Bitcoin Takes a Dive Below $107,000, Sparking 'Buy-the-Dip' Frenzy

Bitcoin's price is currently stabilizing in the mid-$107,000 range, with prominent analysts from VanEck and Standard Chartered anticipating further upside despite recent volatility. Geoffrey Kendrick, Standard Chartered's global head of digital assets research, suggests that a near-term dip below $100,000 is “inevitable,” driven by factors such as renewed U.S.–China trade tensions. However, Kendrick views any such pullback as a fleeting event and a prime buying opportunity. He emphasizes the significance of gold-to-Bitcoin flows, noting that recent rotations, where investors sell gold to acquire Bitcoin, could signal market stabilization and indicate a potential price bottom. Remaining firmly bullish, Kendrick reiterates his forecast for Bitcoin to reach $200,000 by year-end and an ambitious $500,000 by 2028. He advises investors to maintain flexibility and be prepared to capitalize on dips below $100,000, suggesting this could be “the last time Bitcoin is EVER below” that critical threshold.

Echoing a similar optimistic sentiment, VanEck's latest ChainCheck report characterizes Bitcoin's sharp October correction as a liquidity-driven mid-cycle adjustment rather than the onset of a bear market. The asset manager highlighted that while Bitcoin experienced an approximately 18% decline in early October, speculative leverage has since normalized. Furthermore, on-chain activity continues to demonstrate maturity, and the cryptocurrency's crucial macro role as a hedge against fiat debasement is becoming increasingly pronounced. VanEck analysts Matthew Sigel and Nathan Frankovitz observed that global liquidity, precisely measured by the M2 money supply, remains a significant explanatory factor for over half of Bitcoin’s price variance, solidifying its identity as an “anti–money printing” asset. The firm also noted an increasing trend where Asian trading sessions dictate global Bitcoin price movements, with recent declines specifically attributed to tightening liquidity within Asia as central banks strive to defend their respective currencies.

VanEck further interprets the recent drawdown as a beneficial “deleveraging event.” This process, they contend, effectively clears out speculative excess from the market and concurrently creates attractive entry opportunities for new investments. A notable indicator of market maturation, according to VanEck, is the increased institutional participation observed in regulated markets like the CME, signifying a more sophisticated derivatives landscape and a deeper integration of Bitcoin into mainstream finance. Fundamentally, Bitcoin's core strength continues to grow, as evidenced by on-chain metrics showing consistent activity expansion. There are currently 722,000 daily active addresses, and the total transfer volume has seen a 21% month-over-month increase, surpassing $86 billion. VanEck maintains that Bitcoin's long-term trajectory is intricately linked to global liquidity trends and its evolving status as a macro hedge, prudently recommending systematic exposure and opportunistic buying during market pullbacks, including Bitcoin allocations of between 1.5% and 6% in its model portfolios.

Recent market activity underscores Bitcoin's inherent volatility. The cryptocurrency experienced a significant surge following Federal Reserve Governor Christopher Waller's announcement of a “skinny master account” program, which promises eligible fintechs and digital-asset firms limited, direct access to the Fed’s payment system, bypassing traditional banks. However, this surge was followed by a gradual price decline over the subsequent 24 hours. Earlier in October, Bitcoin had soared past $125,500, reaching new all-time highs. This rally was fueled by a combination of political gridlock in Washington and expectations of Federal Reserve rate cuts, which collectively drove investors towards alternative assets. The price surged over 13% in a single week, recovering from $109,000 to nearly $126,000, a move heavily supported by robust inflows into spot Bitcoin ETFs and escalating institutional demand. The market largely interpreted Bitcoin's ascent as a safe-haven response to prevailing fiscal uncertainty. During this period, projections for Bitcoin's price ranged from $135,000 to $200,000 by year-end. This rally also aligned with Bitcoin’s historical “Uptober” trend, traditionally its strongest quarter. Concurrently, gold also extended its record run that month, climbing to $4,381 per ounce amidst sustained central bank buying and a weakening dollar.

You may also like...

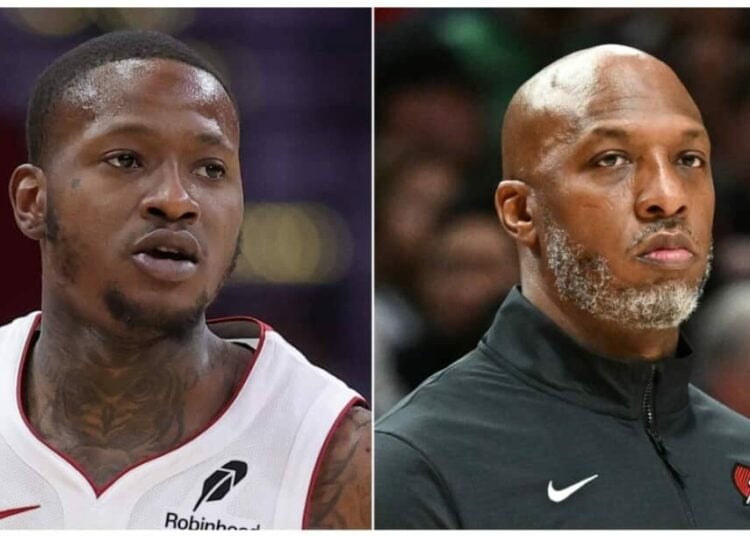

NBA Scandal Rocks League: Billups, Rozier Face Charges in Explosive Sports Betting Probe

Two major federal investigations have rocked the NBA, leading to the indictment and arrest of Portland Trail Blazers coa...

Streaming Wars Intensify: Netflix Exposes Paramount's Role in Industry's 'Brutal Crisis'

Netflix co-CEO Greg Peters has strongly criticized Hollywood's reliance on mergers, arguing they fail to address fundame...

DCU's Epic Future: James Gunn Taps George R. R. Martin's Lore for Major Storylines

James Gunn's DC Universe is heavily influenced by George R.R. Martin's "A Song of Ice and Fire," shaping its structure, ...

K-Pop Firestorm: LE SSERAFIM & J-Hope Unleash 'Spaghetti' Collaboration

LE SSERAFIM has released their new EP, “Spaghetti,” featuring a significant collaboration with BTS’ j-hope, marking his ...

South Africa's Legal Earthquake: Black Coffee Ruling Redefines Marriage Equality

South African actress Enhle Mbali Mlotshwa has won a landmark legal battle, with the Johannesburg High Court validating ...

Groundbreaking! Nigeria Unveils First-Ever Afrobeats Reality Show!

XL Creative Hub introduces "Battle of the Beats Season 1," Nigeria's inaugural Afrobeats production reality show, runnin...

Davido's Diplomatic Daze: Superstar Meets French President Macron!

Nigerian afrobeat superstar Davido recently met with French President Emmanuel Macron in Paris, an event he shared on hi...

Botswana Confronts Wildlife Conflict: Bold New Strategy to Protect Eco-Tourism

Botswana's Minister of Environment and Tourism, Mr Wynter Mmolotsi, announced that addressing human-wildlife conflict is...