Crypto Clampdown: Senior Binance Executives Detained in Nigeria, Platform Activity Stalls

Two senior executives from Binance, the world’s largest cryptocurrency exchange, have been detained in Nigeria following the country’s recent ban on several cryptocurrency trading websites. According to a Financial Times report, the executives traveled to Nigeria but were subsequently detained by the office of Nigeria’s national security adviser, and their passports were confiscated. This development comes amid Nigeria's intensified efforts to curb speculation on the naira by cracking down on cryptocurrency exchanges.

Further exacerbating the situation, Binance has deactivated its peer-to-peer (P2P) marketplace in Nigeria and disabled the NGN trading pair on its platform. These actions follow earlier statements from the Central Bank of Nigeria (CBN) Governor, Olayemi Cardoso, who had indicated collaboration with various law enforcement agencies, including the Economic and Financial Crimes Commission (EFCC), the Police, and the Office of the National Security Adviser (NSA), to protect Nigerians against market manipulation.

During a press conference at the 293rd Monetary Policy Committee (MPC) meeting, Governor Cardoso expressed significant concern regarding illicit and suspicious financial flows through crypto platforms. Specifically, he stated that an alarming $26 billion had passed through Binance Nigeria in the last year alone from sources and users that could not be adequately identified. Nigerian authorities are now reportedly demanding access to a list of Binance’s Nigerian users since the platform's inception.

This crackdown on Binance is not an isolated incident but part of a broader government strategy. Bayo Onanuga, the Special Adviser to the President on Information and Strategy, had previously urged the central bank and the EFCC to clamp down on platforms like Binance and Kucoin, accusing them of manipulating the foreign exchange market and usurping the CBN’s role in setting exchange rates. He highlighted that Binance faces access limitations in multiple jurisdictions globally, including the US, Singapore, Canada, and the UK, and advocated for its prohibition from Nigeria’s cyberspace.

In response to these concerns, the Central Bank of Nigeria, in conjunction with the Nigerian Communications Commission (NCC), directed all telecommunications companies to restrict access to crypto companies’ websites and applications. The Nigerian authorities perceive this move as crucial to averting continuous manipulation of the FX market and preventing the free fall of the local currency, believing that speculators use P2P marketplaces on crypto platforms to weaken the naira significantly.

For Binance, these recent events represent a fresh challenge following a difficult period with global regulators. In November of the previous year, Binance paid a substantial $4.3 billion in penalties to United States authorities after pleading guilty to criminal charges related to money laundering and violating international sanctions rules. Its founder and former CEO, Changpeng Zhao, also pleaded guilty to a criminal charge related to money laundering and subsequently resigned from his position. The Nigerian situation underscores the ongoing regulatory scrutiny faced by the exchange worldwide.

While the narrative linking USDT trading on Binance to the fall of the Naira has gained considerable traction, some analyses suggest that blaming Binance or USDT trading alone oversimplifies a complex economic scenario. The rise of the dollar against the Naira is often attributed to a multifaceted interplay of economic policies, global trends, and domestic decisions, rather than being solely the fault of specific crypto platforms.

You may also like...

Scandal Erupts! Barcelona Outraged After Crushing Defeat, Files Official Complaint Against Atletico

)

Barcelona suffered a crushing 4-0 defeat against Atletico Madrid in the Copa del Rey, sparking outrage from head coach H...

Lookman's Blazing Performance: Atletico Madrid Obliterates Barcelona, Shattering Records!

)

Super Eagles forward Ademola Lookman has made a sensational start at Atletico Madrid since his January move, tallying fo...

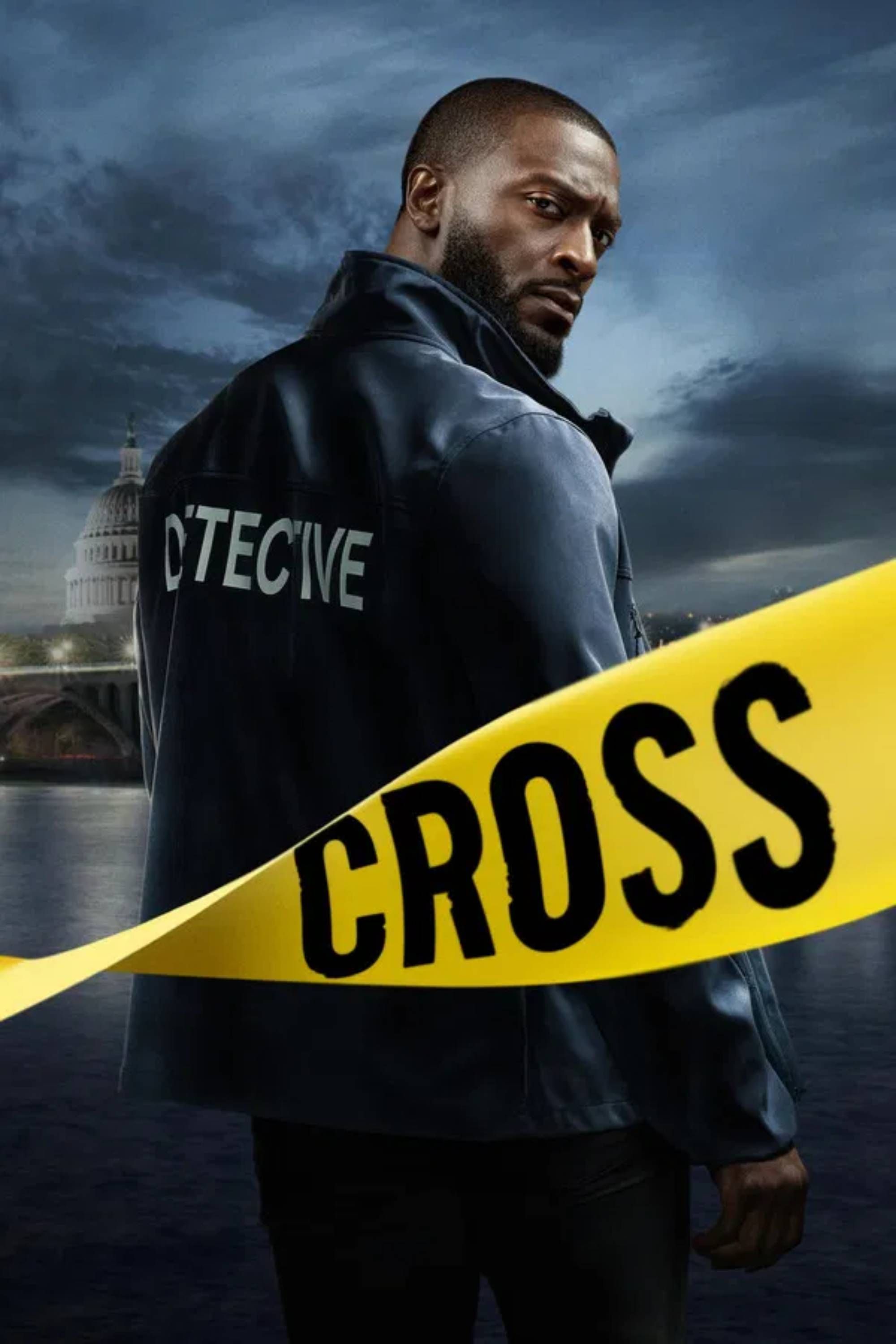

Prime Video's Epic Thriller Dethrones 'True Detective' on Rotten Tomatoes!

Cross Season 2 has swiftly risen to dominate Prime Video's streaming charts, following the conclusion of Fallout. Starri...

Vampire Lestat Teaser Drops, Unleashing Series' Most Explosive Chapter!

The third season of AMC's "Interview with the Vampire" is rebranded as "The Vampire Lestat," shifting focus to Sam Reid'...

BTS's Future Unveiled: Members Vow to Stay Together 'Into Our 60s' Despite RM's Disbandment Doubts

Ahead of their new album "Arirang," BTS members shared their hopes for continued performance into their older years, emp...

Shocking Allegations and Mental Health Battle: Evan Dando Hospitalized Amidst Fan Accusations

Evan Dando of The Lemonheads has been hospitalized for mental health issues, following recent allegations of sending unw...

S.H.E. Project 2026: The 'HERfluence' Initiative Revolutionizing Narratives!

The S.H.E Project, an initiative by SOSSA at the University of Lagos, successfully empowered young women through its ina...

Funmilayo & Dami: 12 Years of Matrimony, Still Unraveling Each Other's Secrets!

Discover the inspiring love story of Dr. Funmilayo and Dr. Dami, who transitioned from medical college classmates to a m...