CleanSpark Rockets After Securing $100M Bitcoin Credit from Coinbase!

CleanSpark Inc. saw its shares tick higher on Monday, extending a bullish trend from the previous week, following the announcement of an expanded Bitcoin-backed credit facility with Coinbase Prime. The Las Vegas-based Bitcoin mining firm's stock, after closing regular trading at $13.74, surged by more than 8% in after-hours trading to $14.86, and was last reported up 6% after hours, trading near $14.60.

The company secured an additional $100 million in credit, leveraging its significant Bitcoin reserves as collateral. This strategic move allows CleanSpark to fund its growth initiatives without having to sell its Bitcoin holdings on the open market, thereby preserving its exposure to the asset's potential upside. This approach effectively transforms mined Bitcoin into a dynamic working asset. For shareholders, this means growth can be financed through non-dilutive means, avoiding the issuance of new stock.

CleanSpark has increasingly adopted this strategy of utilizing its Bitcoin holdings to raise capital, a practice gaining traction among publicly traded Bitcoin miners. By using Bitcoin as collateral, companies can unlock necessary cash while maintaining their long-term position in the cryptocurrency. Matt Schultz, CEO and Chairman of CleanSpark, emphasized this benefit, stating, "This expansion with Coinbase Prime allows us to fund growth without sacrificing shareholder equity or liquidating Bitcoin." He added, "We see tremendous opportunity to accelerate mining growth while also preparing select data centers for high-performance compute applications."

The proceeds from this credit facility are earmarked for several key initiatives. These include expanding CleanSpark's energy portfolio, scaling its Bitcoin mining operations, and developing high-performance computing capabilities. A notable aspect of this plan involves converting some of its facilities located near metro centers into diversified compute campuses, catering to the rapidly growing demand for AI and cloud services. This diversification strategy is becoming increasingly important as competition intensifies among U.S.-based miners, with CleanSpark prioritizing energy expansion and efficiency to maintain its competitive edge. The company has also shown a readiness to venture into other forms of computing beyond mining, signaling adaptability within an evolving industry.

Brett Tejpaul, who leads Coinbase Institutional, lauded CleanSpark's latest capital strategy as "a significant step forward for growing the crypto ecosystem through focused capital deployment." He underscored the crucial role of Coinbase Prime in providing the necessary custody and credit infrastructure for this arrangement. Over the last five trading days, CleanSpark's stock has surged by 33%, reflecting strong market confidence in its strategic direction.

You may also like...

Bournemouth's Summer Nightmare: £200M Player Exodus Sparks Fan Fear

Bournemouth's decision to retain Antoine Semenyo has been a masterstroke, as the Ghana winger's exceptional performances...

WNBA Finals Game 1 Shocker: Dana Evans, Aces Crush Mercury

The Las Vegas Aces secured an 89-86 victory over the Phoenix Mercury in Game 1 of the 2025 WNBA Finals, driven by their ...

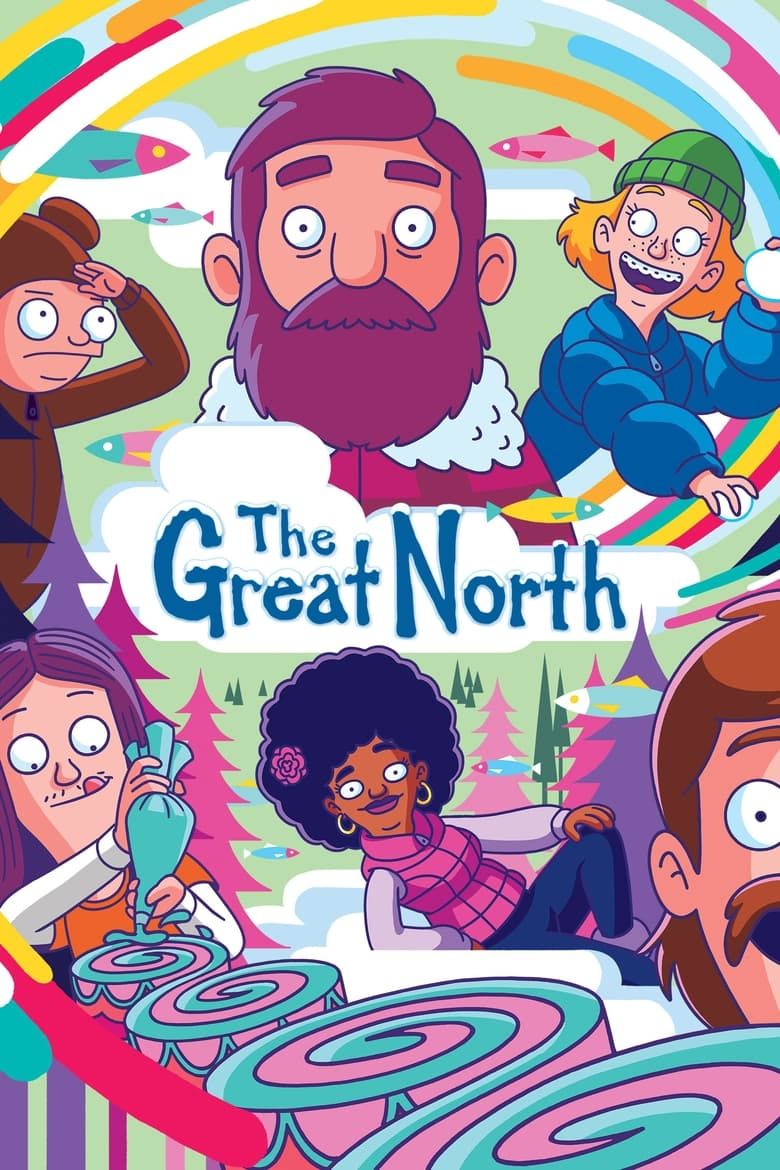

Shocking Ax: Fox Pulls the Plug on Beloved Animated Series 'Great North'

Fox has officially canceled the animated comedy <i>The Great North</i> after five seasons, concluding its run in Septemb...

Unveiling the Horrors: Inside Netflix's Ed Gein Story & Star's Chilling Connection

The Netflix series "Monster: The Ed Gein Story" delves into the life and crimes of the notorious serial killer, explorin...

Backstreet Boys Unleash AI, Brazilian Love, and Millennium Legacy on Tour

Celebrating over three decades in music, Nick Carter and Howie Dorough of the Backstreet Boys reflect on their enduring ...

Ozzy Osbourne's Harrowing Final Confessions Before His Death in Poignant New Documentary

A new documentary, 'Ozzy Osbourne: No Escape From Now,' posthumously showcases the rock legend's final reflections on hi...

Noel Gallagher Unleashes Brutal Critique on Taylor Swift Amid Her 12th Album Launch

Noel Gallagher offers his characteristically blunt, mixed opinions on Taylor Swift's success and modern pop strategies, ...

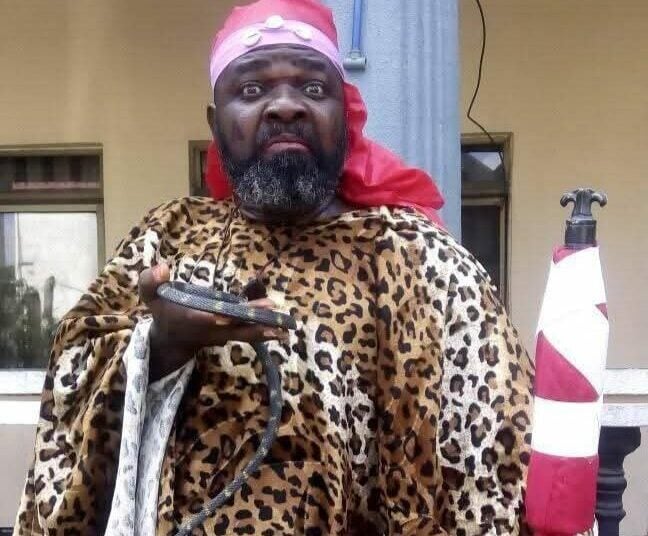

Tragedy Strikes Nollywood: Veteran Actor Duro Michael Passes Away At 67

Nollywood mourns the passing of veteran actor Duro Michael at 67, following a battle with a terminal illness. Producer S...