Uday Kotak’s USK Capital Takes Control of US Seed-Snack Brand Go Raw in Landmark Deal

USK Capital, the family office of Indian billionaire banker Uday Kotak, has acquired a majority stake in Freeland Foods LLC, the US-based company behind the popular seed-snack brand Go Raw. The transaction involved buying out existing shareholders, including middle-market private equity firm Juggernaut Capital Partners and several early-stage investors. Although financial terms were not disclosed, the deal represents a significant milestone for USK Capital’s global expansion strategy.

The acquisition marks USK Capital’s first investment outside India and its maiden entry into the consumer-focused sector. The move signals a deliberate shift toward building a geographically diversified portfolio with exposure to global consumption trends. Venkat Subramanian, Chief Investment Officer at USK Capital, noted that rising awareness around nutrition has reshaped food choices worldwide, adding that Go Raw has demonstrated strong growth while steadily expanding its retail presence across the United States, positioning it as a scalable platform for long-term value creation.

Go Raw, headquartered in the Chicago area, has carved out a niche as a “better-for-you” snacking brand centered on seed-based products. Its offerings include sprouted seeds, granolas, salad toppers, and cluster snacks made from nutrient-rich ingredients such as pumpkin, chia, and flax seeds. The growing global appetite for healthy snacks mirrors broader consumer shifts seen across food ecosystems, including delivery platforms like Zomato and Swiggy, which have increasingly leaned into health-forward menus to meet changing demand, reinforcing the brand’s relevance in today’s food landscape.

For USK Capital, the Go Raw acquisition underscores a focused strategy of backing global consumer businesses with strong brand identity and expansion potential. The family office manages the personal wealth of Uday Kotak, founder and former chief executive of Kotak Mahindra Bank, India’s third-largest private sector lender by market value, in which the Kotak family holds roughly 26 percent. By stepping beyond domestic investments, USK Capital is clearly signaling its ambition to build a resilient, globally diversified investment platform anchored on scalable, consumer-driven enterprises with enduring appeal.

You may also like...

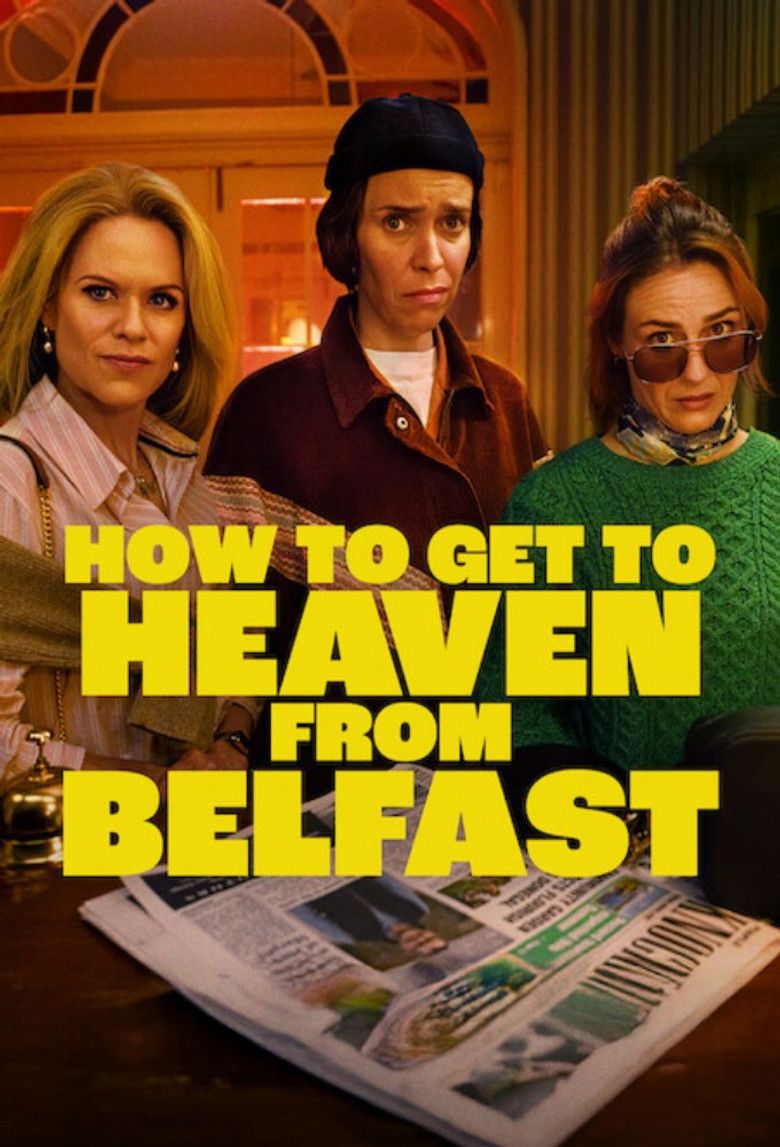

Binge-Worthy 8-Episode Thriller Masterpiece Lands on Netflix!

Lisa McGee, creator of "Derry Girls," brings "How To Get To Heaven From Belfast" to Netflix, a gripping comedy thriller....

Blockbuster Oscar Nominee Hits Netflix After Raking In Millions!

<i>Jurassic World Rebirth</i> redefines the beloved franchise by exploring scientific overreach and humanity's evolving ...

Little Mix's Leigh-Anne Reveals Dream Collaboration with Manon and Normani!

Leigh-Anne Pinnock expressed her desire to collaborate with Manon Bannerman and Normani, a wish that carries significant...

Music Star Thomas Rhett & Lauren Akins Announce Arrival of First Son!

Country music star Thomas Rhett and his wife, Lauren Akins, have welcomed their fifth child and first son, Brave Elijah ...

Bridgerton Stars Unveil Game-Changing Season 4 Death

An interview with the stars of Bridgerton Season 4 Part 2 delves into the tragic death of John Stirling and its aftermat...

Shocking Recruitment Scandal: Kenyan Faces Charges for Sending Youths to Ukraine War

A Kenyan man has been arraigned in court over alleged human trafficking, accused of recruiting 22 youths for the Russia-...

Angola Under Fire: Billion-Dollar Contracts Awarded Without Public Tender

A comprehensive review of Angolan presidential decrees has uncovered that at least US$61.5 billion in public spending wa...

Pentagon Declares AI Heavyweight Anthropic a Supply Chain Risk

The Trump administration has ordered federal agencies to cease using Anthropic products following a dispute over the com...

:max_bytes(150000):strip_icc()/Health-GettyImages-907935124-f092d9cb1d474253a99e5cf8715851b4.jpg)

:max_bytes(150000):strip_icc()/Health-GettyImages-2207955812-f565bc7eed7c4379aa076305011712ee.jpg)

:max_bytes(150000):strip_icc()/Health-GettyImages-186470401-cc399e4518b14680b1244f82dc85405f.jpg)

:max_bytes(150000):strip_icc()/Health-GettyImages-Repub-FrozenFruits-1f6b81d69ab640eab8e0c6458eb544a8.jpg)

:max_bytes(150000):strip_icc()/Health-GettyImages-WholeGrainsForWeightLoss-2da998df8d7f461ba21fa1a43af6b85d.jpg)