OPay and PalmPay Apps Are Outpacing Traditional Banks Among Youths

Youths Go-To Fintech apps

Nigeria’s fin-tech landscape has grown rapidly over the past decade, reshaping how young people handle money. Among the most popular apps capturing youth attention are OPay and PalmPay. For students and young professionals, these mobile wallets are more than just financial tools,they are integrated into their daily lives, social interactions, and side hustles. With smartphone penetration increasing and digital payments becoming a necessity, it is no surprise that these apps have become go-to solutions for a generation that values speed, convenience and flexibility.

The rise of OPay and PalmPay reflects the broader shift from traditional banking to mobile-first solutions. Whereas banks require paperwork, physical visits, and slower transaction processes, these fin-tech apps offer instant transfers, wallet services and even debit card integration, all within a simple interface. For young Nigerians navigating academics, part-time jobs and entrepreneurial ventures, such accessibility is a game-changer.

OPay: Convenience, Loans, and Comprehensive Financial Benefits

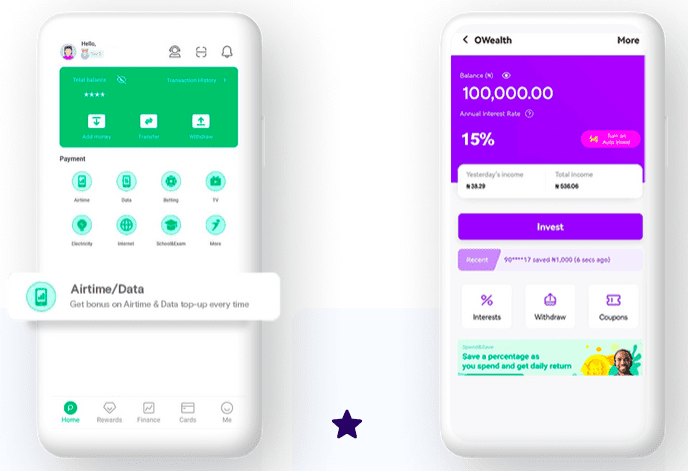

OPay has become one of Nigeria’s most popular fintech apps, particularly among youths and students, thanks to its wide array of digital financial services. According to EcofinagencyBy mid-2025, OPay reported over 50million registered users in Nigeria, with around 10million daily active users.The app allows users to open an account instantly, receive welcome bonuses, and enjoy free transfers and zero-charge bank transactions. Beyond basic payments, OPay provides instant debit cards with zero maintenance fees and free ATM withdrawals, making cashless transactions seamless for students and young professionals. Users can also earn cashback on airtime and bill payments and benefit from high-interest savings through OWealth, which pays interest daily and can earn up to 15% annually.

A key feature that distinguishes OPay is Okash, its in-app loan service. Users can borrow funds instantly for personal or small-business needs, offering a fast alternative to traditional bank loans. Combined with rewards such as special welcome bonuses and cashback incentives, OPay encourages active engagement while providing financial flexibility. Security is also a priority, features like Scam Alert, Emergency Lock, and Large Transaction Shield protect users from fraud and unauthorized transactions, giving youths confidence to manage their money digitally.

OPay also supports merchants and socially conscious initiatives. Merchants can access POS terminals with low transaction fees and integrate payment systems via plugins or custom APIs, enabling smooth business operations. Additionally, programs like the OPay Scholarship Program and Play4aChild initiative blend fin-tech with social impact, supporting students and marginalized children across Nigeria. With borrowing options, savings tools, rewards, and strong security measures, OPay positions itself as a versatile financial platform that empowers youths while addressing both personal and entrepreneurial financial needs.

PalmPay: Rewards, Loans, and Student-Friendly Financial Benefits

PalmPay, launched in 2019, has quickly become a favorite among Nigerian youths due to its wide range of digital financial services. The app allows users to open an account with minimal paperwork, access a digital wallet and perform transactions in real-time, making it ideal for students and young professionals who prefer fast, mobile-first solutions. According to Nairametrics, PalmPay was ranked #2 overall and #1 in financial services on the Financial Times, Africa's Fastest-Growing Companies 2025 list. This ranking, based on revenue growth between 2020 and 2023, recognized PalmPay as the fastest-growing fin-tech company in Africa. Beyond simple money transfers and bill payments, PalmPay offers cashback on everyday spending, discounts on data bundles, and fee-free transfers features that make it particularly appealing for managing tight budgets. For those looking to grow their funds, flexible savings plans and competitive interest rates, especially with premium accounts, provide opportunities to save effectively while earning returns.

A standout feature of PalmPay is its in-app loan service, which allows users to borrow funds instantly for personal expenses or small business needs. Similar to OPay’s Okash, these loans offer a convenient alternative to traditional banks, enabling youths to access quick credit without lengthy approvals. Combined with the app’s rewards system such as daily trial cash, monthly free data and promotional incentives. users are encouraged to engage actively with the platform while enjoying tangible financial benefits. The app also supports agent networks, giving young entrepreneurs the chance to earn through cash-in/cash-out services and other small-scale side hustles.

PalmPay’s interface is simple and user-friendly, prioritizing a smooth experience for mobile-savvy youths. Accounts have zero maintenance fees and transactions are monitored in real-time for reliability and security. Premium account holders enjoy additional perks, including exclusive debit cards, higher interest on savings and priority customer support. By combining borrowing options, savings tools, and daily rewards, PalmPay positions itself as more than a fin-tech wallet, it becomes a versatile financial companion that meets the everyday needs and ambitions of Nigerian youths.

Opay and Palmpay vs Traditional Banks

One of the main reasons Nigerian youths are increasingly adopting OPay and PalmPay is the significant contrast these fin-tech apps present compared to traditional banking. Conventional banks typically require extensive account-opening procedures, in-person branch visits and multiple layers of documentation. For students, young entrepreneurs or part-time workers managing small transactions or side-hustle payments, this can be cumbersome and time-consuming. In contrast, OPay and PalmPay allow users to open accounts instantly on their smartphones, complete with welcome bonuses, zero-maintenance debit cards and real-time transaction capabilities. Beyond transfers, both apps offer integrated loan services, Okash on OPay and PalmPay’s in-app borrowing enabling youths to access credit quickly without navigating the formalities of bank loans.

Speed and convenience remain central to their appeal. While traditional bank transfers can take hours or even days sometimes, OPay and PalmPay process transactions almost instantly. Youths can pay for airtime, data, utility bills or gig work earnings without visiting branches or waiting in long queues. Additionally, both apps offer value-added services not typically available in conventional banks, such as high-interest savings through OWealth on OPay, flexible savings plans on PalmPay, cashback rewards, discounts on data bundles, and daily or monthly incentives. These features provide a level of financial flexibility and engagement that resonates strongly with tech-savvy youths, allowing them to manage, grow and utilize their money more efficiently.

Another major advantage is accessibility and flexibility,Both fin-tech apps are optimized for mobile-first users and supported by broad agent networks, which extend financial services to undeserved or semi-urban communities. They cater to smaller-value transactions, micro-loans, and day-to-day digital payments areas that traditional banks often overlook due to perceived inefficiencies. For students, freelancers, small-scale entrepreneurs and young gig economy workers, these apps offer an agile alternative to banking, allowing them to participate fully in the digital economy. While traditional banks remain critical for long-term savings, investments, and larger financial transactions, OPay and PalmPay provide a dynamic, youth-friendly platform that integrates payments, borrowing, savings and rewards into a single, convenient ecosystem.

Recommended Articles

Milo's Monumental Leap: $100M in Crypto Mortgages & Record Home Loan

Milo, a Miami-based fintech firm, has surpassed $100 million in crypto mortgage originations, demonstrating a significan...

Nigeria's $150K Weekly Forex Window: A Game Changer for Fintech Remittances!

Nigeria's Central Bank has reversed its policy, granting licensed Bureau de Change (BDC) operators access to the officia...

Facebook Backs Escrowlock: Anambra Startup Secures Funding from $100M Grant

Nigerian fintech company Escrowlock has received undisclosed funding from Facebook, part of a $100 million grant to 30,0...

Innovation Spotlight: Owllup Revolutionizes Income for Nigerians via 'Full-Circle Economy' Social Connections!

Owllup, founded by Chimaobi Stanley Anyanwu, is transforming Nigeria's tech and creator economy by providing mentorship,...

African Startups Clash with PayPal Amidst Dollar Scarcity

PayPal has returned to Nigeria after two decades, partnering with Paga to enable naira withdrawals and future business t...

Jack Dorsey's Block Hammered by $40M Fine in Cash App Compliance Crackdown!

Jack Dorsey's Block Inc. has settled with the NYDFS for $40 million over Cash App's compliance misconduct allegations, i...

You may also like...

If Gender Is a Social Construct, Who Built It And Why Are We Still Living Inside It?

If gender is a social construct, who built it—and why does it still shape our lives? This deep dive explores power, colo...

Be Honest: Are You Actually Funny or Just Loud? Find Your Humour Type

Are you actually funny or just loud? Discover your humour type—from sarcastic to accidental comedian—and learn how your ...

Ndidi's Besiktas Revelation: Why He Chose Turkey Over Man Utd Dreams

Super Eagles midfielder Wilfred Ndidi explained his decision to join Besiktas, citing the club's appealing project, stro...

Tom Hardy Returns! Venom Roars Back to the Big Screen in New Movie!

Two years after its last cinematic outing, Venom is set to return in an animated feature film from Sony Pictures Animati...

Marvel Shakes Up Spider-Verse with Nicolas Cage's Groundbreaking New Series!

Nicolas Cage is set to star as Ben Reilly in the upcoming live-action 'Spider-Noir' series on Prime Video, moving beyond...

Bad Bunny's 'DtMF' Dominates Hot 100 with Chart-Topping Power!

A recent 'Ask Billboard' mailbag delves into Hot 100 chart specifics, featuring Bad Bunny's "DtMF" and Ella Langley's "C...

Shakira Stuns Mexico City with Massive Free Concert Announcement!

Shakira is set to conclude her historic Mexican tour trek with a free concert at Mexico City's iconic Zócalo on March 1,...

Glen Powell Reveals His Unexpected Favorite Christopher Nolan Film

A24's dark comedy "How to Make a Killing" is hitting theaters, starring Glen Powell, Topher Grace, and Jessica Henwick. ...