Bitcoin's Next Surge: Bulls Target $98,000 After Strong $90,000 Hold

The Bitcoin price action, which initially appeared bearish last week, saw bulls successfully defend the bullish structure around the $90,000 level, leading to a push towards the $98,000 resistance. Despite a retreat from this level, the week concluded with Bitcoin trading at $93,638.

Market participants anticipate another attempt by the bulls to challenge the $98,000 resistance this week. Sustained price action above $98,000 could pave the way for a move to the upper end of this resistance zone at $103,500. Early in the week, the crucial support level at $91,400 may be tested, and its ability to hold is paramount for the bullish momentum to persist.

Bulls have made discernible progress in chipping away at overhead resistance. The immediate goal for bulls is to reclaim the $94,000 level, establishing it as short-term support for the current week. If this momentum continues, a re-challenge of the $98,000 resistance is expected, with an aim to push towards the $103,500 upper boundary of this zone.

A daily close above this upper boundary could signal a move towards the next significant resistance zone, spanning $106,000 to $109,000. This range is projected to offer very strong resistance; however, if bullish strength endures, the 0.786 Fibonacci retracement level at $116,000 could become the next target.

Conversely, bulls must rigorously defend the $91,400 level, as a breach could embolden bears to drive the price lower. A move below $91,400 would likely see $87,000 act as an interim support before potentially opening the door to the major $84,000 support level. A decisive break of $84,000 support could expose the low $70,000 area for a test.

For the current week, bulls are expected to build upon their recent resilience. A test of $98,000 is likely if they manage to regain $94,000 early on. However, a more bearish scenario could involve a test of the $91,400 support. As long as this level holds, the bullish bias remains intact, and re-challenging $98,000 is still a strong possibility.

A daily close above $98,000 would typically propel the price towards $103,500. The overall market mood is assessed as 'Slightly Bullish,' reflecting the bulls' successful defense of the $90,000 area last week and the favorable price action heading into the new week.

Looking ahead to the next few weeks, while bulls have maintained some momentum, they are now approaching heavier resistance areas. Should they manage to push above $100,000, they would be entering a zone where a major price reversal could occur.

The range between $103,500 and $109,000 is anticipated to be a formidable challenge, and a significant price rejection from this area in the coming weeks would not be unexpected. Holding support levels from such a rejection would be crucial in determining whether the current rally can extend to new highs or if it will ultimately capitulate to new lows below $80,000.

To assist in understanding these market dynamics, here is a guide to common terminology:

Bulls/Bullish: Refers to buyers or investors who anticipate an increase in price.

Bears/Bearish: Refers to sellers or investors who expect a decrease in price.

Support or support level: A price level at which an asset's price is expected to hold, at least initially. Repeated touches on a support level tend to weaken it, making it more susceptible to a break.

Resistance or resistance level: The inverse of support. This is a price level that is likely to reject the price, at least initially. Multiple touches on a resistance level can weaken it, increasing the likelihood of the price breaking through.

Fibonacci Retracements and Extensions: These are ratios derived from the golden ratio (Phi: 1.618 and phi: 0.618), a universal constant observed in growth and decay cycles in nature, applied to identify potential support and resistance levels.

You may also like...

NBA Bombshell: LeBron James and Ayton Out for Pacers Clash!

The Los Angeles Lakers will be severely impacted by injuries, with LeBron James, Deandre Ayton, and Maxi Kleber all side...

Man City Stays: Pep Guardiola Drops Major Hint on Future!

Pep Guardiola has hinted at staying at Manchester City, expressing confidence that his team will reach its full potentia...

HBO's New Crime Thriller Dethrones 'A Knight of the Seven Kingdoms' in Streaming Battle

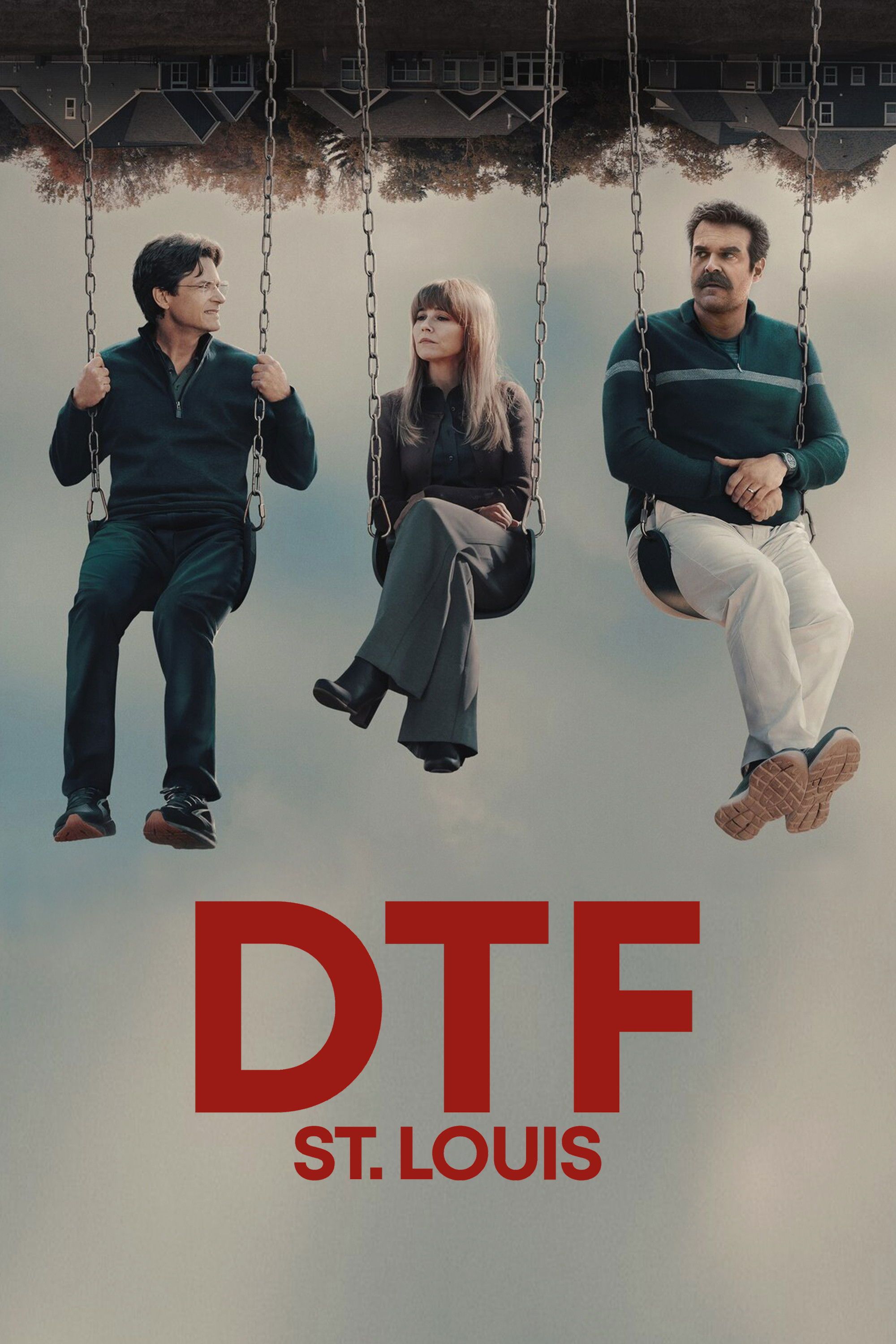

HBO Max is currently showcasing two notable series: 'DTF St. Louis,' a star-studded crime story praised for its blend of...

SZA Slams Chart Predictions, Defying Taylor Swift Comparison: 'Anything Is Possible!'

SZA's album SOS defied expectations by topping the Billboard 200 over Taylor Swift, a feat her label initially doubted. ...

Sam Asghari Demands Privacy Amid Britney Spears’ DUI Arrest After Explosive Comments

Sam Asghari has addressed Britney Spears' recent DUI arrest during a Fox News interview, calling for privacy for his ex-...

Giant Meets Miniature! World's Tallest Dog Shares Paws With the Smallest Canine Star!

The world's shortest dog, Pearl the Chihuahua, and a towering Great Dane named Reggie, had an unforgettable playdate arr...

End of an Era: Girl Scouts Announce Retirement of Two Beloved Cookie Flavors After 2025 Season!

Girl Scout cookie season is officially underway, but fans should prepare to say goodbye to Toast-Yay! and S’mores, which...

Unlock Peak Performance: Timing Magnesium for Ultimate Muscle Recovery

:max_bytes(150000):strip_icc()/Health-GettyImages-MagnesiumBeforeOrAfterWorkout-1012169458424c3791686bd6c68427e5.jpg)

Magnesium is vital for athletes, supporting muscle function, energy, and recovery, with increased demands during intense...