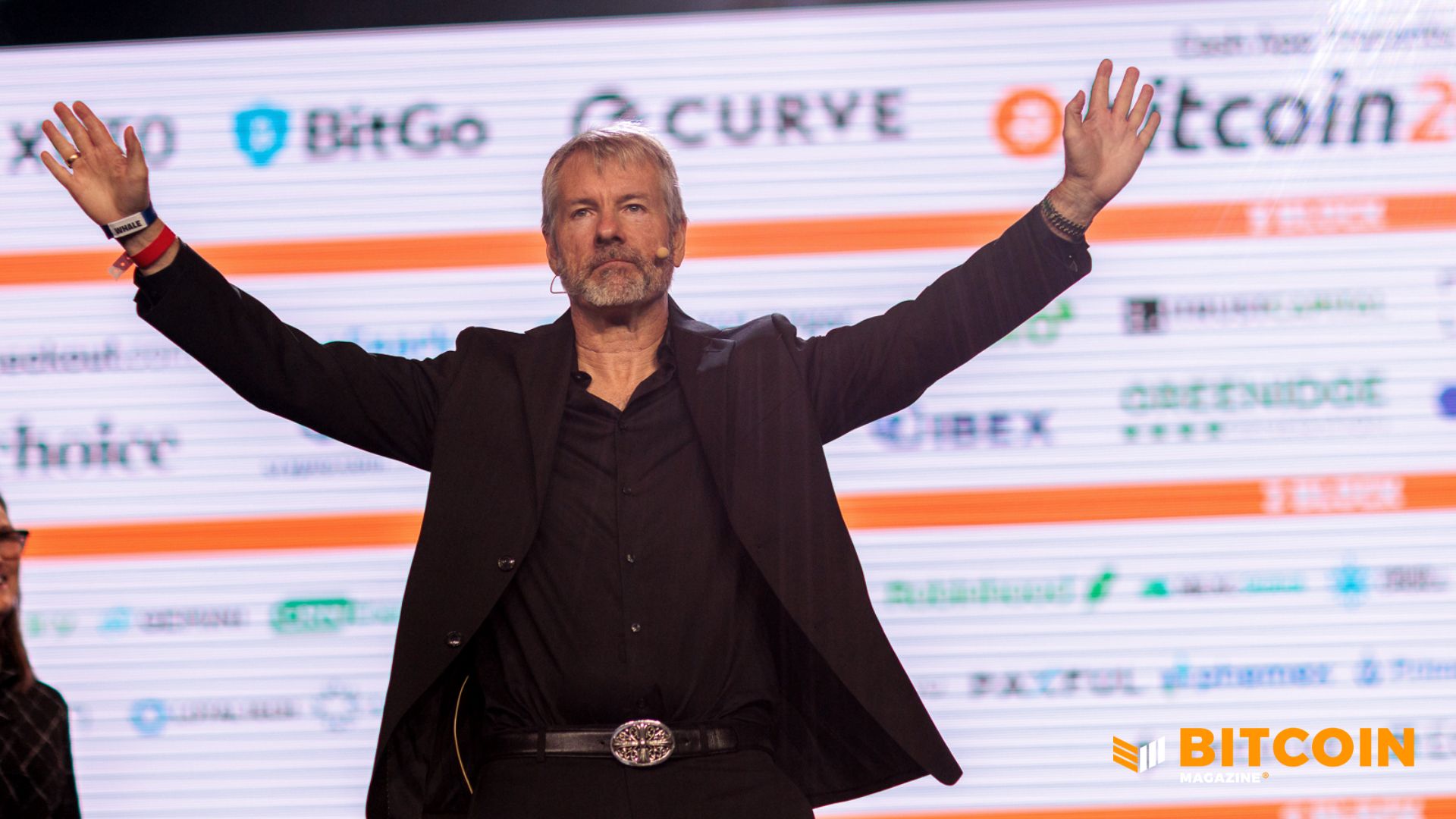

BREAKING: Mystery 'Strategy' Amasses Staggering 700,000 BTC, Shaking Crypto Markets!

Strategy Inc. (MSTR), the Tysons Corner–based firm formerly known for its enterprise software business, has significantly expanded its cryptocurrency treasury, officially surpassing the 700,000 Bitcoin milestone. The move reinforces the company’s long-standing, aggressive accumulation strategy and further cements its position as one of the largest corporate holders of Bitcoin worldwide.

The latest purchase reflects Strategy’s unwavering conviction in Bitcoin as a long-term store of value, even amid elevated prices and ongoing market volatility.

$2.13 Billion Bitcoin Purchase Disclosed

In a recent Form 8-K filing with the U.S. Securities and Exchange Commission (SEC), Strategy revealed that it acquired an additional 22,305 BTC between January 12 and January 19, 2026. The purchase totaled approximately $2.13 billion, with an average acquisition price of $95,284 per Bitcoin.

Following this transaction, Strategy’s total Bitcoin holdings now stand at 709,715 BTC, representing one of the largest known corporate crypto treasuries in existence.

Equity-Funded Strategy and Cost Basis Update

The entire acquisition was financed through Strategy’s At-The-Market (ATM)equity offering program, which raised $2.125 billion in net proceeds. The company achieved this by issuing shares across its increasingly complex capital structure, which includes multiple classes of preferred stock.

As a result of the latest purchase, Strategy’s total Bitcoin cost basis has climbed to approximately $54 billion, with an average cost per coin of nearly $76,000 across its full holdings. The figures highlight both the scale of Strategy’s exposure and its willingness to continue accumulating Bitcoin at historically high price levels.

You may also like...

When Sacred Calendars Align: What a Rare Religious Overlap Can Teach Us

As Lent, Ramadan, and the Lunar calendar converge in February 2026, this short piece explores religious tolerance, commu...

Arsenal Under Fire: Arteta Defiantly Rejects 'Bottlers' Label Amid Title Race Nerves!

Mikel Arteta vehemently denies accusations of Arsenal being "bottlers" following a stumble against Wolves, which handed ...

Sensational Transfer Buzz: Casemiro Linked with Messi or Ronaldo Reunion Post-Man Utd Exit!

The latest transfer window sees major shifts as Manchester United's Casemiro draws interest from Inter Miami and Al Nass...

WBD Deal Heats Up: Netflix Co-CEO Fights for Takeover Amid DOJ Approval Claims!

Netflix co-CEO Ted Sarandos is vigorously advocating for the company's $83 billion acquisition of Warner Bros. Discovery...

KPop Demon Hunters' Stars and Songwriters Celebrate Lunar New Year Success!

Brooks Brothers and Gold House celebrated Lunar New Year with a celebrity-filled dinner in Beverly Hills, featuring rema...

Life-Saving Breakthrough: New US-Backed HIV Injection to Reach Thousands in Zimbabwe

The United States is backing a new twice-yearly HIV prevention injection, lenacapavir (LEN), for 271,000 people in Zimba...

OpenAI's Moral Crossroads: Nearly Tipped Off Police About School Shooter Threat Months Ago

ChatGPT-maker OpenAI disclosed it had identified Jesse Van Rootselaar's account for violent activities last year, prior ...

MTN Nigeria's Market Soars: Stock Hits Record High Post $6.2B Deal

MTN Nigeria's shares surged to a record high following MTN Group's $6.2 billion acquisition of IHS Towers. This strategi...