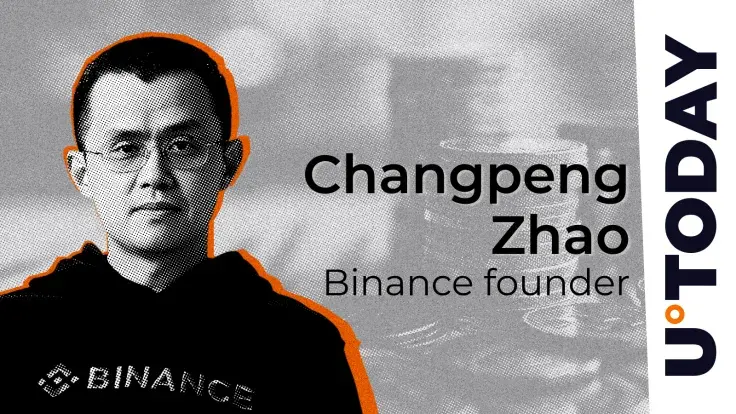

CZ’s Dire Warning: Binance Chief Unveils Crucial Crypto Market Outlook

Changpeng Zhao, the influential founder of Binance, has issued a timely warning to crypto traders, reminding them that every upward rally is inevitably marked by periods of decline. His cautionary note arrives at a critical moment, as both Bitcoin and Ethereum show signs of fatigue after a strong upward trend, signaling that volatility may soon test investor confidence in the short to midterm.

Currently, Bitcoin trades within a narrow corridor between $109,000 and $110,000, hovering dangerously close to its 200-day moving average—a metric often used to gauge long-term market stability. Despite several breakout attempts, Bitcoin has struggled to maintain momentum above the $114,000 resistance mark. The persistent inability to reclaim this threshold, combined with dwindling buyer enthusiasm, suggests a potential slide toward $106,000 or even $102,000. The Relative Strength Index (RSI), resting near 45, implies that the asset is not yet oversold, leaving traders cautious about a possible pullback before a deeper correction.

Meanwhile, Ethereum exhibits a pattern that mirrors Bitcoin’s trajectory, though with slightly weaker momentum. The token currently trades just below $4,000, having faced repeated rejection at its 100-day moving average. Analysts warn that continued pressure could drive ETH toward the $3,400–$3,200 range, an area reinforced by the 200-day moving average. Should Ethereum break below this level, traders may witness an extended consolidation phase. Conversely, a successful surge above $4,200 could reignite bullish sentiment, but given current market conditions, such a rally appears unlikely in the immediate term.

For Zhao, widely known as CZ, this outlook is not an expression of pessimism but a reflection of market realism. He emphasizes that no market ascends in a straight line, especially after prolonged bearish cycles. Historical patterns suggest that corrections are vital—they flush out excess leverage and weak hands, paving the way for more stable and sustainable growth.

The broader crypto sector continues to navigate a complex environment shaped by regulatory pressures and macroeconomic uncertainty. Yet, seasoned investors view these pullbacks as opportunities for strategic accumulation. As both Bitcoin and Ethereum consolidate near key support levels, Zhao’s message is clear: true resilience in crypto lies not in chasing momentum but in understanding the cycles that define its rhythm.

Recommended Articles

High-Stakes Legal Drama: Detained Binance Executive Sues, Wife Urges US Intervention

Detained Binance executive Tigran Gambaryan has petitioned an Abuja Federal High Court for compensation and release, all...

Crypto Titan CZ Gets Shock Pardon: Industry Stunned!

Binance founder Changpeng Zhao (CZ) has been pardoned by US President Donald Trump, according to a report by The Wall St...

Trump Shocks Crypto World: Binance Founder CZ Receives Presidential Pardon!

President Donald Trump has granted a full pardon to Changpeng Zhao, the founder of Binance, marking a significant and co...

Crypto Quake: Trump Pardons Binance Founder, BNB Soars!

President Donald Trump has granted a full pardon to Binance founder Changpeng Zhao, a move that immediately sent the exc...

Coinbase Bombshell: BNB Set to Explode with Major Exchange Listing

Coinbase has confirmed support for Binance's BNB token, allowing BNB/USD trading once liquidity is established, followin...

You may also like...

European Competition Expansion Slashes Premier League Boxing Day Fixtures to Just One Game!

English football's traditional Boxing Day schedule will feature only one Premier League match this year, as Manchester U...

Hollywood's New Fab Four Wives: Stars Unveiled for Upcoming Beatles Biopics

Sam Mendes' ambitious four-film Beatles quadrilogy has unveiled its leading actresses, with Saoirse Ronan, Anna Sawai, A...

AI Revolution: Xania Monet Makes Historic Radio Chart Breakthrough on Adult R&B!

Xania Monet, an AI-driven artist, has made history by charting on Billboard's Adult R&B Airplay survey with her song “Ho...

KPop Phenomenon 'Golden' Smashes UK Chart Records with Ninth Week at No. 1!

"Golden" from KPop Demon Hunters has returned to the No. 1 spot on the U.K. Singles Chart, ending Taylor Swift’s three-w...

Royal Scandal: King Charles' Ruthless Decision on Prince Andrew's Future Unveiled

King Charles has formally stripped Prince Andrew of all royal titles and removed him from Royal Lodge, a historic decisi...

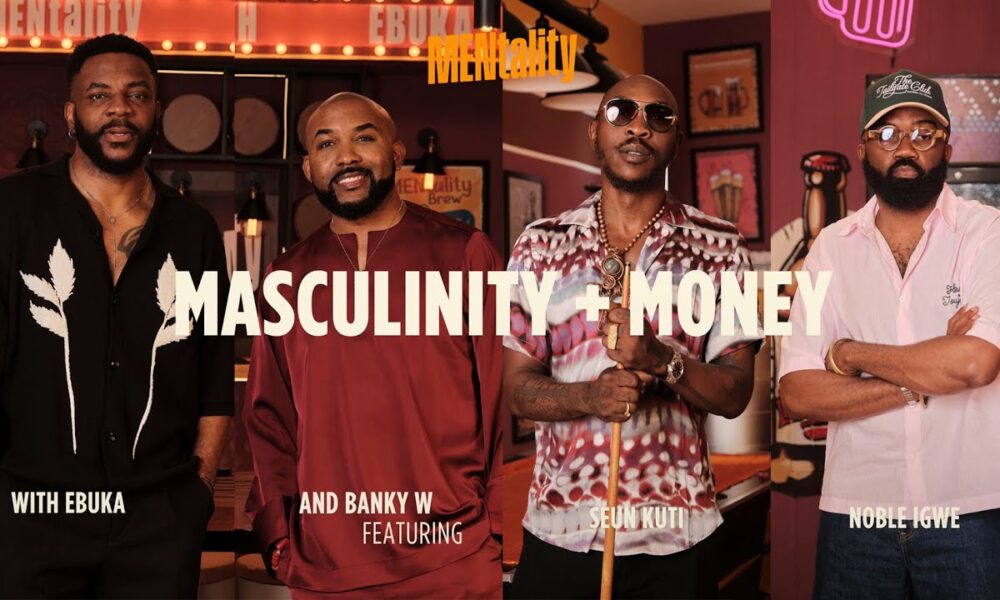

Don't Miss: Ebuka's Highly Anticipated 'MENtality' Series Kicks Off!

The new podcast "MENtality With Ebuka" has premiered, hosted by Ebuka Obi-Uchendu and co-hosted by Banky W. It aims to e...

Ciara's Stunning Runway Debut for Fruché at Lagos Fashion Week

Ciara made a show-stopping runway debut at the 2025 Lagos Fashion Week for Fruché, captivating audiences in a striking b...

Cameroon Crisis Deepens: Opposition Leader Flees as UN and France Condemn Repression!

Cameroon is embroiled in post-election unrest as opposition leader Issa Tchiroma Bakary flees amid violent crackdowns an...