African Fintech Giant Paystack Hits Profitability and Pivots to AI Future

Paystack has unveiled The Stack Group (TSG), a newly formed holding company, signifying a major strategic expansion beyond its foundational payments business. This move integrates Paystack into broader sectors including banking, consumer finance, and advanced AI-led product development. The launch of TSG is a monumental step for the company, coinciding with its 10th anniversary and its achievement of profitability.

The Stack Group will function as an umbrella organization, overseeing a collection of independent yet complementary businesses. These include the original Paystack payments platform, the newly established Paystack Microfinance Bank, Zap (a consumer payments product), and TSG Labs, a venture studio dedicated to developing innovative products within and outside the financial services sector, particularly leveraging emerging technologies like AI.

Agreements formalizing the group's structure were signed in October 2025 and are currently awaiting regulatory approvals. This formation underscores a pivotal shift for Paystack, transforming it from primarily a payments processor into a comprehensive builder of technology and financial infrastructure for businesses across Africa. Since its acquisition by Stripe in 2020, Paystack has witnessed substantial growth, with its payment volume increasing more than twelvefold.

Geographically, Paystack maintains licensed and operational presence in Côte d’Ivoire, Ghana, Kenya, Nigeria, and South Africa. Furthermore, it is actively pursuing regulatory approvals in Egypt and Rwanda, markets that collectively represent approximately 46% of Africa’s Gross Domestic Product, signaling a continued commitment to regional expansion.

A key component of TSG is the Paystack Microfinance Bank (MFB), which was created through the recent acquisition of Ladder Microfinance Bank in Nigeria. Operating as a standalone, regulated bank, Paystack MFB enables the group to internalize core financial rails. This capability is crucial for building robust banking and credit infrastructure for its extensive network of over 300,000 Nigerian merchants, thereby reducing reliance on third-party partner banks and facilitating faster development of end-to-end money movement solutions.

In addition to its merchant and banking endeavors, TSG also encompasses Zap for consumer payments and TSG Labs. The venture studio, TSG Labs, will focus on creating new products utilizing cutting-edge technologies, including artificial intelligence. Importantly, TSG Labs will operate independently from the group’s regulated entities, a structural decision designed to enable experimentation with AI-led products without exposing its core financial businesses to undue regulatory risks.

The founding shareholders of The Stack Group include Stripe, Paystack's founder and CEO Shola Akinlade, and existing Paystack employees. Stripe's continued shareholder status following its $200 million acquisition of Paystack in 2020 reinforces its enduring commitment to the company's long-term vision. Shola Akinlade remarked that the establishment of TSG reflects Paystack's broadened ambitions. He stated, “There are significant opportunities to support businesses beyond payments, and TSG enables us to address the challenges African companies face over the next decade.” Through TSG, Paystack is strategically positioning itself as a diversified technology group, with banking, consumer finance, and artificial intelligence identified as its primary engines for future growth.

You may also like...

NBA Bombshell: LeBron James and Ayton Out for Pacers Clash!

The Los Angeles Lakers will be severely impacted by injuries, with LeBron James, Deandre Ayton, and Maxi Kleber all side...

Man City Stays: Pep Guardiola Drops Major Hint on Future!

Pep Guardiola has hinted at staying at Manchester City, expressing confidence that his team will reach its full potentia...

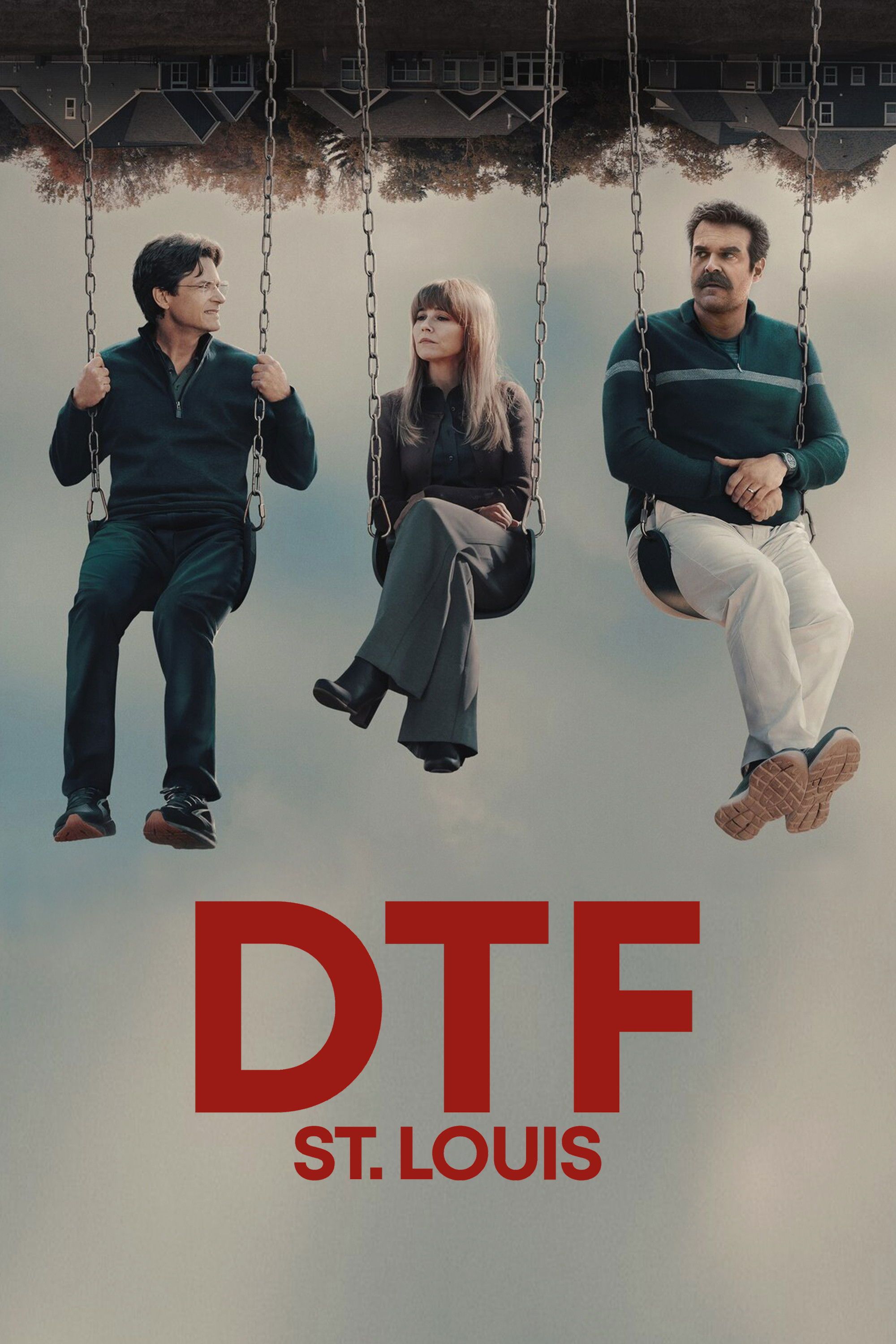

HBO's New Crime Thriller Dethrones 'A Knight of the Seven Kingdoms' in Streaming Battle

HBO Max is currently showcasing two notable series: 'DTF St. Louis,' a star-studded crime story praised for its blend of...

SZA Slams Chart Predictions, Defying Taylor Swift Comparison: 'Anything Is Possible!'

SZA's album SOS defied expectations by topping the Billboard 200 over Taylor Swift, a feat her label initially doubted. ...

Sam Asghari Demands Privacy Amid Britney Spears’ DUI Arrest After Explosive Comments

Sam Asghari has addressed Britney Spears' recent DUI arrest during a Fox News interview, calling for privacy for his ex-...

Giant Meets Miniature! World's Tallest Dog Shares Paws With the Smallest Canine Star!

The world's shortest dog, Pearl the Chihuahua, and a towering Great Dane named Reggie, had an unforgettable playdate arr...

End of an Era: Girl Scouts Announce Retirement of Two Beloved Cookie Flavors After 2025 Season!

Girl Scout cookie season is officially underway, but fans should prepare to say goodbye to Toast-Yay! and S’mores, which...

Unlock Peak Performance: Timing Magnesium for Ultimate Muscle Recovery

:max_bytes(150000):strip_icc()/Health-GettyImages-MagnesiumBeforeOrAfterWorkout-1012169458424c3791686bd6c68427e5.jpg)

Magnesium is vital for athletes, supporting muscle function, energy, and recovery, with increased demands during intense...