Crisis Deepens: China Vanke Teeters on Brink After Failed Vote

China Vanke Co., once the nation’s largest homebuilder by sales and the last major developer to avoid default amidst an unprecedented property crisis, now faces imminent debt failure. The company failed to secure sufficient creditor support for its proposal to defer a looming 2 billion yuan bond payment due on December 15. A filing to the National Association of Financial Market Institutional Investors revealed that three proposals, including a one-year extension plan, fell short of the required more than 90% support for passage.

This development leaves Vanke in a precarious situation, underscoring the formidable challenges China encounters in addressing a real estate debt crisis now entering its fifth year. This prolonged slump has already triggered record defaults and led to liquidations or restructurings for property giants such as Country Garden Holdings Co. and China Evergrande Group. Despite policymakers’ recent pledges to intensify efforts to stabilize the housing market, they have refrained from implementing measures that some economists believe are essential for reviving a sector crucial to the broader economy.

Vanke is now mandated to find the necessary funds to pay the bond by the end of Monday or within a grace period of five business days. Failure to do so, without a separate agreement to push back the deadlines, could lead creditors to declare a default – an outcome once considered unimaginable for the state-backed developer. For a long time, Vanke benefited from a pervasive investor belief that authorities would ensure its solvency, primarily due to its largest shareholder, state-owned Shenzhen Metro Group Co.

Indeed, Shenzhen Metro had provided over 30 billion yuan in shareholder loans, offering a crucial lifeline that helped the cash-strapped builder avert defaults earlier this year. However, this support came under increased scrutiny in recent months after Shenzhen Metro indicated plans to tighten borrowing terms. This strategic shift caused Vanke’s securities to plummet to deeply distressed levels. Just a week prior to the failed vote, financial and state asset regulators from Shenzhen appealed to bondholders for understanding regarding Vanke's current financial strain.

Yao Yu, founder of credit research firm RatingDog, commented on the voting results, stating, “The voting results indicated that the regulatory guidance hadn’t changed anything, making it very difficult for Vanke to reach a consensus with investors.” Yu suggests that Vanke is “quite likely” to propose another motion to extend the five-business-day grace period to 30 business days, thereby allowing more time for negotiations. The original proposal, which sought a 12-month delay on principal and interest without any upfront cash or installments, received no votes in favor. Two subsequent proposals, which included credit enhancements and an on-time interest payment, garnered backing from investors holding 83.4% and 18.95% of the bond’s outstanding amount, respectively.

Calls to Vanke’s investor relations office remained unanswered outside of business hours. Some market observers, including Li Huan, co-founder of Forest Capital Hong Kong Ltd., have expressed that a full-scale debt restructuring for Vanke is inevitable. They argue that even if Vanke could successfully secure further extensions, such measures would fail to address the fundamental underlying issues plaguing the company’s financial health and the broader Chinese property market.

Recommended Articles

Altice International's Daring Debt Play: Shifting Assets to Raise Capital

Altice International has reclassified its Portuguese and Caribbean units as "unrestricted subsidiaries," enabling them t...

Sarah Ferguson's Business Empire Collapses Amid New Epstein Scandal Revelations

Six businesses associated with Sarah Ferguson, the former Duchess of York, are being dissolved amid heightened scrutiny ...

Mega $451M Deal Rescues Bankrupt NYC Buildings!

Real estate firm Summit Properties USA secured court approval for its $451 million acquisition of 5,200 apartments from ...

Lagos's New Jewel: Cruxstone Unveils Nautica Rise, Redefining Coastal Luxury!

Cruxstone Development and Investment Limited has unveiled Nautica Rise, a new resort-inspired waterfront development on ...

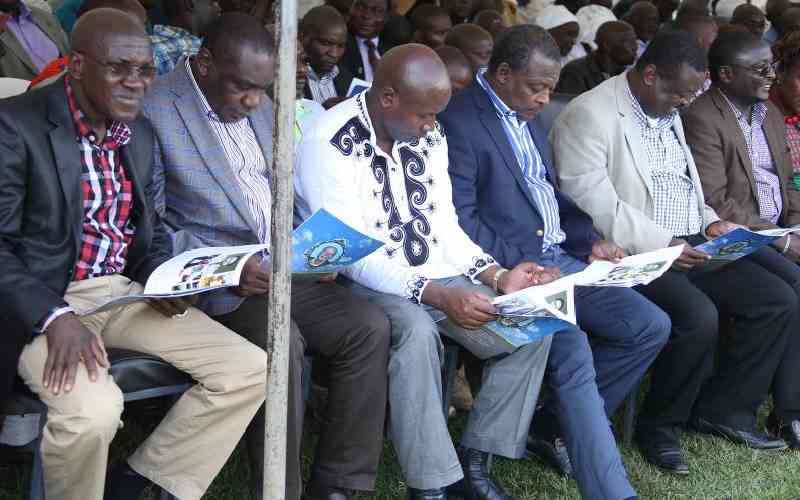

Untamed: Jirongo's Rollercoaster Ride Through Politics, Wealth, and Legal Battles

Cyrus Shakhalaga Khwa Jirongo was a prominent Kenyan politician and businessman, known for his flamboyant lifestyle and ...

You may also like...

Super Eagles Fury! Coach Eric Chelle Slammed Over Shocking $130K Salary Demand!

)

Super Eagles head coach Eric Chelle's demands for a $130,000 monthly salary and extensive benefits have ignited a major ...

Premier League Immortal! James Milner Shatters Appearance Record, Klopp Hails Legend!

Football icon James Milner has surpassed Gareth Barry's Premier League appearance record, making his 654th outing at age...

Starfleet Shockwave: Fans Missed Key Detail in 'Deep Space Nine' Icon's 'Starfleet Academy' Return!

Starfleet Academy's latest episode features the long-awaited return of Jake Sisko, honoring his legendary father, Captai...

Rhaenyra's Destiny: 'House of the Dragon' Hints at Shocking Game of Thrones Finale Twist!

The 'House of the Dragon' Season 3 teaser hints at a dark path for Rhaenyra, suggesting she may descend into madness. He...

Amidah Lateef Unveils Shocking Truth About Nigerian University Hostel Crisis!

Many university students are forced to live off-campus due to limited hostel spaces, facing daily commutes, financial bu...

African Development Soars: Eswatini Hails Ethiopia's Ambitious Mega Projects

The Kingdom of Eswatini has lauded Ethiopia's significant strides in large-scale development projects, particularly high...

West African Tensions Mount: Ghana Drags Togo to Arbitration Over Maritime Borders

Ghana has initiated international arbitration under UNCLOS to settle its long-standing maritime boundary dispute with To...

Indian AI Arena Ignites: Sarvam Unleashes Indus AI Chat App in Fierce Market Battle

Sarvam, an Indian AI startup, has launched its Indus chat app, powered by its 105-billion-parameter large language model...