Crypto Gold Rush: Bitcoin Mining Stocks Ignite Amidst Soaring Market Optimism

Shares of leading Bitcoin mining firms experienced significant surges today, with Marathon Digital Holdings (NASDAQ: MARA) climbing 7.97% to $21.13, Riot Platforms (NASDAQ: RIOT) jumping 11.21% to $22.28, and CleanSpark (NASDAQ: CLSK) rising 9.09% to $21.30 at the time of writing. Earlier in Monday’s trading session, some of these tickers had recorded gains of 10% or more. This rally is largely attributed to a strong rebound in Bitcoin prices and increasing investor confidence in the profitability of mining operations, coupled with strategic advancements in AI initiatives.

A pivotal moment for CleanSpark came with its announcement of a move into Artificial Intelligence (AI) and High-Performance Computing (HPC). The company stated its intention to position itself as a leading technology enterprise, leveraging its extensive large-scale energy and data infrastructure. Other notable gainers in the market included Bitdeer Technologies (NASDAQ: BTDR), Canaan Inc. (NASDAQ: CAN), and Coinbase (NASDAQ: COIN)—all of which saw strong upside as Bitcoin successfully rebounded above key support levels.

Canaan Inc. has continued an impressive month, with its stock surging following the launch of a Calgary pilot program designed to convert stranded natural gas into power for both Bitcoin mining and HPC. This diversification trend into AI and HPC is increasingly prevalent among major Bitcoin mining companies, marking the industry’s evolution into a critical player in powering the AI-driven digital economy. Firms such as Core Scientific, Bitdeer, IREN, Hut 8, Cipher Mining, and TeraWulf have also recorded robust stock gains as investors reward this strategic transition.

The current market cycle has also highlighted a pivotal dynamic between Bitcoin’s corporate treasuries and mining stocks. While firms such as MicroStrategy and Metaplanet collectively hold over 1 million BTC—representing more than 5% of the total supply and cementing their role as structural pillars of Bitcoin’s rise—their valuations have seen compression, with MicroStrategy’s stock notably sliding toward parity with its net Bitcoin holdings. In stark contrast, Bitcoin miners have surged ahead; Marathon Digital rose 61%, Riot Platforms climbed 231%, and Hive Digital gained 369% over the past six months. Meanwhile, the WGMI Mining ETF has outperformed Bitcoin by approximately 75% since September. Historically, miner equities like Marathon have often led Bitcoin’s major rallies, and their latest breakout suggests renewed bullish momentum in the sector.

Despite the strong performance in mining stocks, Bitcoin’s price has experienced volatile fluctuations over the past two weeks. It reached a high of over $126,000 on October 6, before recently dropping to $104,000. This decline was primarily attributed to escalating geopolitical tensions and broader market corrections, highlighted by a significant $1 billion sell-off on October 10 as U.S.-China trade tensions intensified.

You may also like...

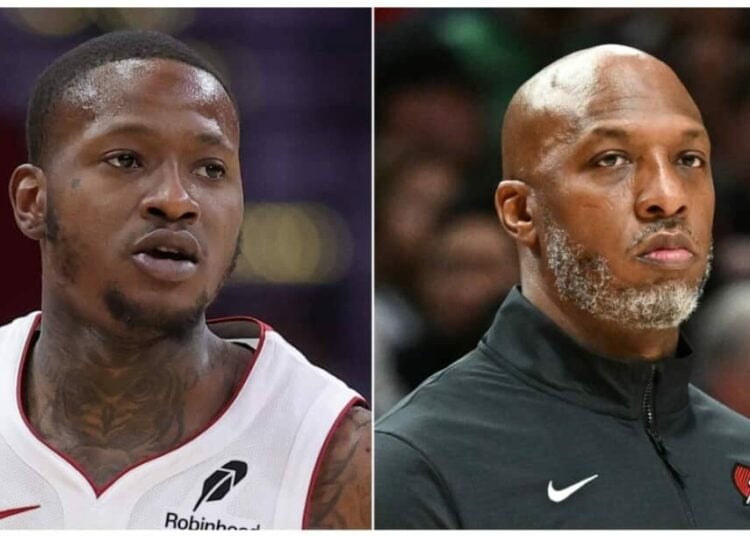

NBA Scandal Rocks League: Billups, Rozier Face Charges in Explosive Sports Betting Probe

Two major federal investigations have rocked the NBA, leading to the indictment and arrest of Portland Trail Blazers coa...

Streaming Wars Intensify: Netflix Exposes Paramount's Role in Industry's 'Brutal Crisis'

Netflix co-CEO Greg Peters has strongly criticized Hollywood's reliance on mergers, arguing they fail to address fundame...

DCU's Epic Future: James Gunn Taps George R. R. Martin's Lore for Major Storylines

James Gunn's DC Universe is heavily influenced by George R.R. Martin's "A Song of Ice and Fire," shaping its structure, ...

K-Pop Firestorm: LE SSERAFIM & J-Hope Unleash 'Spaghetti' Collaboration

LE SSERAFIM has released their new EP, “Spaghetti,” featuring a significant collaboration with BTS’ j-hope, marking his ...

South Africa's Legal Earthquake: Black Coffee Ruling Redefines Marriage Equality

South African actress Enhle Mbali Mlotshwa has won a landmark legal battle, with the Johannesburg High Court validating ...

Groundbreaking! Nigeria Unveils First-Ever Afrobeats Reality Show!

XL Creative Hub introduces "Battle of the Beats Season 1," Nigeria's inaugural Afrobeats production reality show, runnin...

Davido's Diplomatic Daze: Superstar Meets French President Macron!

Nigerian afrobeat superstar Davido recently met with French President Emmanuel Macron in Paris, an event he shared on hi...

Botswana Confronts Wildlife Conflict: Bold New Strategy to Protect Eco-Tourism

Botswana's Minister of Environment and Tourism, Mr Wynter Mmolotsi, announced that addressing human-wildlife conflict is...