Explosive GoldBod Scandal: Calls for Probe into Unlicensed Firm's Shady Dealings!

Public policy advocacy frequently navigates a complex interplay between precision and clarity, a challenge exemplified by the recent GoldBod losses saga. Despite a comprehensive analysis, key questions regarding the exact nature and significance of these losses, and whether they are offset by the Cedi's recent stability, continue to confuse stakeholders. This focused piece aims to clarify these critical points without extensive philosophical digressions.

The losses incurred by GoldBod are multifaceted. According to IMF data, GoldBod sold approximately $5 billion to the Bank of Ghana (BoG) sourced from small-scale and artisanal (ASM) gold miners and purchased $2.6 billion from other legacy sources. Concurrently, it spent around $10 billion to intervene in the foreign exchange (FX) market to bolster Cedi stability. The BoG currently holds about $11.4 billion in reserves, with at least $3.58 billion in gold bullion, valued conservatively. The IMF reports a 4.28% ($214 million) loss on gold bought from local ASM miners, indicating a shortfall between the Cedi value supplied to miners by BoG through GoldBod and the dollar value received from overseas off-takers.

This shortfall arises because GoldBod consistently pays a premium for local gold compared to international market rates. Illustrative transactions on specific dates, such as December 10, 2025, and December 29, demonstrate GoldBod incurring losses ranging from 1.30% to 5.714% per ounce, primarily due to the bonus offered to miners. GoldBod's mandate to buy all ASM gold at close to market rates, displacing the previously efficient and competitive market of lean intermediaries, contributes to these premiums. On the external selling side, GoldBod must offer discounts to international buyers to account for freight, insurance, assay verification, and the inherent risks of trading dore (raw gold) outside trusted exchanges. Additionally, off-takers are compensated for advancing dollars due to BoG's pressing liquidity needs. The concentrated ecosystem created by GoldBod, replacing diverse buyers and sellers with a super-aggregator and a few mega off-takers, centralizes risks that translate into significant losses.

The significance of these losses is considerable, particularly if GoldBod were to operate with its own capital. In 2025, GoldBod was allocated $279 million in working capital, which was not disbursed by the Finance Ministry. Annualizing the reported Q3 2025 loss rate of $214 million suggests an approximate annual loss of $285 million. This rate would render GoldBod functionally insolvent within 12 months if reliant solely on the allocated capital, or cause severe operational stress within six months. This fiscal burden, effectively a subsidy, highlights the need for transparency, drawing parallels to the capital stress experienced by Cocobod, which historically recorded lower loss-per-turnover numbers. Furthermore, the risk of losses amplifies if a single off-taker defaults on delivery.

Evaluating whether the benefits of Cedi stability outweigh these costs is complex. Exchange rate movements are influenced by numerous factors, including the fiscal deficit, inflation, export performance, and external financial flows. No single factor, including GoldBod, can be solely credited for the Cedi's stability. GoldBod's mechanism for influencing the Cedi is through diverting

You may also like...

NBA All-Star Weekend Delivers Blockbuster Headlines from Los Angeles

The recent NBA All-Star Weekend in Los Angeles saw a resurgence of competitive spirit, with Anthony Edwards winning MVP ...

Sensational Transfer Saga: Atletico Madrid Enters Race for Super Eagle Victor Osimhen

Atletico Madrid is reportedly pursuing Nigerian striker Victor Osimhen, with Galatasaray demanding a €100 million fee. S...

Lagos Dazzles as AFNAN’s 9PM Night Out Perfume Unveils in Global Spectacle

AFNAN officially unveiled its 9PM Night Out fragrance in Lagos, Nigeria, on February 11, 2026, marking a significant ste...

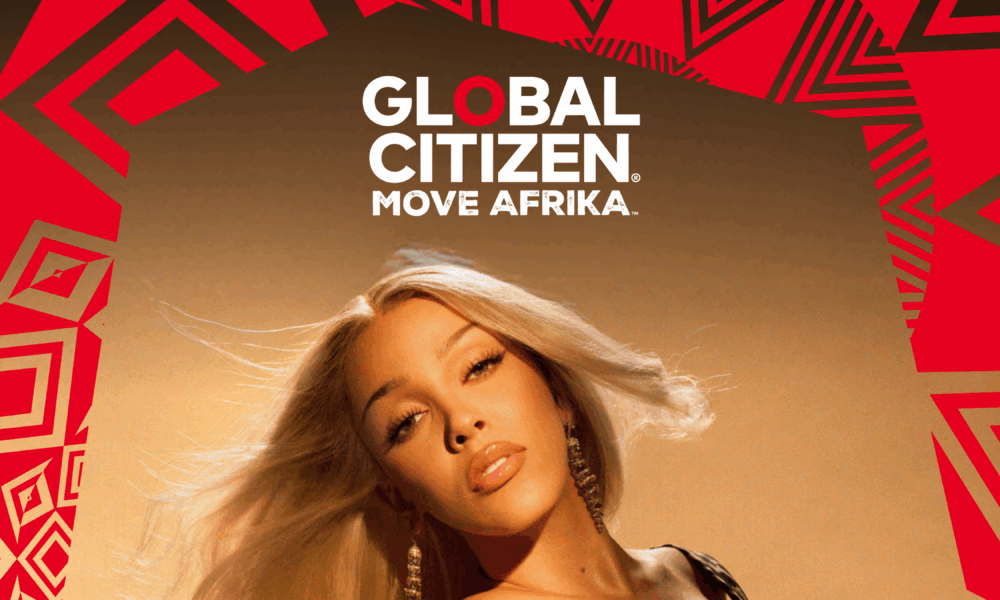

Doja Cat to Electrify Africa: Mega Headlining Role for Global Citizen ‘MOVE AFRIKA’ 2026

Global Citizen announces Doja Cat will headline Move Afrika 2026, expanding the music touring circuit to Rwanda and Sout...

Ethiopia Crowned Among World's Fastest-Growing Tourism Destinations with Staggering 15% Surge

Ethiopia emerged as one of the fastest-growing global tourism destinations in 2025, recording a 15% increase in internat...

Kenya's Aviation Authority Scrambles to Clear Backlog Amid Worker Strike Chaos

The Kenya Civil Aviation Authority (KCAA) is actively working to restore normal flight operations at Jomo Kenyatta Inter...

Measles Outbreak Grips London: Schools Hit, Vaccine Fears Rise!

London is facing a significant measles outbreak, with health officials urging parents to vaccinate their children amid a...

California Braces for Monster Winter Storm

California is bracing for a potent winter storm bringing heavy snow, high winds, and severe thunderstorms, prompting wid...