Crypto Shockwave: Bitcoin ETFs Bleed $394 Million as Market Braces for Impact!

The new week commenced with a cautious tone for the crypto community, particularly affecting U.S. spot Bitcoin Exchange-Traded Funds (ETFs). During their last trading session, these Bitcoin funds failed to attract any new capital, signaling a significant shift in investor sentiment. Data from SosoValue indicated a substantial outflow of $394.68 million from Bitcoin ETFs on January 16, occurring even as Bitcoin's price initially maintained stability around $95,550.

Following this significant ETF pullback, Bitcoin's price has since retreated below the $95,550 mark, suggesting that the declining momentum observed in the ETF ecosystem has now extended to the asset's spot trading price. This widespread caution across the Bitcoin ETF landscape strongly points towards increasing short-term profit-taking activities, which have pushed Bitcoin into a 'deep red' territory.

Despite the notable single-day outflow, the long-term outlook for Bitcoin ETFs remains robust. Cumulative net inflows since their launch in January 2024 still stand at a considerable $57.82 billion. This figure underscores sustained institutional interest and conviction in Bitcoin's long-term trajectory, demonstrating that the recent caution is not necessarily a loss of confidence. Furthermore, these funds collectively hold approximately 6.53% of Bitcoin's total circulating supply, highlighting how deeply embedded ETFs have become within the market's structure, effectively bridging the gap between traditional finance and the Bitcoin ecosystem.

Amidst the general negative trend, BlackRock's Bitcoin ETF (IBIT) proved an outlier, managing to attract $15.09 million in daily inflows and thus breaking the prevailing negative capital flow. Conversely, Fidelity's FBTC experienced the largest single-day withdrawal, with outflows totaling $205.22 million. Other Bitcoin funds also recorded significant outflows, which collectively offset the modest positive inflow seen by BlackRock, contributing to the overall negative net flow for the day.

You may also like...

NBA Bombshell: LeBron James and Ayton Out for Pacers Clash!

The Los Angeles Lakers will be severely impacted by injuries, with LeBron James, Deandre Ayton, and Maxi Kleber all side...

Man City Stays: Pep Guardiola Drops Major Hint on Future!

Pep Guardiola has hinted at staying at Manchester City, expressing confidence that his team will reach its full potentia...

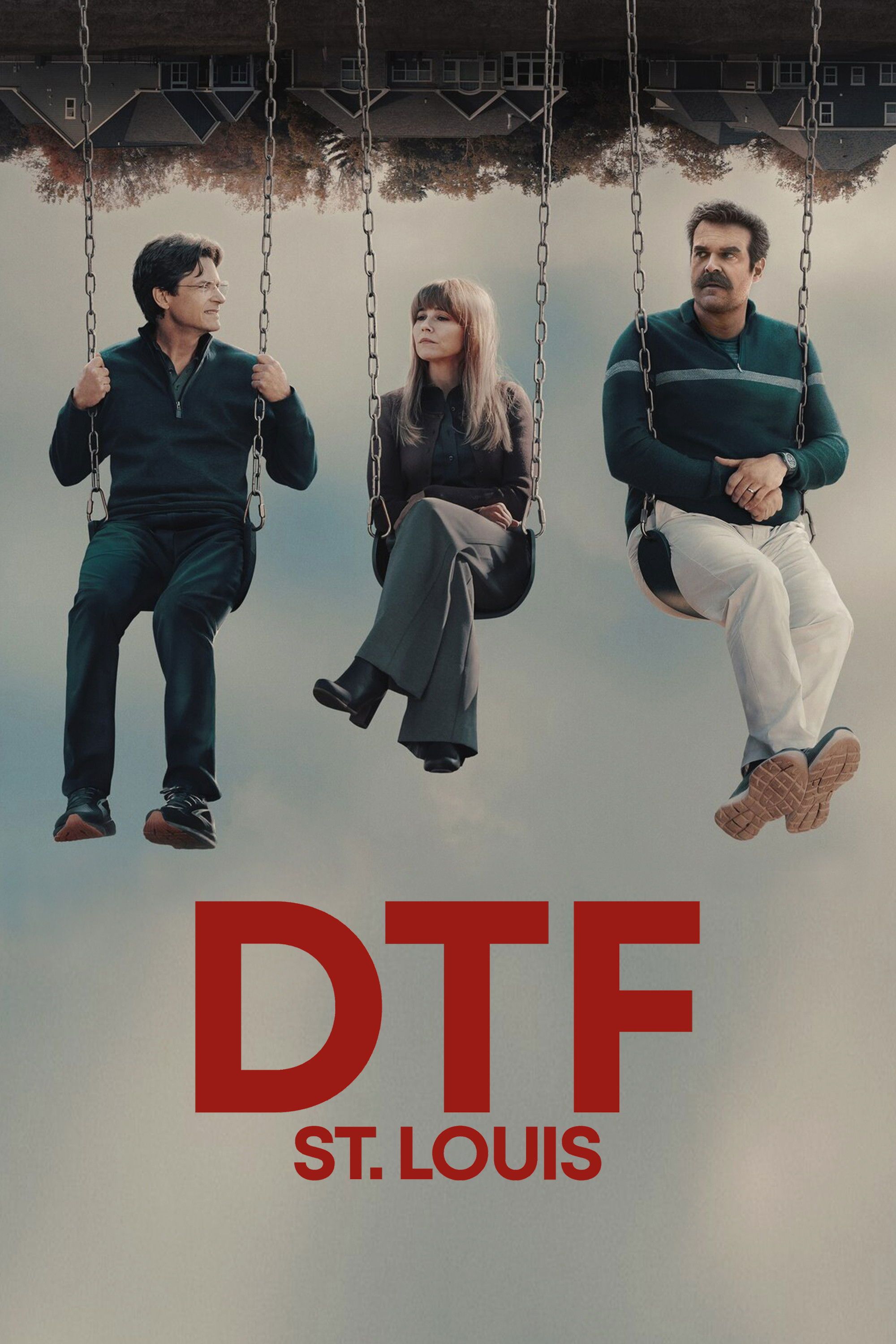

HBO's New Crime Thriller Dethrones 'A Knight of the Seven Kingdoms' in Streaming Battle

HBO Max is currently showcasing two notable series: 'DTF St. Louis,' a star-studded crime story praised for its blend of...

SZA Slams Chart Predictions, Defying Taylor Swift Comparison: 'Anything Is Possible!'

SZA's album SOS defied expectations by topping the Billboard 200 over Taylor Swift, a feat her label initially doubted. ...

Sam Asghari Demands Privacy Amid Britney Spears’ DUI Arrest After Explosive Comments

Sam Asghari has addressed Britney Spears' recent DUI arrest during a Fox News interview, calling for privacy for his ex-...

Giant Meets Miniature! World's Tallest Dog Shares Paws With the Smallest Canine Star!

The world's shortest dog, Pearl the Chihuahua, and a towering Great Dane named Reggie, had an unforgettable playdate arr...

End of an Era: Girl Scouts Announce Retirement of Two Beloved Cookie Flavors After 2025 Season!

Girl Scout cookie season is officially underway, but fans should prepare to say goodbye to Toast-Yay! and S’mores, which...

Unlock Peak Performance: Timing Magnesium for Ultimate Muscle Recovery

:max_bytes(150000):strip_icc()/Health-GettyImages-MagnesiumBeforeOrAfterWorkout-1012169458424c3791686bd6c68427e5.jpg)

Magnesium is vital for athletes, supporting muscle function, energy, and recovery, with increased demands during intense...