CBN Unleashes Strict New Regulations to Combat Escalating Digital Payment Fraud

The Central Bank of Nigeria (CBN) has rolled out draft guidelines aimed at curbing the rising cases of push payment fraud, a type of scam where individuals are manipulated into transferring funds to fraudsters. This initiative responds to a surge in such fraud, fueled by the rapid growth of digital payment systems, which has resulted in significant financial losses for both banks and their customers. The new measures build on previous reforms, including mandatory geotagging of POS terminals and stricter oversight of agent activities.

Under the proposed regulations, financial institutions must implement comprehensive preventive measures to protect customers. This includes establishing round-the-clock reporting channels through social media, emails, mobile apps, and in-person services. Customers are required to report any suspected fraud within 24 hours of discovery, with an additional 48-hour window allowed if justified, ensuring all relevant information is provided to support investigations.

Once a report is lodged, banks are mandated to acknowledge receipt within 24 hours, provide a unique case reference number, and outline the anticipated timeline for resolution. The guidelines enforce a strict 14-day deadline for completing investigations, during which financial institutions may collaborate with the CBN, the Nigeria Inter-Bank Settlement System (NIBSS), and other stakeholders to withhold settlement of the disputed funds.

The draft also specifies conditions for reimbursement. Banks are not obligated to compensate customers if reports are delayed beyond 72 hours without valid justification, such as illness or security constraints. Eligible customers must receive refunds within 48 hours of investigation closure. In cases where neither financial institution is directly responsible for the fraud, liability for reimbursement is shared equally between both parties.

If disputes remain unresolved at the bank level, customers may escalate complaints to the CBN’s Consumer Protection and Financial Inclusion Department, which acts as the final arbiter. Ultimately, the enforcement of these rules, along with additional risk-management practices, rests with the boards of individual financial institutions, who are responsible for monitoring fraud trends and ensuring the effectiveness of their controls.

You may also like...

Future Unclear: Is Pep Guardiola Set to Depart Man City?

Intense speculation surrounds Pep Guardiola's future at Manchester City, with rumors suggesting he might leave earlier t...

Saudi League Slams Ronaldo: 'You Are Not Bigger Than The League' Amid Al-Nassr Strike

)

Cristiano Ronaldo protested the Saudi Pro League's transfer dealings, citing perceived financial bias against Al-Nassr, ...

Set Secrets Unveiled: Rebecca Ferguson Details On-Set Abuse, Keeps 'Idiot' Actor Anonymous

Rebecca Ferguson opened up about a past incident where a co-star screamed at her on set, emphasizing that her story high...

Hollywood Shockwave: Timothy Busfield Indicted on Child Sex Abuse Charges

Timothy Busfield, director of "The Cleaning Lady," has been indicted on four counts of child sexual abuse in New Mexico,...

Must-Read: Yejide Kilanko's 'In Our Own Ways' Offers Exclusive Sneak Peek

Fadaka's spiritual quest, guided by Aunty Kike, leads her through a deceptive journey to a secluded ministry for a 'spec...

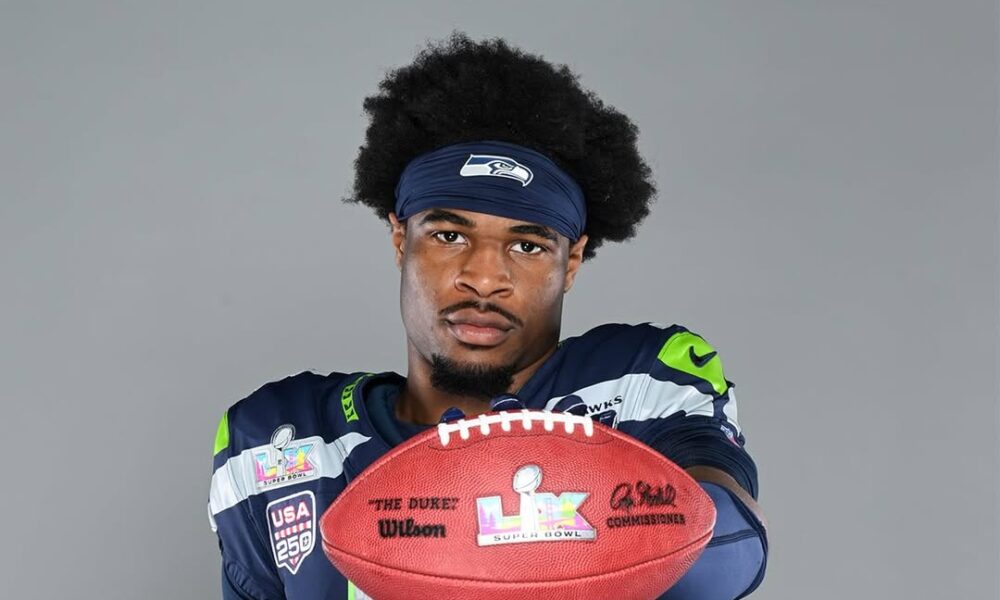

Super Bowl LX 2026: Anticipation Builds for Halftime Spectacle

Super Bowl LX is set to electrify Levi’s Stadium on February 8, 2026, featuring a star-studded halftime show by Bad Bunn...

Probiotic Powerhouse: Yogurt's Reign Challenged by 7 Surprising Dairy Rivals!

:max_bytes(150000):strip_icc()/Health-GettyImages-DairyWithMoreProbioticsThanYogurt-61aceb114e8542caae52b4e4a6067ac6.jpg)

While yogurt is a popular source of probiotics, many other fermented foods surprisingly offer significantly higher conce...

Miracle Spice? Turmeric's 10 Shocking Health Benefits Uncovered

:max_bytes(150000):strip_icc()/Health-GettyImages-ConditionsTurmericCanHelpWith-73e93e547c534162b3a55d2dc5b121d6.jpg)

Discover the extensive health benefits of turmeric and its active compound, curcumin, a potent anti-inflammatory and ant...