US Crypto Bill Hits Major Snag: Senate Prioritizes Housing, Delays Action for Months

A significant effort by the U.S. Senate to establish a comprehensive legal framework for cryptocurrency trading and oversight has encountered a major setback, leading to its likely postponement for weeks or even months. The legislative momentum stalled following substantial industry backlash, culminating in the indefinite postponement of work on the long-anticipated market structure bill by the Senate Banking Committee. This bill was widely considered the centerpiece of U.S. crypto regulation.

The primary catalyst for this delay was the public withdrawal of support for the measure by Coinbase, one of the cryptocurrency industry's largest exchanges. This withdrawal occurred at a critical juncture, just before a scheduled markup hearing where lawmakers were set to debate amendments and potentially advance the bill toward a floor vote.

With Coinbase explicitly stating it no longer backed the legislation "as written," the committee redirected its immediate attention to other legislative priorities, including housing affordability initiatives aligned with President Donald Trump's agenda. Industry observers, citing Bloomberg reporting, suggest the delay could extend into late February or March.

Several interconnected factors are contributing to this slowdown. Coinbase's decision, influenced by CEO Brian Armstrong, highlighted deep divisions between major crypto firms and the bill's drafters, particularly concerning stablecoin rewards. Industry leaders have voiced strong objections, arguing that provisions within the current text could weaken the Commodity Futures Trading Commission's (CFTC) authority, impose undue restrictions on decentralized finance (DeFi), and curtail essential stablecoin rewards—measures they deem vital for continued crypto innovation and growth.

Adding to the complexity are the formidable lobbying efforts from the traditional banking sector. Banks have pressed lawmakers for more stringent restrictions on yield-bearing crypto products, expressing concerns that such features could divert deposits from conventional banking institutions and potentially destabilize lending markets. These lobbying efforts appear to have influenced the bill's language, intensifying opposition from the cryptocurrency industry. Furthermore, shifting legislative priorities in anticipation of midterm elections have compounded the delay, as senators face pressure to prioritize voter-facing issues like housing affordability over complex financial regulations.

While some lawmakers maintain that the delay is temporary and that robust crypto regulations remain achievable, this interruption underscores the fragile nature of legislative consensus on digital assets.

Although members of the Senate Agriculture Committee have released a separate market structure draft, industry experts caution that it may lack the crucial bipartisan backing necessary to succeed. Patrick Witt, executive director of the White House council on digital assets, has publicly advocated for continued negotiation, asserting that regulatory clarity is "a question of when, not if." However, he also issued a stark warning that without robust industry cooperation, future iterations of the legislation could prove significantly less favorable to crypto firms.

You may also like...

Tottenham's Champions League Success Contrasts With Troubled Premier League Form Under Thomas Frank

Tottenham's Premier League form poses problems for boss Thomas Frank despite their Champions League success. BBC Sport e...

The Pitt Unleashed: Exclusive Sneak Peeks, Star Secrets, and a Shocking 'Simpsons' Crossover!

The Indian SUV market sees compact SUVs leading sales in FY2025, with Tata Punch topping the charts. Maruti Brezza </div...

Neil Young Unleashes Fury: Slams Apple, Verizon, T-Mobile Over Trump Regime Support!

Neil Young has intensified his political activism, publicly condemning the Trump administration and companies like Veriz...

Grammy Gala Shakes Up 2026: Chappell Roan, Teyana Taylor, Karol G Join Presenter Ranks!

The 68th annual Grammy Awards are slated for February 1, 2026, with Trevor Noah hosting his final consecutive show. Chap...

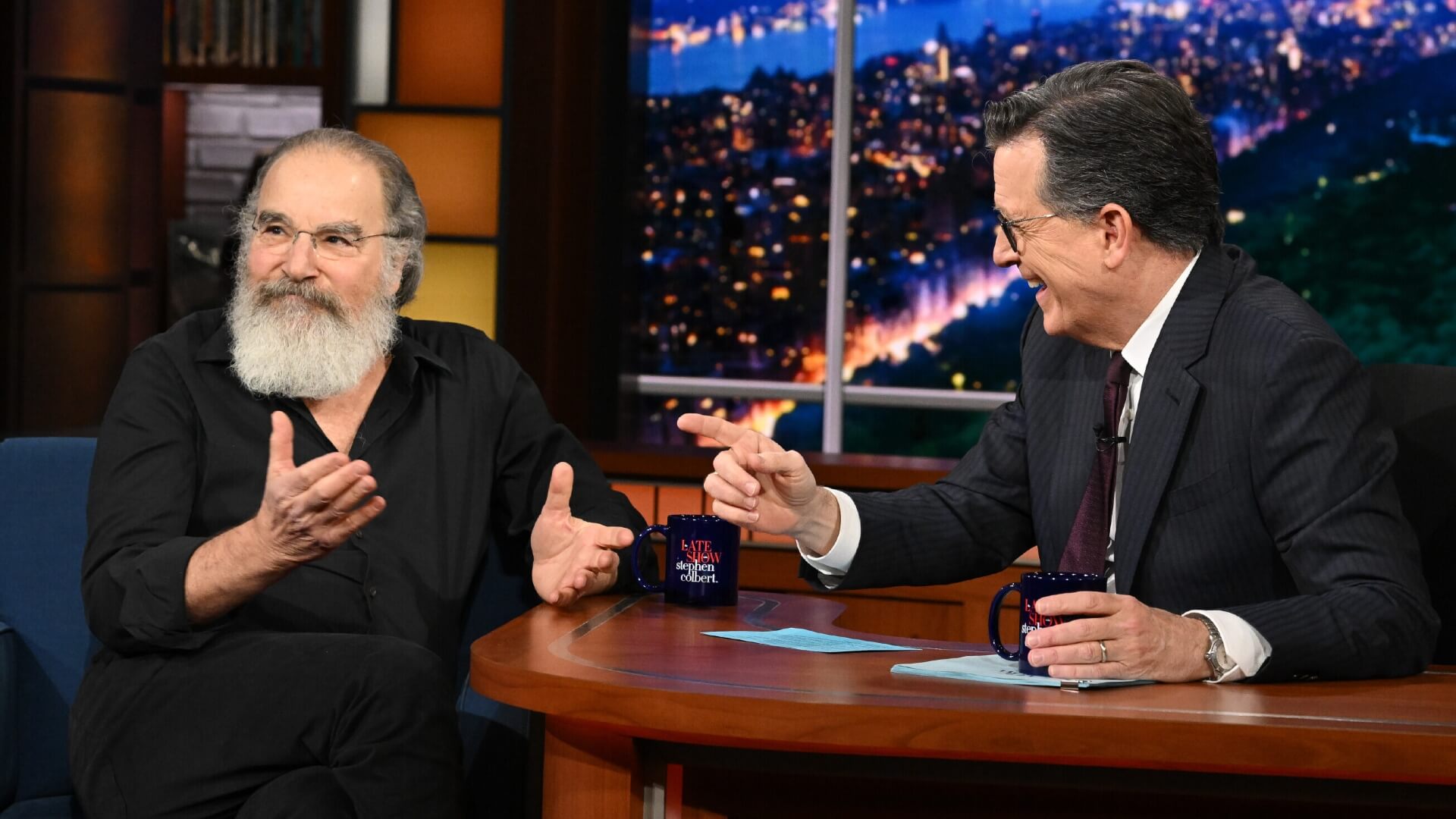

Divine Casting Revelation: Mandy Patinkin Ascends as Odin in Amazon's God Of War Series!

Mandy Patinkin has officially joined Amazon's live-action 'God of War' series, taking on the role of Odin, the Allfather...

Gaming Glory: Beth Mead, Cunha Dominate EA FC 26 Team of the Week 20!

Arsenal's Beth Mead earned a spot in the Team of the Week after a stellar performance against Chelsea, scoring and assis...

Crypto Bloodbath: Bitcoin Plummets to $84K, Triggering MicroStrategy Stock's 52-Week Low

Bitcoin's price plummeted sharply this morning, falling to the $84,000 range due to macro uncertainty and Federal Reserv...

Billion-Dollar Scandal: First Brands Founder Faces Charges for Massive Fraud

The founder and a former executive of First Brands Group, Patrick and Edward James, have been indicted in New York on ch...