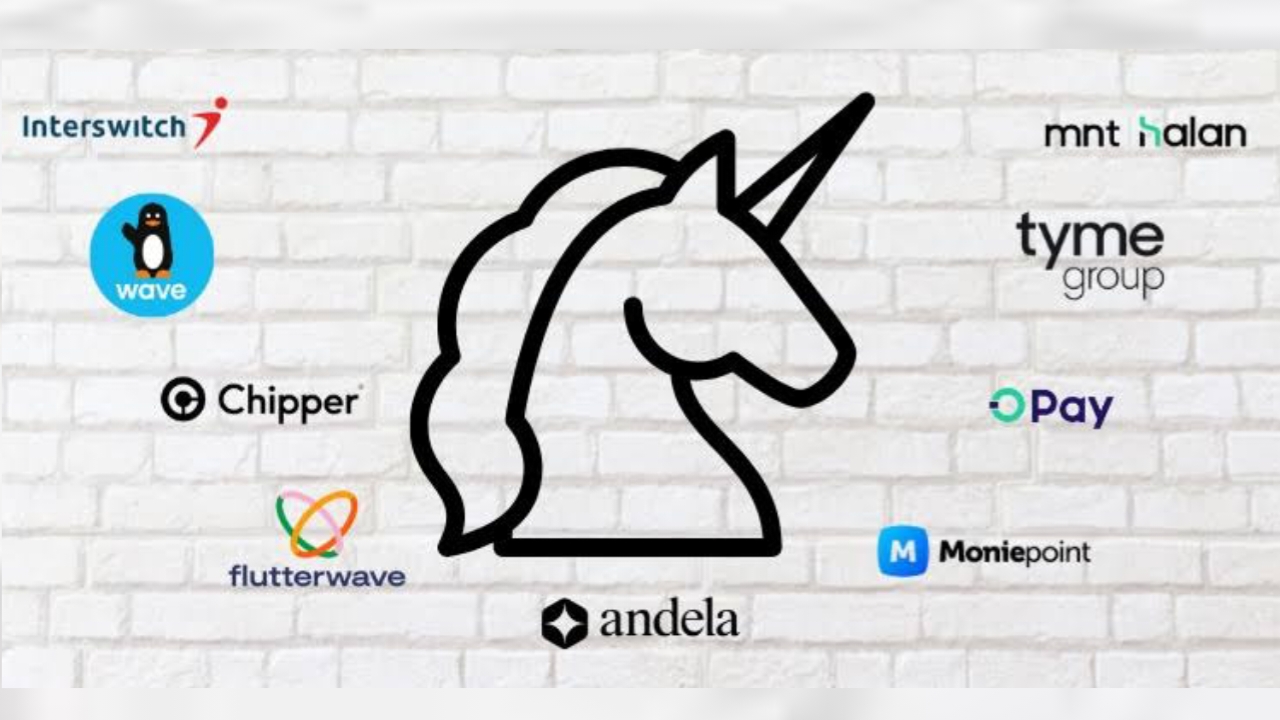

9 Startups In Africa That Have Attained The Status Of A Unicorn

The African continent has always had potential and innovations have sprang up across from different parts of the continent that have met local needs.

Today we would be looking at African startups that did not wait for permission to be on the global stage. They solved local problems with global ambition, building platforms that scaled beyond borders, attracted international capital, and have eventually crossed a milestone once considered impossible on the continent: unicorn status.

A unicorn status is a privately held startup valued at one billion dollars or more. This is not just a fancy label, it is a proof and signal of market confidence, product relevance, scalability, and belief in long-term growth.

Today, Africa has a growing list of such companies that are being predicted to reach the status of a unicorn in the near future because each one of them tells a story of persistence, problem-solving, and timing.

Here are nine African startups that reached unicorn status, the year they reached unicorn status, their valuation and why they matter.

Interswitch — Nigeria (2019, $1 Billion)

Founded by Mitchell Elegbe, Interswitch grew to become Africa’s first fintech unicorn. It built the digital payments infrastructure powering ATM transactions, card services, and electronic payments across Nigeria and beyond.

Interswitch didn’t just build a product, it built plumbing for modern finance. By digitising payments at scale, it laid the groundwork for many fintechs that followed.

Flutterwave — Nigeria (2021, $1 Billion)

Founded by Olugbenga “GB” Agboola, Flutterwave enables businesses to accept and process payments across Africa and internationally.

Its core strength lies in simplifying cross-border payments, allowing African businesses to sell globally without friction.

Flutterwave’s rise highlighted Africa’s growing participation in global commerce.

Chipper — Nigeria (2021, $2.2 Billion)

ChipperCash is a consumer-focused fintech platform offering digital payments and cross-border transfers. It achieved unicorn status by building a user-friendly, mobile-first financial ecosystem for everyday users.

Its valuation reflects the massive demand for affordable, seamless financial services across Africa and emerging markets.

Opay — Nigeria (2021, $2 Billion)

Operating extensively in Nigeria, Opay provides digital banking, payments and other financial services.

Opay’s success comes from aggressive expansion and deep integration into daily transactions, from transfers to merchant payments, making it a familiar name in urban centres.

Andela — Nigeria (2021, $1.5 Billion)

Source: Google

Founded by Jeremy Johnson, Iyinoluwa Aboyeji, and other notable individuals, Andela began as a talent accelerator for African software developers.

It later evolved into a global talent marketplace connecting skilled engineers from Africa to companies worldwide. Andela proved that Africa’s human capital is exportable, competitive, and world-class.

Moniepoint — Nigeria (2024, $1 Billion)

Moniepoint provides banking and payment solutions for businesses, especially small and medium enterprises.

Reaching unicorn status in 2024, it reflects the increasing formalisation of African businesses and the demand for reliable financial infrastructure at scale.

Wave — Senegal (2021, $1.7 Billion)

Wave is a mobile money platform that revolutionised financial inclusion in Francophone Africa.

By offering low-cost, accessible digital payments, Wave has expanded rapidly across West Africa, proving that fintech success is not limited to Anglophone markets.

MNT | Halan — Egypt (2021, $1 Billion)

MNT | Halan operates as a fintech and lending platform, providing financial services to the unbanked and underbanked in Egypt.

Its valuation reflects the scale of demand for credit, mobility, and financial access in North Africa’s largest population hub.

TymeBank — South Africa (2024, $2.5 Billion)

TymeBank is a digital-only bank offering accessible financial services without traditional branch infrastructure.

Achieving unicorn status in 2024, it shows how digital banking models can scale efficiently in African markets with the right regulatory and consumer alignment.

Together, these startups reveal a clear pattern:

Fintech dominates, because financial access remains Africa’s biggest opportunity

African founders are building for scale, not survival

Global investors are paying attention

These unicorns are definitely not the end of this story, they are just the beginning. Each one of them opens doors for newer startups, attracts more capital, and shifts how Africa is viewed in global innovation conversations.

What It Means to Be a Unicorn in Africa

Globally, unicorns are rare. In Africa, they are rarer, not because ideas are scarce, but because access to funding, infrastructure, and early-stage support has historically been limited.

So when an African startup reaches a billion-dollar valuation, it represents more than money. It represents:

Trust in African founders

Confidence in African markets

Proof that local problems can inspire global solutions

A signal to investors that Africa is investable, scalable, and profitable

These companies did not copy Silicon Valley. They built for African realities; payments, mobility, identity, access, financial inclusion and stability.

You may also like...

Premier League Fury: Chelsea & West Ham Hit With Heavy Fines Over Mass Brawl

Chelsea and West Ham have been hit with significant fines by an independent regulatory commission following a mass confr...

NBA Shocker: Luka-LeBron Botch Crushes Lakers' Hopes Against Magic

The Los Angeles Lakers suffered a narrow 110-109 defeat to the Orlando Magic, following a critical botched inbounds play...

Ryan Gosling Shines in 'Project Hail Mary,' Early Buzz Hails 'Must-See Space Odyssey'

Phil Lord and Christopher Miller's "Project Hail Mary" is receiving stellar early reviews, with critics calling the sci-...

Margot Robbie's Latest Epic Love Story Dominates Box Office, Outperforms 'RRR'

"Wuthering Heights," director Emerald Fennell's controversial adaptation of Emily Brontë's novel, has achieved significa...

End of an Era? Mike Patton Hints at Faith No More Split, Fans Brace for Impact

Mike Patton suggests Faith No More's active period may be over, citing an unspoken sense of closure after their last per...

Rock & Roll Hall of Fame Shakes Up 2026 With Star-Studded Nominee List and Artist Reactions

The Rock & Roll Hall of Fame has announced its 17 nominees for the Class of 2026, featuring 10 first-time contenders lik...

Snoop Dogg Unveils Shocking Connection to Bitter Beckham Family Spat

Hollywood megastar Snoop Dogg has weighed in on the ongoing Beckham family feud, which saw Brooklyn Beckham publicly acc...

Shawn Hatosy's Shocking 'Twin, Wife, Mom' Remark on Sarah Michelle Gellar's Ursula

"Ready or Not 2: Here I Come" picks up immediately after the first film, as Grace's survival triggers a new, dangerous g...