Crypto Market Alert: XRP ETF Looms, 'Big Short' Burry Warns of Bubble, Bitcoin Faces Massive Liquidations!

The cryptocurrency market entered Halloween in a state of uneasy balance, recovering from a turbulent week that wiped nearly $600 million from global exchange-traded fund (ETF) holdings. Bitcoin continues to hover around the $110,000 zone, facing strong buy interest near $107,000 and heavy sell walls closer to $114,000. According to CoinShares, U.S. Bitcoin funds recorded $488 million in outflows on October 30, while Ethereum products lost $184 million. In contrast, Solana emerged as the lone bright spot, adding $37 million and firmly consolidating near the $190 level.

Adding to the market’s mixed tone, MicroStrategy — one of the largest institutional Bitcoin holders — reported quarterly earnings of $8.42 per share and $128.7 million in revenue. Its balance sheet revealed ownership of 640,808 BTC, valued at $47.44 billion. The company maintained its ambitious $150,000 Bitcoin target for 2025, echoing Michael Saylor’s persistent bullish outlook.

Spot XRP ETF Could Redefine the Market

A major catalyst now looms as Canary Capital’s spot XRP ETF approaches potential approval. Following the removal of its “delaying amendment,” a 20-day countdown began — setting November 13 as the earliest possible launch date, pending SEC action. Once Nasdaq approves Form 8-A, Canary’s product would become the first fully backed XRP ETF in the United States, distinct from trust-style funds such as REX Osprey XRPR. Analysts, including Nate Geraci of the ETF Store, have compared its potential debut to Bitwise’s Solana ETF, forecasting a strong initial inflow and new institutional liquidity.

As of Friday, XRP trades at $2.50, up 3% intraday, with support near $2.45 and resistance at $2.73. A decisive close above $2.73 could propel prices toward $2.90–$3.00, particularly if the ETF launch materializes mid-month. Analysts at The Block note that an approved XRP ETF could enhance transparency, improve price discovery, and attract new investors to the digital asset market.

Michael Burry’s Warning: ‘Valuations Are Faith-Based’

Markets were further jolted by the return of Michael Burry, famed for his role in predicting the 2008 financial crisis and portrayed in The Big Short. After nearly two years of silence, Burry issued a stark warning on social media about “bubbles” forming across AI and crypto sectors. His comments coincided with Nvidia’s valuation surpassing $5 trillion, reviving concerns that investors are once again “buying belief” rather than fundamentals.

According to Bloomberg, Burry’s caution has already impacted derivative markets. Bitcoin and Ethereum funding rates fell overnight, open interest declined by 8%, and put option demand spiked. Despite his earlier optimism toward Chinese AI stocks such as Alibaba, JD.com, and Baidu, Burry’s timing — as crypto leverage hit record highs — suggested traders may be ignoring mounting risks.

Bitcoin’s Halloween Shakeout

Fresh data from CoinGlass shows over $303 million in Bitcoin positions were liquidated within 24 hours, with longs accounting for $262 million compared to just $41 million from shorts — a staggering 600% disparity. This highlights the market’s ongoing bullish bias despite heavy corrections. Bitcoin’s Halloween range fluctuated between $108,266 and $110,452 before closing near $110,086, up 1.6% for the day.

While momentum remains cautiously positive, persistent ETF outflows continue to weigh on spot demand. Key support sits around $107,500, with a deeper cushion near $105,000 where CME futures interest overlaps with spot accumulation. Bulls will need a clean close above $111,200 to confirm a push toward $114,000 and eventually $117,500 levels that capped October’s highs. Historically, whenever October closes green, November has followed with additional upside, strengthening hopes for a pre-halving rally.

Outlook: Burry’s Caution vs Saylor’s Conviction

As the U.S. session closed Friday night, traders were split between Burry’s caution and MicroStrategy’s optimism. Volume thinned but remained concentrated in BTC, XRP, and SOL, with funding rates stabilizing after the midweek flush. Ethereum hovered near $3,250, supported by robust staking activity and moderate inflows. Solana maintained its $180 base, trading within a $198–$200 resistance band.

Attention now shifts to Nasdaq’s pending decision on Canary’s XRP ETF filing and any Federal Reserve commentary on liquidity or inflation in early November. Should Bitcoin close October above $110,000, it would mark its fifth consecutive green month and strongest pre-halving setup since 2019, a technical milestone that could define the next leg of crypto’s global bull cycle.

You may also like...

European Competition Expansion Slashes Premier League Boxing Day Fixtures to Just One Game!

English football's traditional Boxing Day schedule will feature only one Premier League match this year, as Manchester U...

Hollywood's New Fab Four Wives: Stars Unveiled for Upcoming Beatles Biopics

Sam Mendes' ambitious four-film Beatles quadrilogy has unveiled its leading actresses, with Saoirse Ronan, Anna Sawai, A...

AI Revolution: Xania Monet Makes Historic Radio Chart Breakthrough on Adult R&B!

Xania Monet, an AI-driven artist, has made history by charting on Billboard's Adult R&B Airplay survey with her song “Ho...

KPop Phenomenon 'Golden' Smashes UK Chart Records with Ninth Week at No. 1!

"Golden" from KPop Demon Hunters has returned to the No. 1 spot on the U.K. Singles Chart, ending Taylor Swift’s three-w...

Royal Scandal: King Charles' Ruthless Decision on Prince Andrew's Future Unveiled

King Charles has formally stripped Prince Andrew of all royal titles and removed him from Royal Lodge, a historic decisi...

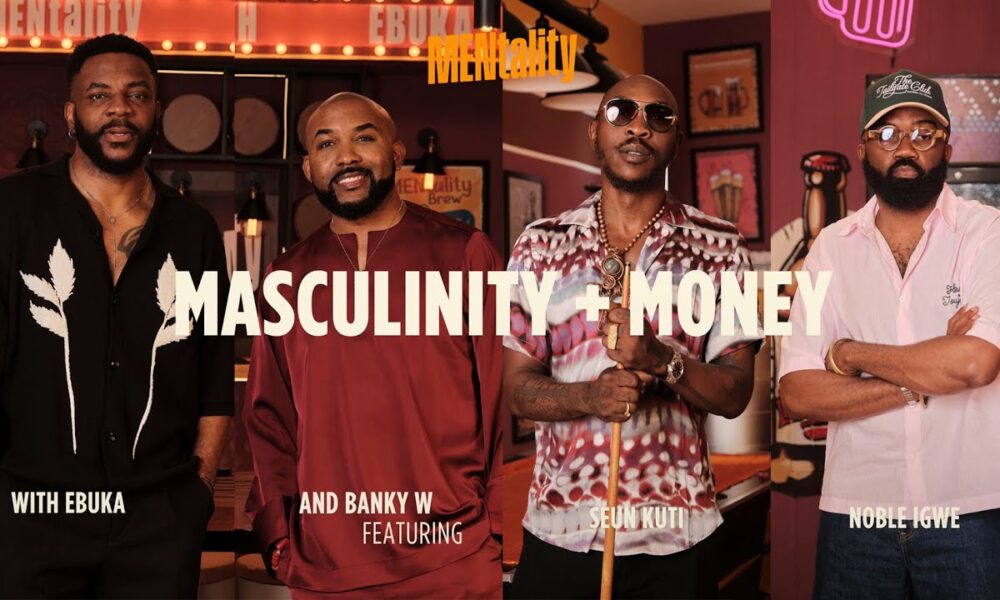

Don't Miss: Ebuka's Highly Anticipated 'MENtality' Series Kicks Off!

The new podcast "MENtality With Ebuka" has premiered, hosted by Ebuka Obi-Uchendu and co-hosted by Banky W. It aims to e...

Ciara's Stunning Runway Debut for Fruché at Lagos Fashion Week

Ciara made a show-stopping runway debut at the 2025 Lagos Fashion Week for Fruché, captivating audiences in a striking b...

Cameroon Crisis Deepens: Opposition Leader Flees as UN and France Condemn Repression!

Cameroon is embroiled in post-election unrest as opposition leader Issa Tchiroma Bakary flees amid violent crackdowns an...