Bitcoin Bloodbath: Price Plunges Below $89,000 After Grim Weekend Carnage!

Bitcoin's price experienced another challenging weekend, dropping from highs around $92,000 on Thursday to weekend lows near $87,000, a move largely influenced by thin liquidity and persistent sell pressure. This decline led to a roughly 7% drop on the month, extending a period of choppy consolidation that has characterized Bitcoin's price action since reaching an all-time high in October. The break below the $90,000 mark occurred during typically illiquid Sunday trading, which amplified downside volatility as traders adopted a cautious stance ahead of a crucial week filled with U.S. economic data releases and central bank announcements.

The broader cryptocurrency market reflected Bitcoin's weakness, with major altcoins such as Solana, XRP, Dogecoin, and Cardano continuing their slide, registering double-digit monthly losses. This performance further solidified Bitcoin's dominance, which remained near 57% of the total crypto market capitalization. Trading volumes across the market remained muted, suggesting a lack of strong conviction among investors rather than an outright capitulation.

Macroeconomic factors are currently at the forefront of traders' concerns. In the United States, upcoming employment data, inflation prints, Purchasing Managers' Index (PMI) readings, and Federal Reserve commentary are keenly anticipated, as these could significantly reshape interest rate expectations. Internationally, attention is focused on Japan, where the Bank of Japan is widely expected to implement a rate hike later this week. Such a move could put pressure on yen-funded carry trades, which have previously provided support for various risk assets, including Bitcoin, over the past year.

From a technical perspective, analysts are closely monitoring the mid-$80,000 range. A sustained breach below this critical zone could signal a deeper market correction, whereas a successful hold above it would reinforce the idea that Bitcoin's price remains range-bound rather than entering a new bear market phase. Despite the prevailing uneasy market sentiment, some of the more extreme bearish predictions appear to be outpacing the current data.

For instance, Bloomberg Intelligence strategist Mike McGlone recently issued a warning that Bitcoin's price could potentially collapse by as much as 90% from its peak, speculating a return to the $10,000 level during a future deflationary downturn. This forecast aligns with previous bearish calls and comes amidst an ongoing unwinding of leveraged long positions, with approximately $230 million in Bitcoin long liquidations occurring in a recent 24-hour period.

However, on-chain data presents a more nuanced picture. Bitcoin Magazine Pro's Price Forecast Tools, which are built on fundamental network metrics rather than market sentiment, indicate that the market is currently trading below its fair value, suggesting it is not on the verge of a structural collapse. Aggregated indicators, including CVDD, Balanced Price, and the Bitcoin Cycle Master, currently estimate a fair market value for Bitcoin near $106,000. They also suggest that any long-term downside risk is more likely to cluster around the $80,000 range, rather than plummeting to five figures. Historically, these metrics have shown a strong correlation with cycle tops and bottoms, providing a reliable framework that helps cut through short-term market noise. While broader macro conditions will undoubtedly continue to drive volatility, on-chain signals suggest that the current drawdown is more indicative of a late-cycle consolidation than the onset of a generational market unwind. At the time of writing, Bitcoin's price stands at $89,317.

Recommended Articles

Bitcoin Plunges to $87K Amidst Market 'Extreme Fear'

Bitcoin is currently trading around $87,000 amidst extreme market fear, reflected by a Crypto Fear and Greed Index of 11...

Bitcoin's December Nightmare: Price Crashes 8% to $84,000 Amidst Market Tremors

Bitcoin's price plummeted to the mid-$84,000s due to a confluence of macro anxiety, thin liquidity, and a Yearn Finance ...

Bitcoin Rainbow Chart Flashes 'Fire Sale': BTC Enters Undervalued Zone!

Bitcoin's price has plummeted to "fire sale" levels according to the Bitcoin Rainbow Chart, signaling deep undervaluatio...

Bitcoin Slides to $84,000, Sends MicroStrategy Shares to 52-Week Low

Bitcoin drops to $84,000 amid Fed-driven volatility, triggering heavy liquidations and sending MicroStrategy shares to a...

Bitcoin Rockets Past $90K Amidst High-Stakes Fed Meeting and Senate Crypto Vote!

Bitcoin's price surged past $90,000 amidst fresh macro signals and anticipation for U.S. crypto regulation. The rally co...

You may also like...

Future Unclear: Is Pep Guardiola Set to Depart Man City?

Intense speculation surrounds Pep Guardiola's future at Manchester City, with rumors suggesting he might leave earlier t...

Saudi League Slams Ronaldo: 'You Are Not Bigger Than The League' Amid Al-Nassr Strike

)

Cristiano Ronaldo protested the Saudi Pro League's transfer dealings, citing perceived financial bias against Al-Nassr, ...

Set Secrets Unveiled: Rebecca Ferguson Details On-Set Abuse, Keeps 'Idiot' Actor Anonymous

Rebecca Ferguson opened up about a past incident where a co-star screamed at her on set, emphasizing that her story high...

Hollywood Shockwave: Timothy Busfield Indicted on Child Sex Abuse Charges

Timothy Busfield, director of "The Cleaning Lady," has been indicted on four counts of child sexual abuse in New Mexico,...

Must-Read: Yejide Kilanko's 'In Our Own Ways' Offers Exclusive Sneak Peek

Fadaka's spiritual quest, guided by Aunty Kike, leads her through a deceptive journey to a secluded ministry for a 'spec...

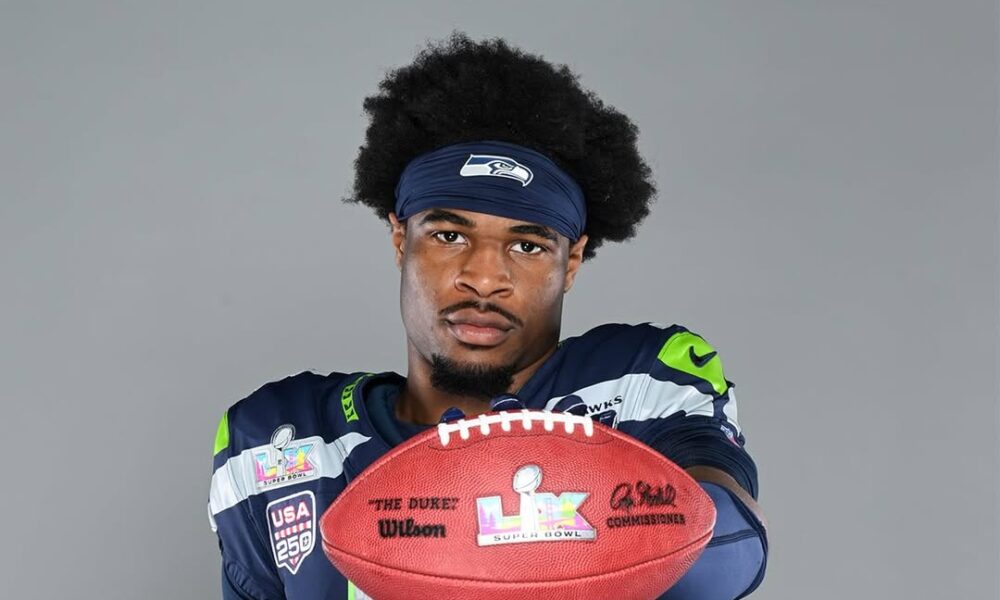

Super Bowl LX 2026: Anticipation Builds for Halftime Spectacle

Super Bowl LX is set to electrify Levi’s Stadium on February 8, 2026, featuring a star-studded halftime show by Bad Bunn...

Probiotic Powerhouse: Yogurt's Reign Challenged by 7 Surprising Dairy Rivals!

:max_bytes(150000):strip_icc()/Health-GettyImages-DairyWithMoreProbioticsThanYogurt-61aceb114e8542caae52b4e4a6067ac6.jpg)

While yogurt is a popular source of probiotics, many other fermented foods surprisingly offer significantly higher conce...

Miracle Spice? Turmeric's 10 Shocking Health Benefits Uncovered

:max_bytes(150000):strip_icc()/Health-GettyImages-ConditionsTurmericCanHelpWith-73e93e547c534162b3a55d2dc5b121d6.jpg)

Discover the extensive health benefits of turmeric and its active compound, curcumin, a potent anti-inflammatory and ant...