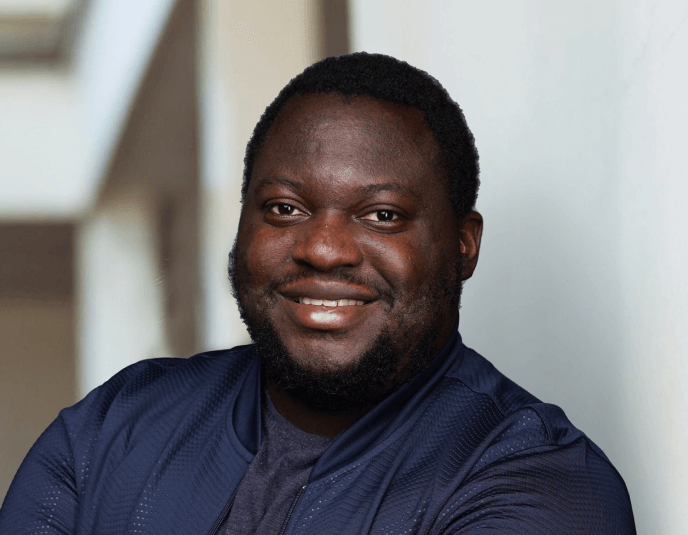

Afro-Trailblazers Series(Part 8): Ham Serunjogi, The Man Behind Chipper Cash

Picture this: It’s 11:43 PM. Deji’s Netflix subscription cuts out mid-episode—right as the villain is about to reveal why they are a terrible person.

No worries, he thinks. He grabs his local currency card. Declined.

Alright, maybe it’s just that particular bank acting up. He switches to another card. System error.

He refreshes. This time, a new message pops up: "Your card has been suspended due to a policy violation."

How? Why? When? Nobody knows. Not even the card.

Meanwhile, it’s been eight months since Stella completed a $50 gig for a “free-spirited” company. The only thing flowing freely has been the excuses. It began with, “The finance team is on Easter break” (in September), then evolved into, “We’re switching payment apps.”

Then right on cue, as if their phones had been secretly listening to their life frustrations, Google serves them an ad: Chipper Cash. An app that promises instant cross-border payments, virtual dollar cards, and maybe—just maybe—a real shot at surviving the gig economy.

And if you’re anything like Deji or Stella, caught in the chaos of African financial systems—you pause and ask: Wait… who built this genius thing?

What Is Chipper Cash?

Chipper Cash is a cross-border payments platform built for Africans by Africans. It enables fee-free peer-to-peer payments, virtual cards for online purchases, and a suite of fintech tools including crypto trading, stock purchases, and business payment services.

Launched in 2018 by two African immigrants—Ham Serunjogi from Uganda and Maijid Moujaled from Ghana, Chipper Cash has grown into a behemoth valued at over $2 billion at its peak. But behind the app you use to buy US Netflix or finally collect your gig payments, there’s a story of grit, vision, and swimming pools.

From Swimming Lanes to Silicon Valley

Ham Serunjogi was born on December 2, 1993, in Gayaza, Uganda, the middle child of a middle-class family that punched above its weight. His parents, firm believers in discipline and education, enrolled him in private school and competitive swimming from the age of six.That same tenacity pushed him to represent Uganda at the 2010 Youth Olympic Games in Singapore—a rare feat for any teenager, let alone one from a country where pools are less common than power outages.

He later attended the prestigious Aga Khan Academy in Kenya before securing admission to Grinnell College in Iowa, USA. While swimming competitively in college, he also co-developed an app for encrypted voice messages—an early taste of the fintech future ahead.

Tech, Timing, and Tenacity

After graduating in 2016 with a degree in Economics, Ham joined Meta (then Facebook) in Dublin. There, he cut his teeth in advertising partnerships and corporate growth. But even amidst the creature comforts of Big Tech, he couldn’t ignore the inefficiencies in African financial systems—especially how hard it was for his father to send money across borders. One story that stuck: his dad once flew to South Africa just to pay a coach in cash. That kind of absurdity didn’t sit well with Ham.

So, he teamed up with Ghanaian software engineer Maijid Moujaled, and in 2018, Chipper Cash was born.

The Rise of a Fintech Titan

Chipper Cash secured its first funding—$150,000—from 500 Startups, laying the groundwork for rapid expansion.By 2021, the company had achieved a peak valuation of $2.2 billion, officially reaching unicorn status.

Its user base grew to over 5 million across seven African countries by 2022. Over time, Chipper Cash attracted more than $300 million in venture capital from major investors such as Bezos Expeditions, Ribbit Capital, Deciens Capital, and SVB Capital.

The company reported revenues exceeding $75 million in 2021, with estimates suggesting it reached as high as $150 million in 2022.

Not All That Glitters: The Setbacks and Stumbles

Success wasn’t a straight line. Despite unicorn status and rapid user growth, Chipper Cash hit a rough patch between 2022 and 2023. The so-called “fintech winter” slammed global investment, and Chipper wasn’t spared. Layoffs wiped out nearly 30% of its workforce. Its internal valuation dropped by 70%—from $2.2 billion to $450 million.

Then came failed acquisition talks with Zepz (formerly WorldRemit), and the cherry on top: one of its backers, FTX, imploded in a crypto scandal. If you thought your Netflix cliffhanger was bad, imagine being in Ham’s shoes watching your valuation nosedive while headlines speculated on your company’s demise.

Why Chipper Cash Still Matters

Even after the financial bruises, Chipper Cash remains one of the most influential fintech companies in Africa. It wasn’t just the tech—it was the timing, the need, and the founder’s dedication to fixing what the banks ignored. Ham’s product suite now includes everything from business payments to US stock trading—offering African users unprecedented access to global financial tools.

In recognition of his leadership, Ham Serunjogi was appointed to President Biden’s Advisory Council on African Diaspora Engagement—proof that people are watching, and listening.

Conclusion: The Hustler, the Code, and the Continent

Ham Serunjogi’s journey isn’t a feel-good story—it’s a real one. Next time your virtual card works, or you finally get that $50 from a gigcompany that’s been dodging your emails, remember the kid from Uganda who swam his way to Silicon Valley and built a financial lifeline for millions.

For More stories in our Afro Trailblazers series, click on our entrepreneurship category on the top bar of the website, and see who else made the list!

You may also like...

Ndidi's Besiktas Revelation: Why He Chose Turkey Over Man Utd Dreams

Super Eagles midfielder Wilfred Ndidi explained his decision to join Besiktas, citing the club's appealing project, stro...

Tom Hardy Returns! Venom Roars Back to the Big Screen in New Movie!

Two years after its last cinematic outing, Venom is set to return in an animated feature film from Sony Pictures Animati...

Marvel Shakes Up Spider-Verse with Nicolas Cage's Groundbreaking New Series!

Nicolas Cage is set to star as Ben Reilly in the upcoming live-action 'Spider-Noir' series on Prime Video, moving beyond...

Bad Bunny's 'DtMF' Dominates Hot 100 with Chart-Topping Power!

A recent 'Ask Billboard' mailbag delves into Hot 100 chart specifics, featuring Bad Bunny's "DtMF" and Ella Langley's "C...

Shakira Stuns Mexico City with Massive Free Concert Announcement!

Shakira is set to conclude her historic Mexican tour trek with a free concert at Mexico City's iconic Zócalo on March 1,...

Glen Powell Reveals His Unexpected Favorite Christopher Nolan Film

A24's dark comedy "How to Make a Killing" is hitting theaters, starring Glen Powell, Topher Grace, and Jessica Henwick. ...

Wizkid & Pharrell Set New Male Style Standard in Leather and Satin Showdown

Wizkid and Pharrell Williams have sparked widespread speculation with a new, cryptic Instagram post. While the possibili...

Victor Osimhen Unveils 'A Prayer From the Gutter', Inspiring Millions with His Journey

Nigerian football star Victor Osimhen shares his deeply personal journey from the poverty-stricken Olusosun landfill in ...