders.

You may also like...

NBA All-Star Weekend Delivers Blockbuster Headlines from Los Angeles

The recent NBA All-Star Weekend in Los Angeles saw a resurgence of competitive spirit, with Anthony Edwards winning MVP ...

Sensational Transfer Saga: Atletico Madrid Enters Race for Super Eagle Victor Osimhen

Atletico Madrid is reportedly pursuing Nigerian striker Victor Osimhen, with Galatasaray demanding a €100 million fee. S...

Lagos Dazzles as AFNAN’s 9PM Night Out Perfume Unveils in Global Spectacle

AFNAN officially unveiled its 9PM Night Out fragrance in Lagos, Nigeria, on February 11, 2026, marking a significant ste...

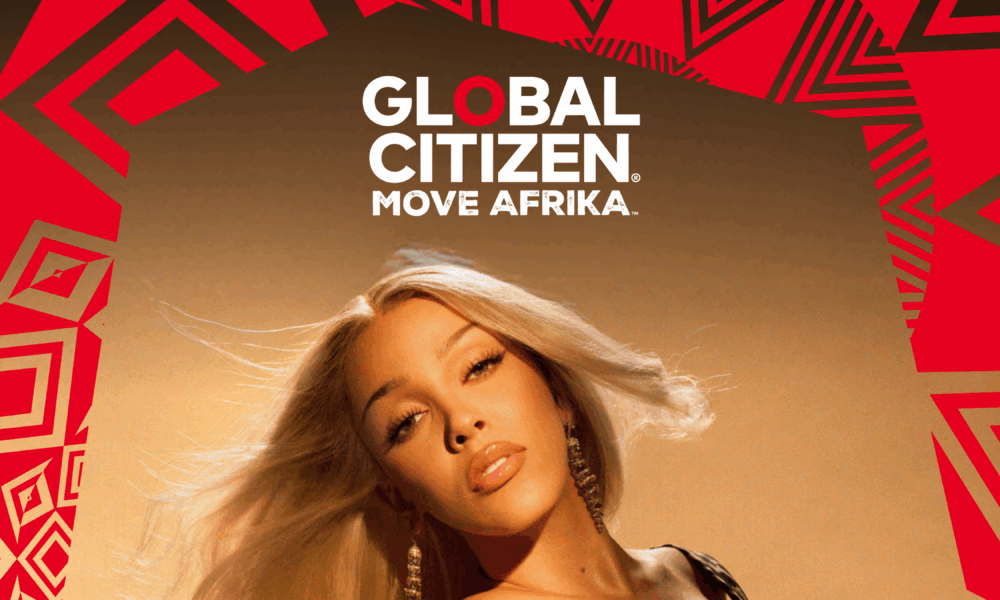

Doja Cat to Electrify Africa: Mega Headlining Role for Global Citizen ‘MOVE AFRIKA’ 2026

Global Citizen announces Doja Cat will headline Move Afrika 2026, expanding the music touring circuit to Rwanda and Sout...

Ethiopia Crowned Among World's Fastest-Growing Tourism Destinations with Staggering 15% Surge

Ethiopia emerged as one of the fastest-growing global tourism destinations in 2025, recording a 15% increase in internat...

Kenya's Aviation Authority Scrambles to Clear Backlog Amid Worker Strike Chaos

The Kenya Civil Aviation Authority (KCAA) is actively working to restore normal flight operations at Jomo Kenyatta Inter...

Measles Outbreak Grips London: Schools Hit, Vaccine Fears Rise!

London is facing a significant measles outbreak, with health officials urging parents to vaccinate their children amid a...

California Braces for Monster Winter Storm

California is bracing for a potent winter storm bringing heavy snow, high winds, and severe thunderstorms, prompting wid...