Fed's Bold Move: Interest Rate Cut Sends Ripples Through Crypto Markets

The Federal Reserve has announced a benchmark interest rate cut of 0.25% today, bringing the target range to 3.75%-4%. This move, widely anticipated by markets, follows a period of rate holds and marks the second such reduction since September 2025, when the Fed implemented its first rate cut of the year. The primary aim of lowering borrowing costs is to stimulate spending and investment by consumers and businesses, although some analysts perceive rate cuts as a signal of underlying economic weakness.

Bitcoin's price reacted dynamically to the news. After trading at $116,000 yesterday, it slumped to just under $111,000 earlier today before experiencing a slight jump into the high $111,000s immediately following the Fed's announcement. It is currently trading at $111,470. Historically, Bitcoin has shown responsiveness to monetary policy shifts, as seen in March 2020 when it plunged nearly 39% after emergency rate cuts before a strong rebound. More recently, however, its reaction to the September 2025 rate cut was muted, suggesting that markets might have already priced in such moves.

In a significant related development, Federal Reserve Chair Jerome Powell also stated that the central bank is nearing the end of its Quantitative Tightening (QT) program, with reports indicating a cessation by December. This announcement holds substantial implications for risk assets, including Bitcoin. Quantitative Tightening is the Fed's strategy for shrinking its balance sheet and reducing liquidity in financial markets, operating in direct contrast to Quantitative Easing (QE), which expands the balance sheet to stimulate the economy. QT typically involves selling government bonds or allowing them to mature without reinvestment, which increases bond supply, pushes yields higher, and consequently raises borrowing costs for consumers and businesses. This process helps control inflation and prevent economic overheating, as was the goal when the Fed implemented QT in 2022, allowing nearly $1 trillion in securities to mature.

While effective at curbing inflation, QT carries inherent risks such as market volatility and potential economic instability. The impending end of QT halts the draining of liquidity from the market, a move that could free up capital to flow into risk-sensitive assets like Bitcoin and other cryptocurrencies, potentially providing a boost to their valuations. Powell had previously flagged that the Fed was approaching this stage, although earlier uncertainty from an ongoing government shutdown had complicated the outlook.

Broader macroeconomic signals, including cooler-than-expected consumer price inflation last week and a slowing labor market, have fueled expectations for today's rate cut and potentially more reductions by year-end. Lower interest rates generally boost risk appetite by reducing yields on cash and bonds, increasing liquidity. Despite signs of weakness in the U.S. labor market, such as historically long average job search durations, institutional demand for Bitcoin remains robust. BTC ETFs have recorded consistent net inflows, with $202.4 million added on Tuesday alone, reflecting growing confidence among professional investors.

From a technical perspective, Bitcoin continues to hold above a rising trendline dating back to May, with immediate resistance identified at $114,500 and support at $112,000. A break above resistance could target $120,000, while a slip below support might see a pullback toward $106,500. As the Federal Reserve's decisions unfold, Bitcoin remains positioned at the critical intersection of macroeconomic policy shifts, technical market indicators, and prevailing investor sentiment.

You may also like...

Unlock NBA Wins: Betting Pro's Jokic Triple-Double Prediction Shocks Fans

Get ready for a busy Wednesday night in the NBA with ESPN's daily fantasy basketball cheat sheet. This guide provides es...

African Football's Elite Unveiled: Top 10 Nominees for 2025 Award

CAF has unveiled its ten-man shortlist for the 2025 African Footballer of the Year, featuring stars like Mohamed Salah, ...

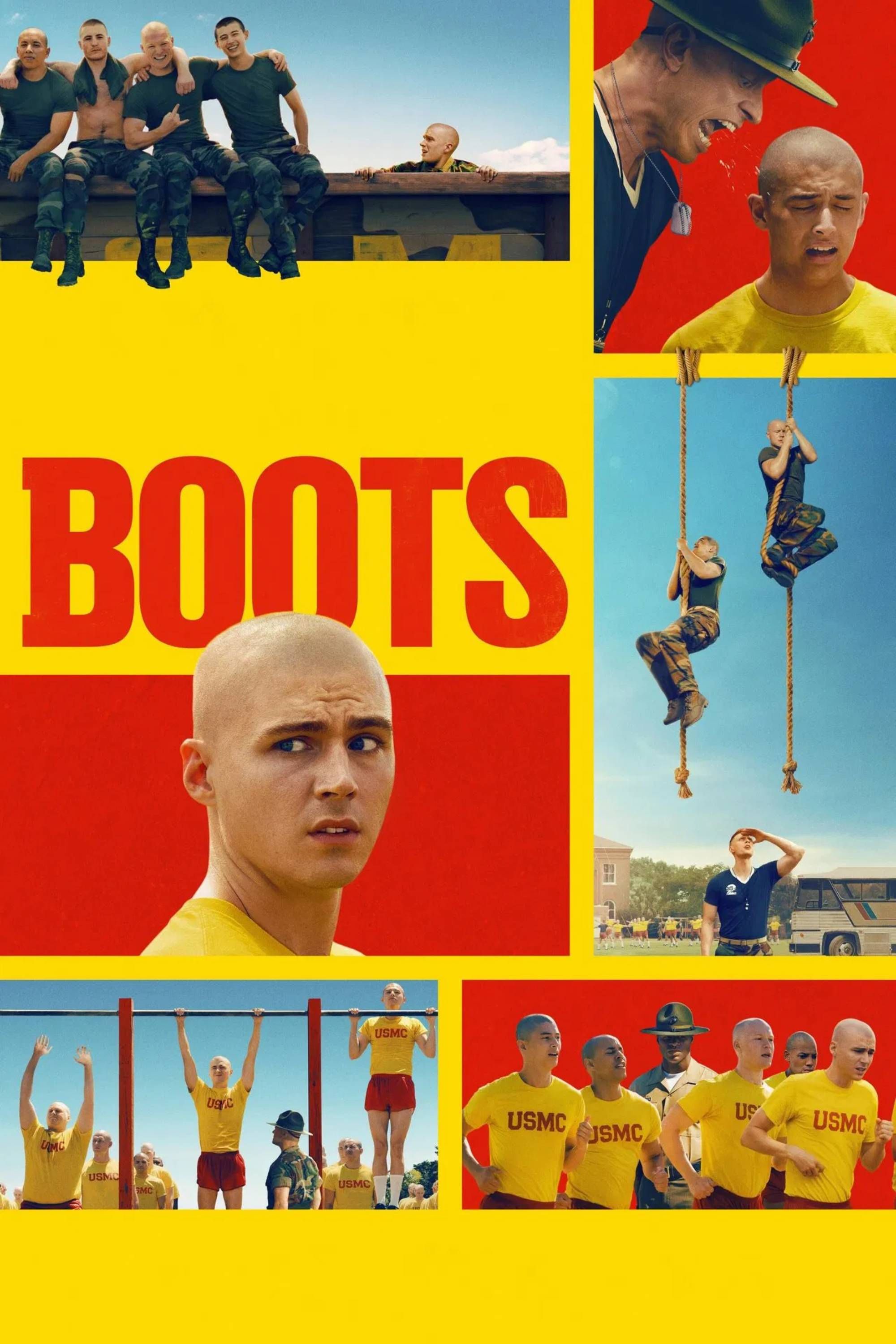

Netflix's 89% RT Hit Military Series Ignites Buzz: Season 2 & Queer Representation Breakthrough

Netflix's hit dramedy "Boots" has resonated with viewers by subverting queer media tropes and showcasing diverse queer c...

Mumford & Sons Announce Star-Studded New Album Featuring Gracie Abrams & Hozier!

Mumford & Sons announced their sixth studio album, "Prizefighter," due February 13, 2026, featuring collaborations with ...

TikTok Triumph: Victoria Justice Revives Her Hit Song Thanks to Fan Demand!

Victoria Justice's unreleased song “Love Zombie,” recorded years ago, has officially launched following its unexpected v...

DNA Drama: Charlotte Chilton Challenges Conor Maynard's Paternity Results!

Charlotte Chilton continues to insist that musician Conor Maynard is the father of her daughter, despite two separate pa...

Urgent Health Alert: Dangerous Bleach-Filled Teeth Whitening Gels Burning Gums via Social Media Sales

A BBC investigation has unveiled the widespread sale of illegal teeth whitening kits in the UK, containing dangerously h...

NHS Launches Groundbreaking Initiative to Slash Endometriosis Diagnosis Times

Endometriosis UK introduces 'Jess's Rule' on September 23, 2025, a new initiative to drastically speed up the diagnosis ...