Binance's $1 Billion Fund Shifts to Bitcoin: A Market Game-Changer?

Binance announced on Friday its intention to convert all stablecoin holdings within its $1 billion Secure Asset Fund for Users (SAFU) entirely into Bitcoin over the next 30 days. This strategic move, which will be carried out gradually and overseen by regular audits, signals a significant shift in Binance’s asset management strategy. The cryptocurrency exchange also committed to reinforcing the fund, pledging to use treasury reserves to restore its value to $1 billion should Bitcoin price volatility cause it to fall below $800 million.

The SAFU fund, established by Binance in 2018, was created with the primary purpose of safeguarding users against potential losses stemming from unforeseen and extreme events, such as security breaches or major system failures. It is financed through a dedicated portion of Binance's trading fees and is meticulously held in cold wallets, completely separate from individual user assets, underscoring its role as an independent safety net. Binance has consistently highlighted SAFU as a fundamental pillar of its comprehensive risk-management and trust framework within the crypto ecosystem.

In a translated statement posted to X, Binance articulated that this initiative is a crucial component of its long-term efforts to build and strengthen the industry. The exchange further stated its commitment to advancing related work and regularly sharing progress updates with the community. This decision by Binance arrives amidst a period characterized by heightened market stress, with Bitcoin experiencing a notable decline from its recent peak values. The prevailing liquidity dislocations during extreme price movements have reignited crucial debates surrounding exchange infrastructure and the need for enhanced transparency.

Binance framed the decision to re-denominate SAFU in Bitcoin as a powerful statement of conviction in the asset's long-term and foundational role within the broader crypto ecosystem. By positioning Bitcoin not merely as a speculative trading instrument but as the industry's ultimate foundational reserve asset, Binance is making a clear declaration about its belief in Bitcoin's enduring value and stability. While the immediate focus is on Bitcoin, Binance noted that future reviews of the fund's allocations could potentially consider other "core assets," including its native BNB token.

Historically, SAFU's most prominent deployment occurred in 2019 when Binance utilized the fund to cover losses incurred after a significant security breach resulted in the theft of approximately 7,000 BTC. In that incident, affected users were fully reimbursed without any impact on their personal account balances, demonstrating the fund's efficacy. Since that time, the SAFU fund has largely remained untouched, functioning primarily as an assurance mechanism and a symbol of user protection rather than an actively deployed resource.

At the time the announcement was made, Bitcoin was trading below $83,000, having experienced a 6% slide over the preceding 24 hours, with daily trading volume reaching $94 billion. The asset was 6% down from its seven-day high of $87,883, though it remained approximately 2% above its weekly low of $81,315, which had been recorded late the previous Thursday night. Bitcoin's circulating supply stood at 19,982,315 BTC out of a maximum capped supply of 21 million, resulting in a global market capitalization of roughly $1.65 trillion, which also reflected a 6% decrease on the day.

Recommended Articles

Crypto Titan Zhao Fights Back Against Market Crash Accusations

Changpeng “CZ” Zhao, former Binance CEO, has vehemently denied accusations that Binance caused the October crypto market...

Davos Decoded: Binance's CZ Pinpoints Crypto's Next Major Frontiers

Crypto billionaire Changpeng Zhao (CZ), at the World Economic Forum in Davos, outlined three major future targets for th...

Ripple Roars: Binance Unveils Groundbreaking RLUSD Listing!

Binance has officially announced the listing of Ripple USD (RLUSD) for spot trading, set to begin on January 22, 08:00 U...

Crypto Giant Binance Pours $500M into Musk's Twitter Bid to Supercharge Blockchain Adoption!

Binance has committed $500 million to Elon Musk's Twitter takeover, becoming a significant equity investor alongside oth...

Ancient Bitcoin Whale Awakens: $500M Dump After 12 Years Yields Jaw-Dropping 31,250% Profit!

A dormant Bitcoin whale, known as "5K BTC OG," has re-emerged after 12 years to sell half of its 5,000 BTC stash, earnin...

You may also like...

Fenerbahce Battles Atletico Madrid for Ademola Lookman as Transfer Saga Deepens

)

Ademola Lookman's transfer future is a hot topic as Fenerbahce intensifies direct talks with Atalanta, with a verbal €40...

Crystal Palace Star Jean-Philippe Mateta's Future Uncertain Amidst Exit Reports

Crystal Palace striker Jean-Philippe Mateta will miss the upcoming match against Nottingham Forest amid transfer specula...

Markiplier's 'Iron Lung' Horror Debut Shocks Audiences, Becomes Streaming Sensation

Markiplier, the celebrated YouTuber, makes his directorial debut with "Iron Lung," a self-financed and fan-supported hor...

Hollywood Mourns Legend Catherine O'Hara: Tributes Pour In After Her Passing at 71

Catherine O'Hara, the beloved two-time Emmy-winning actor known for her iconic roles in "Home Alone" and "Schitt's Creek...

Unpacking the Enduring Influence of Music Legend Fela Kuti

Decades after his death, Fela Anikulapo-Kuti's legacy of courage and resistance continues to inspire, with his Afrobeat ...

Fela Kuti Set for Posthumous Lifetime Grammy in 2026

Afrobeat legend Fela Anikulapo Kuti is slated to receive a posthumous Lifetime Achievement Award at the 2026 Grammy Awar...

HBO Series Star Reveals TikTok's Crucial Role in Genre-Defining Hit!

Shabana Azeez discusses her character Dr. Victoria Javadi in "The Pitt," revealing her secret life as a MedTok star. Aze...

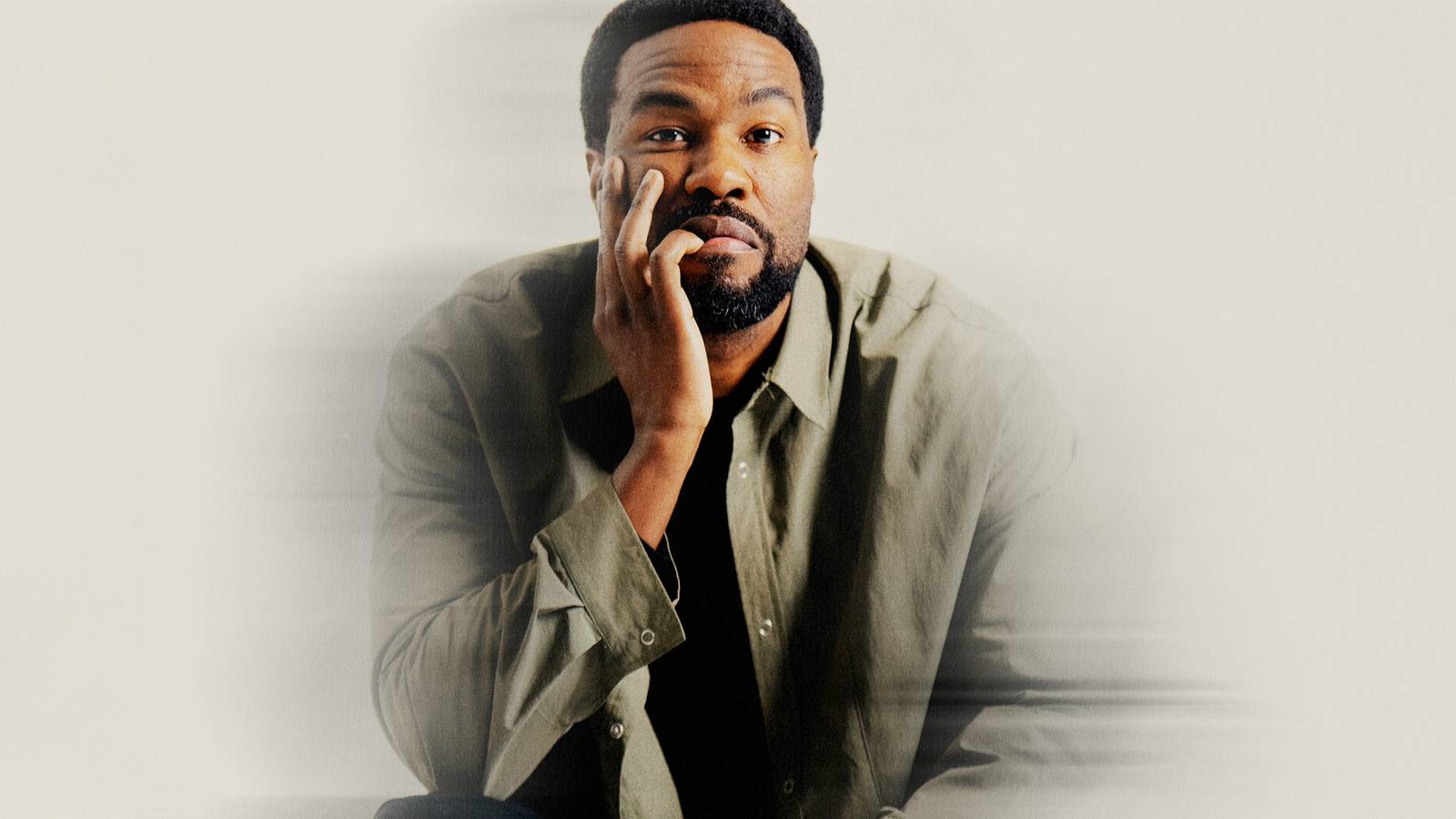

Yahya Abdul-Mateen II Redefines Marvel: 'Wonder Man' Becomes His Most Personal Work Yet!

Yahya Abdul-Mateen II stars in Marvel's <i>Wonder Man</i>, a Disney+ series that uniquely focuses on an actor's journey ...