CBN Unleashes Strict Daily PoS Cash Limits for Individuals!

The Central Bank of Nigeria (CBN) has implemented new daily cash transaction limits for Point-of-Sale (POS) agents, setting a maximum of N100,000 per customer. This directive, part of the apex bank’s strategy to advance Nigeria’s cashless policy, was circulated in a statement dated December 17, 2024. All Deposit Money Banks, Microfinance Banks, Mobile Money Operators, Super-Agents, and other relevant stakeholders have been instructed to comply immediately.

These new measures aim to ensure uniform operational standards, combat fraudulent activities, and promote the adoption of electronic payment systems within agency banking operations. Under the new guidelines, POS agents must ensure that individual customer withdrawals do not exceed N100,000 daily. Furthermore, agents are restricted to a cumulative cash-out limit of N1.2 million per day. Customers, in turn, face a maximum cash withdrawal limit of N500,000 per week, applicable across all channels.

To enforce compliance, the CBN has outlined several stringent directives. All agency banking operations must be conducted exclusively through float accounts maintained with principal institutions. Agents are mandated to use the approved Agent Code 6010 for transactions, and agent banking services must be clearly separated from other merchant activities. Principal institutions are required to diligently monitor accounts linked to agents’ Bank Verification Numbers (BVNs) to identify and prevent any unauthorized transactions outside the designated float accounts.

Moreover, banking terminals must be connected to the Payments Terminal Service Aggregator (PTSA) to ensure strict adherence to regulations. Daily transaction reports, including withdrawal limits and float account balances, are to be electronically submitted to the Nigerian Inter-Bank Settlement System (NIBSS) using a CBN-provided reporting template. The CBN also plans to conduct timely monitoring and impromptu backend configuration checks. The apex bank has emphasized that principals will be held fully responsible for the actions and omissions of their agents concerning banking services, with any breaches attracting penalties such as monetary fines and administrative sanctions.

This latest policy initiative comes amidst a challenging period for Nigerians, who have been experiencing significant difficulties due to a scarcity of cash, particularly during the holiday season. The new limits are expected to impact POS operators and customers, especially in regions with limited traditional banking infrastructure. Despite the CBN’s claim on Monday that over N3.3 trillion was in circulation as of December 2024, a substantial increase from N1 trillion in early 2023, the country continues to face a severe cash shortage. Reports indicate that currency outside banks surged to N4.29 trillion in October, representing 94.3 percent of the total currency in circulation (N4.55 trillion). This paradox suggests that a considerable amount of cash is being hoarded by individuals, exacerbating the scarcity despite the CBN’s threats to sanction banks for failing to make cash available through counters or ATMs. The CBN has urged all stakeholders to strictly adhere to these directives to ensure the smooth implementation of the policy and contribute to the advancement of Nigeria's cashless economy.

You may also like...

Future Unclear: Is Pep Guardiola Set to Depart Man City?

Intense speculation surrounds Pep Guardiola's future at Manchester City, with rumors suggesting he might leave earlier t...

Saudi League Slams Ronaldo: 'You Are Not Bigger Than The League' Amid Al-Nassr Strike

)

Cristiano Ronaldo protested the Saudi Pro League's transfer dealings, citing perceived financial bias against Al-Nassr, ...

Set Secrets Unveiled: Rebecca Ferguson Details On-Set Abuse, Keeps 'Idiot' Actor Anonymous

Rebecca Ferguson opened up about a past incident where a co-star screamed at her on set, emphasizing that her story high...

Hollywood Shockwave: Timothy Busfield Indicted on Child Sex Abuse Charges

Timothy Busfield, director of "The Cleaning Lady," has been indicted on four counts of child sexual abuse in New Mexico,...

Must-Read: Yejide Kilanko's 'In Our Own Ways' Offers Exclusive Sneak Peek

Fadaka's spiritual quest, guided by Aunty Kike, leads her through a deceptive journey to a secluded ministry for a 'spec...

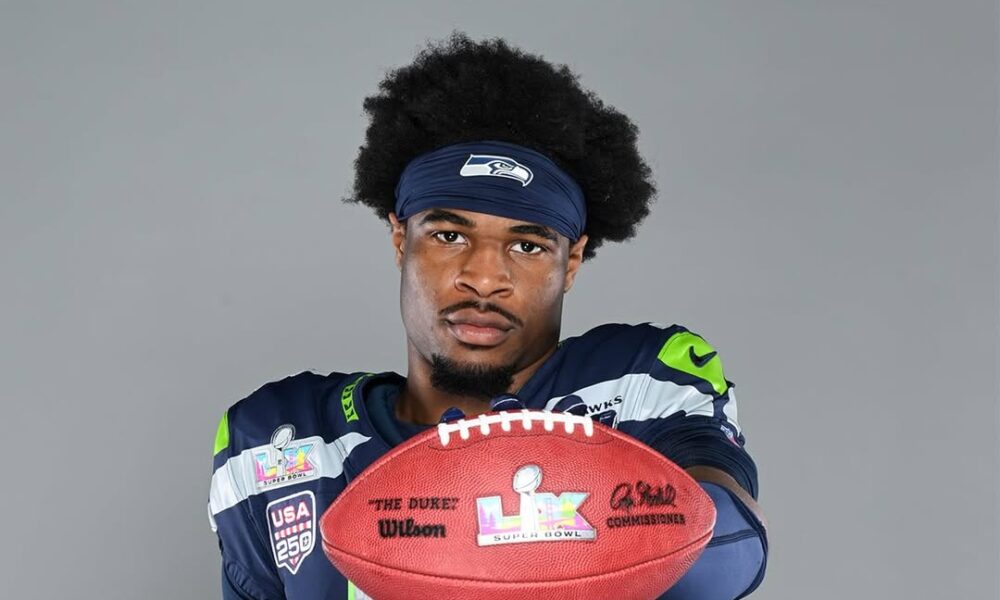

Super Bowl LX 2026: Anticipation Builds for Halftime Spectacle

Super Bowl LX is set to electrify Levi’s Stadium on February 8, 2026, featuring a star-studded halftime show by Bad Bunn...

Probiotic Powerhouse: Yogurt's Reign Challenged by 7 Surprising Dairy Rivals!

:max_bytes(150000):strip_icc()/Health-GettyImages-DairyWithMoreProbioticsThanYogurt-61aceb114e8542caae52b4e4a6067ac6.jpg)

While yogurt is a popular source of probiotics, many other fermented foods surprisingly offer significantly higher conce...

Miracle Spice? Turmeric's 10 Shocking Health Benefits Uncovered

:max_bytes(150000):strip_icc()/Health-GettyImages-ConditionsTurmericCanHelpWith-73e93e547c534162b3a55d2dc5b121d6.jpg)

Discover the extensive health benefits of turmeric and its active compound, curcumin, a potent anti-inflammatory and ant...