KindlyMD and Nakamoto Merge, Unveiling Ambitious 1 Million BTC Acquisition Plan

KindlyMD, Inc. (NASDAQ: NAKA) and Bitcoin-native holding company Nakamoto Holdings Inc. have officially completed their long-anticipated merger, creating a new publicly traded Bitcoin treasury vehicle. This combined entity, operating under the KindlyMD name and trading on the Nasdaq Capital Market, has an ambitious goal to acquire one million BTC. Nakamoto will function as a wholly owned subsidiary, specifically overseeing the Bitcoin financial services division, thereby establishing an institutional-grade platform for Bitcoin treasury management.

David Bailey, CEO of the newly merged company and Chairman of the Board, expressed a clear vision: “Our vision is for the world’s capital markets to operate on a Bitcoin standard.” He articulated his long-held belief that Bitcoin would become the most valuable asset in human history and emphasized the role of securitization in institutional adoption. Tim Pickett, former KindlyMD CEO, now Chief Medical Officer, added that KindlyMD is extending its principle of operational and innovative excellence to its capital strategy, recognizing Bitcoin’s ability to preserve value. The leadership team has been strengthened with key appointments, including Amanda Fabiano as COO, Tyler Evans as CIO, and Andrew Creighton as CCO. Independent directors include Charles Blackburn, Perianne Boring, Eric Weiss, Greg Xethalis, and Mark Yusko, alongside Pickett.

The financial foundation for this ambitious endeavor includes approximately $540 million in gross proceeds generated through a private placement in public equity (PIPE) financing, which is primarily designated for Bitcoin purchases. Additionally, a $200 million convertible note offering was expected to close shortly after the merger, further earmarking proceeds for subsequent Bitcoin acquisitions. These strategic financial moves underscore the company’s disciplined approach to building its Bitcoin treasury.

The merged company's mission is unequivocally focused on establishing a premier, institutional-grade Bitcoin treasury vehicle. This initiative aims to drive corporate and government adoption of Bitcoin by leveraging advanced corporate finance strategies to simplify Bitcoin integration into global capital markets. KindlyMD intends to position itself as a leading entity in public market Bitcoin treasury management, facilitating a broader transition towards a Bitcoin standard, as reiterated by Bailey in his commitment on X.

Following its August 2025 merger, KindlyMD made its first significant Bitcoin acquisition, purchasing 5,743.91 BTC for approximately $679 million. This purchase was executed at a weighted average price of $118,204.88 per Bitcoin, bringing the company’s total holdings to 5,764.91 BTC. This initial acquisition solidifies KindlyMD’s position as a notable participant in the expanding corporate Bitcoin treasury space, aligning with its long-term objective of accumulating one million Bitcoin.

David Bailey emphasized that this acquisition reinforces the company’s conviction in Bitcoin as the ultimate reserve asset for corporations and institutions. He reiterated their long-term mission reflects the belief that Bitcoin will anchor the next era of global finance, with a commitment to building a trusted and transparent vehicle. The funding for this acquisition utilized proceeds from the recently completed PIPE financing, demonstrating the direct application of their capital strategy, further supported by the proceeds from the $200 million convertible note offering, specifically earmarked for additional Bitcoin purchases.

The corporate Bitcoin treasury landscape has seen rapid evolution in 2025, with an increasing number of major companies establishing dedicated Bitcoin acquisition vehicles. This trend has accelerated as traditional financial institutions increasingly acknowledge Bitcoin as a legitimate treasury asset, leading to the development of more sophisticated financial instruments and investment vehicles designed for corporate Bitcoin exposure.

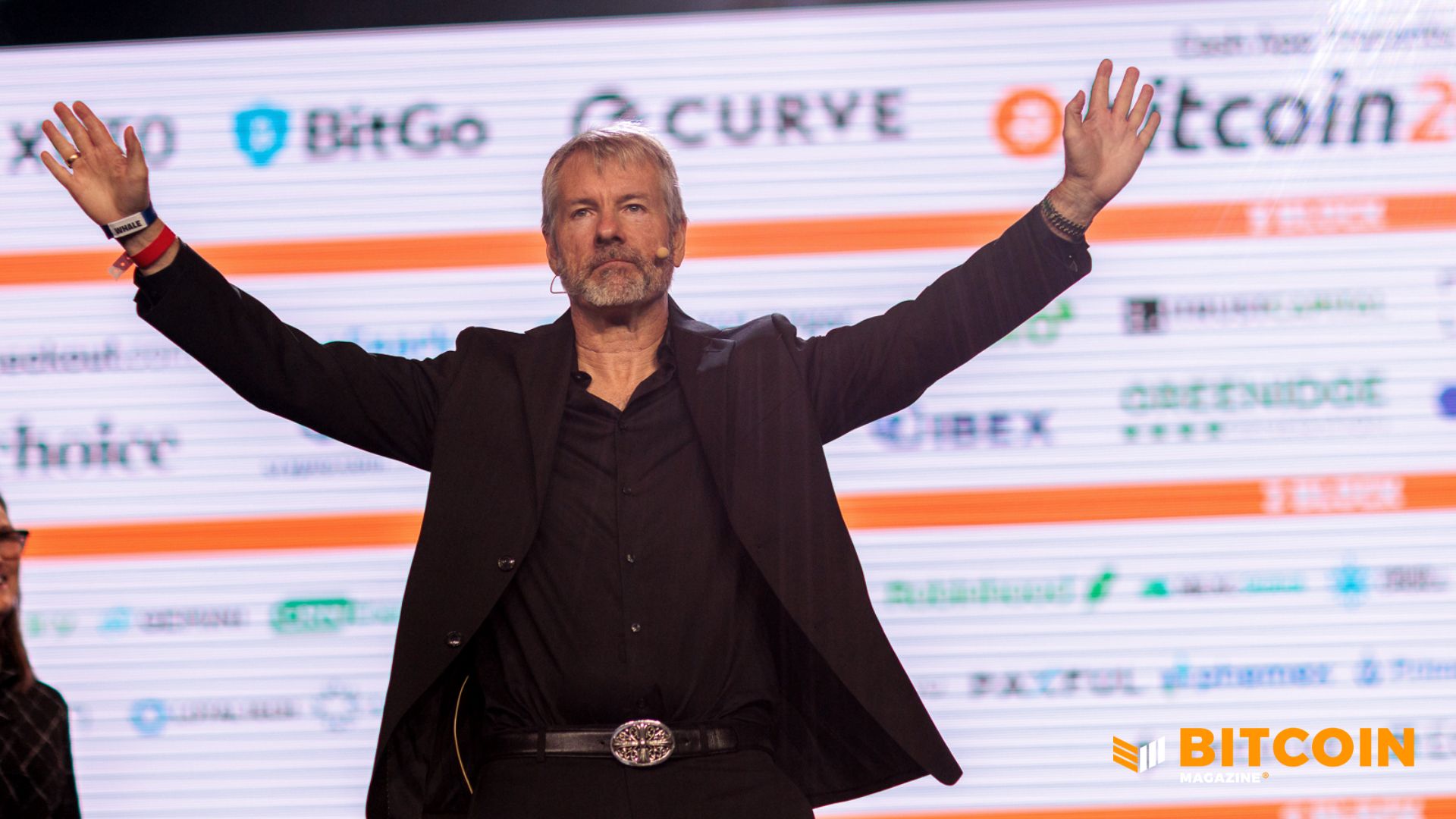

KindlyMD and Nakamoto Holdings maintain a partnership with Bitcoin Magazine’s parent company BTC Inc, where BTC Inc provides certain marketing services to Nakamoto, as part of an effort to build the first global network of Bitcoin treasury companies.

You may also like...

Super Eagles Fury! Coach Eric Chelle Slammed Over Shocking $130K Salary Demand!

)

Super Eagles head coach Eric Chelle's demands for a $130,000 monthly salary and extensive benefits have ignited a major ...

Premier League Immortal! James Milner Shatters Appearance Record, Klopp Hails Legend!

Football icon James Milner has surpassed Gareth Barry's Premier League appearance record, making his 654th outing at age...

Starfleet Shockwave: Fans Missed Key Detail in 'Deep Space Nine' Icon's 'Starfleet Academy' Return!

Starfleet Academy's latest episode features the long-awaited return of Jake Sisko, honoring his legendary father, Captai...

Rhaenyra's Destiny: 'House of the Dragon' Hints at Shocking Game of Thrones Finale Twist!

The 'House of the Dragon' Season 3 teaser hints at a dark path for Rhaenyra, suggesting she may descend into madness. He...

Amidah Lateef Unveils Shocking Truth About Nigerian University Hostel Crisis!

Many university students are forced to live off-campus due to limited hostel spaces, facing daily commutes, financial bu...

African Development Soars: Eswatini Hails Ethiopia's Ambitious Mega Projects

The Kingdom of Eswatini has lauded Ethiopia's significant strides in large-scale development projects, particularly high...

West African Tensions Mount: Ghana Drags Togo to Arbitration Over Maritime Borders

Ghana has initiated international arbitration under UNCLOS to settle its long-standing maritime boundary dispute with To...

Indian AI Arena Ignites: Sarvam Unleashes Indus AI Chat App in Fierce Market Battle

Sarvam, an Indian AI startup, has launched its Indus chat app, powered by its 105-billion-parameter large language model...