Bitcoin Breaks $96K Barrier, MicroStrategy Soars 8%!

The Bitcoin price experienced a significant surge this afternoon, pushing decisively through the $96,000 level and establishing a renewed wave of bullish momentum. This breakout occurred after weeks of choppy, range-bound trading, signaling a clear move beyond the upper boundary of January’s consolidation range. As of the time of writing, Bitcoin was trading around $96,000, marking an increase of approximately 4.4% over the past 24 hours. The cryptocurrency is now hovering near its weekly highs, approximately 5% above its seven-day low of $91,700, indicating that buyers have regained control of the short-term market structure. This notable price action, which saw Bitcoin rocket to $96,000, was reported on January 13, 2026.

Alongside the price rally, Bitcoin trading activity has also seen a significant increase, with the 24-hour volume climbing to roughly $55 billion, reflecting renewed participation from investors as the price accelerated higher. Bitcoin’s total market capitalization has risen to approximately $1.92 trillion, further reinforcing its dominance within the digital asset market. The circulating supply currently stands at just under 19.98 million BTC, inching closer to the protocol’s fixed 21 million coin cap.

The bullish sentiment in the crypto market extended to related equities, with shares of Strategy (MSTR) jumping sharply. The company’s stock closed at $172.99 USD with a 6.63% gain, further extending its strength in after-hours trading to $177.00. This reflects investors continuing to price in Strategy’s high-risk, Bitcoin-linked strategy.

On January 12, Strategy announced a substantial acquisition of 13,627 Bitcoin for $1.25 billion, bringing its total holdings to an impressive 687,410 BTC. These purchases were executed between January 5 and January 11, funded through the company’s at-the-market offering program, which included sales of Class A common stock (MSTR) and its 10.00% Series A perpetual preferred stock, Stretch (STRC).

This market activity unfolds amidst legislative delays affecting the crypto sector. The US Senate Agriculture Committee has postponed its key markup of the Digital Asset Market Structure CLARITY Act until late January, while the Senate’s Banking Committee markup is still scheduled for January 15.

Senate Agriculture Committee Chairman, John Boozman, announced a timeline for advancing crypto market structure legislation, with the legislative text set for release by the close of business on Wednesday, January 21, and a committee markup slated for Tuesday, January 27, at 3 p.m. Boozman emphasized that this schedule is designed to ensure transparency and thorough review, providing regulatory clarity for crypto markets, supporting consumer protection, and fostering U.S. innovation.

However, the delay signals potential challenges, suggesting that Senate leaders may lack the necessary votes to advance the bill due to disagreements over stablecoin rewards, DeFi oversight, and the allocation of authority between the SEC and CFTC. Although the House passed its version of the bill in mid-2025, the legislation cannot proceed without approval from both Senate committees.

Looking ahead, Tuesday’s surge follows several unsuccessful breakout attempts over the last couple of months, during which Bitcoin repeatedly tested resistance near the mid-$94,000 range before pulling back. For much of the past month, price action remained compressed between roughly $85,000 and $94,000, prompting analysts to warn that bulls needed a decisive move higher to reassert control.

That crucial move now appears to be underway. If the Bitcoin price can sustain acceptance above $96,000, the next major resistance zones are anticipated to sit between $98,000 and $104,000, levels that have previously capped upside momentum. A failure to hold current levels, however, could see the price retrace towards former resistance, which could then act as potential support.

The current breakout arrives as investors continue to evaluate evolving inflation trends, interest-rate expectations, and escalating political uncertainty tied to U.S. monetary policy. On the political front, the Department of Justice has initiated a criminal investigation into Federal Reserve Chair Jerome Powell, intensifying a months-long feud between the White House and the U.S. central bank.

According to Powell, the Department of Justice served the Federal Reserve with grand jury subpoenas and threatened a criminal indictment related to his June 2025 testimony concerning a $2.5 billion-plus renovation of Fed office buildings. In recent months, the Bitcoin price has increasingly traded in response to such macro narratives, with many market participants viewing it as a robust hedge against policy instability and long-term currency debasement. At the time of publication, the Bitcoin price remains near $96,000.

Recommended Articles

BTC Surges 7% to $69,000, Defying Market Capitulation

Bitcoin's price surged over 7% today, breaking above $69,000, signaling a potential end to months of sell-offs. This ral...

MicroStrategy Surges 9% as Bitcoin Makes Strong Comeback

Bitcoin and MicroStrategy's stock saw a rebound by week's end, spurred by inflation data, yet concerns persist over Bitc...

Bitcoin's Epic Rebound: From $60K Abyss to $74,500 Target?

Bitcoin experienced significant volatility last week, plummeting through the $70,000s and $60,000s before a strong bounc...

Bitcoin Rockets Past $71,000 as Institutional Investors Flood the Market

Bitcoin surges past $71,000 as institutional investors take advantage of a pullback below $70,000. Retail traders remain...

Bitcoin Rainbow Chart Flashes 'Fire Sale': BTC Enters Undervalued Zone!

Bitcoin's price has plummeted to "fire sale" levels according to the Bitcoin Rainbow Chart, signaling deep undervaluatio...

Bitcoin Slides to $84,000, Sends MicroStrategy Shares to 52-Week Low

Bitcoin drops to $84,000 amid Fed-driven volatility, triggering heavy liquidations and sending MicroStrategy shares to a...

You may also like...

Binge-Worthy 8-Episode Thriller Masterpiece Lands on Netflix!

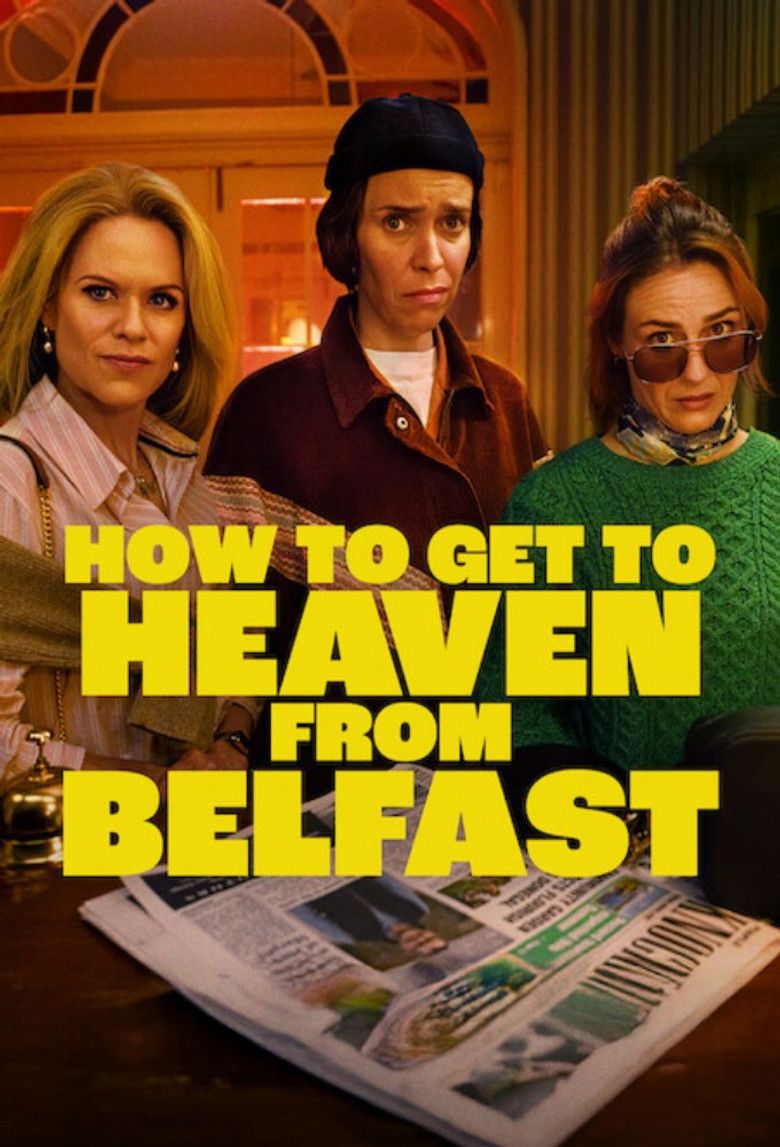

Lisa McGee, creator of "Derry Girls," brings "How To Get To Heaven From Belfast" to Netflix, a gripping comedy thriller....

Blockbuster Oscar Nominee Hits Netflix After Raking In Millions!

<i>Jurassic World Rebirth</i> redefines the beloved franchise by exploring scientific overreach and humanity's evolving ...

Little Mix's Leigh-Anne Reveals Dream Collaboration with Manon and Normani!

Leigh-Anne Pinnock expressed her desire to collaborate with Manon Bannerman and Normani, a wish that carries significant...

Music Star Thomas Rhett & Lauren Akins Announce Arrival of First Son!

Country music star Thomas Rhett and his wife, Lauren Akins, have welcomed their fifth child and first son, Brave Elijah ...

Bridgerton Stars Unveil Game-Changing Season 4 Death

An interview with the stars of Bridgerton Season 4 Part 2 delves into the tragic death of John Stirling and its aftermat...

Shocking Recruitment Scandal: Kenyan Faces Charges for Sending Youths to Ukraine War

A Kenyan man has been arraigned in court over alleged human trafficking, accused of recruiting 22 youths for the Russia-...

Angola Under Fire: Billion-Dollar Contracts Awarded Without Public Tender

A comprehensive review of Angolan presidential decrees has uncovered that at least US$61.5 billion in public spending wa...

Pentagon Declares AI Heavyweight Anthropic a Supply Chain Risk

The Trump administration has ordered federal agencies to cease using Anthropic products following a dispute over the com...