Trump's Bold Move: US Takes 10% Stake in Intel Giant

In an extraordinary intervention into corporate America, President Donald Trump announced on Friday that the U.S. government has secured a significant stake in the struggling Silicon Valley chipmaker, Intel. The deal, completed just weeks after Trump had publicly criticized Intel's CEO, Lip-Bu Tan, now makes the U.S. government one of Intel's largest shareholders, holding approximately a 10% stake in the company.

The U.S. government is acquiring a 9.9% stake, comprising 433.3 million non-voting shares, at a price of $20.47 apiece, totaling an investment of $8.9 billion. This price represents a discount from Intel's closing share price of $24.80 on Friday, resulting in an immediate paper gain of $1.9 billion for the government. The funding for this acquisition primarily stems from $5.7 billion in unpaid grants originally pledged to Intel under the Biden-era CHIPS and Science Act, and an additional $3.2 billion from another program called "Secure Enclave," also awarded under the previous administration. In total, the U.S. government is getting the stake through the conversion of $11.1 billion in previously issued funds and pledges.

This remarkable turn of events follows a period of public friction between President Trump and CEO Lip-Bu Tan. Earlier in the month, Trump had demanded Tan's resignation, citing national security concerns over his past investments in Chinese companies. However, Tan professed his allegiance to the U.S. in a public letter and met with the President at the White House, leading to this deal. Trump subsequently lauded Tan as a "highly respected" CEO, and Tan, in turn, applauded Trump for "driving historic investments in a vital industry" and expressed gratitude for the administration's confidence in Intel.

Intel, a pioneering company, has been grappling with significant challenges for years. It is currently in the process of cutting more than 20,000 jobs and has recorded substantial losses, including over $22 billion since the end of 2023 and an annual loss of $18.8 billion in 2024. The company's stock price remains significantly below its peak from 25 years ago, and its market value of approximately $108 billion pales in comparison to the current chip market leader, Nvidia, valued at $4.3 trillion. Intel's loss-making foundry unit, in particular, has struggled to attract customers and compete with technologically advanced rivals like TSMC and has lost market share to Advanced Micro Devices in its central processor business.

The Trump administration views this equity stake as a strategic move, transforming what it previously deemed a "needless giveaway" under the CHIPS Act into a potential profit for the American people, while simultaneously advancing the president's agenda to bolster domestic manufacturing of computer chips. This initiative aims to reduce the country's dependence on overseas factories and solidify the U.S.'s technological leadership over China, particularly in the race for artificial intelligence. U.S. Commerce Secretary Howard Lutnick affirmed the move, stating, "It’s obvious that it’s the right move to make."

Despite the government's passive ownership, which includes non-voting shares and no board seat (though with a five-year warrant at $20 a share for an additional 5% under specific conditions if Intel loses control of its foundry business), critics have voiced strong concerns. Observers like Scott Lincicome of the Cato Institute warned of "horrendous" implications, fearing cross-pollination between public and private sectors, potential pressure on tech companies to favor Intel, and harm to U.S. tech leadership and the economy. Investors like Nancy Tengler of Laffer Tengler Investments questioned the benefit to taxpayers and the chip industry, raising worries about government meddling in business. These interventions, though rare, recall historical precedents such as the government's significant stake in General Motors during the 2008 Great Recession, which ultimately resulted in a loss for the government.

This deal with Intel aligns with a broader pattern of White House intervention in corporate affairs under the Trump administration. Other recent examples include an agreement requiring Nvidia and Advanced Micro Devices to pay a 15% commission on their AI chip sales in China in exchange for export licenses, the Pentagon becoming a major shareholder in MP Materials to boost rare earth magnet output, and the U.S. government securing a "golden share" with veto rights in the deal for Japan's Nippon Steel to acquire U.S. Steel. These actions signal a new era of federal involvement in shaping strategic industries.

Recommended Articles

Trump's Power Play: US Snags 10% Equity in Intel, Shaking Up Tech

The U.S. government has acquired a 9.9% stake in Intel for $8.9 billion, converting federal grants into equity in a bid ...

Afrikaner Group Slams Trump's 'White Genocide' Claims in Fiery Open Letter

Prominent Afrikaners have penned an open letter titled "Not in our name," strongly rejecting former US President Donald ...

Tesla's Grim Future? Ex-Stellantis CEO Predicts Demise Within a Decade

EV giant Tesla faces a challenging future, with former Stellantis CEO Carlos Tavares predicting its potential exit from ...

Zoho Founder's Bold Call: Sridhar Vembu Urges Immigrants to Return and Build 'Strong Bharat'

Zoho Corporation founder Sridhar Vembu has passionately urged Indians living abroad to return home, questioning why they...

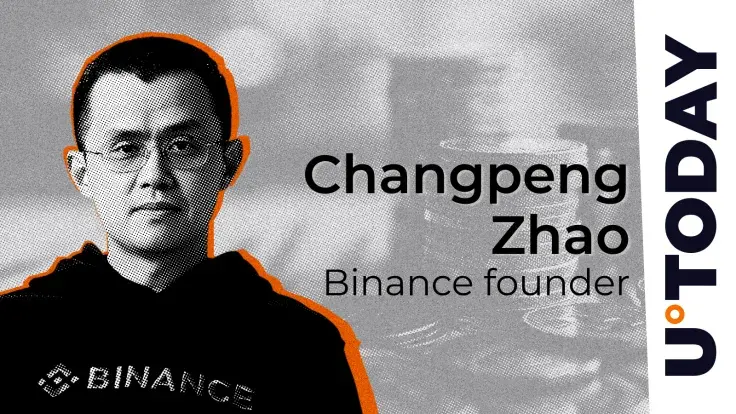

Crypto Titan CZ Gets Shock Pardon: Industry Stunned!

Binance founder Changpeng Zhao (CZ) has been pardoned by US President Donald Trump, according to a report by The Wall St...

You may also like...

Time Wealth: The Real Currency Everyone’s Now Chasing

In a world obsessed with hustle, “time wealth” has become the real luxury. This in-depth lifestyle feature explores ...

Food for the Mind: How Diet Shapes Mental Health More Than We Think

What we eat affects more than our bodies, it shapes our emotions, focus, and resilience. This feature talks on how diet ...

The End of Minimalism: Why We’re Choosing Meaning Over Aesthetic

A cultural shift is redefining modern living: Minimalism is fading, and “Meaningism” is rising, a movement that values c...

Sleep Deprivation: Africa’s Most Overlooked Health Epidemic

Sleep deprivation is quietly sweeping across Africa, undermining health, productivity and well-being. Different lifesty...

The Next Big Discovery Might Be Growing in Someone’s Backyard

Hidden in gardens, local farms, and village backyards across Africa and beyond, the next major scientific breakthroughs ...

The Grand Egyptian Museum: Re-Engineered History of Africa.

2002 was the genesis of a dream. Egypt opens its Grand Museum in 4days.

NanoFilter: The Tanzanian Invention Turning Dirty Water into Life

Read on how Dr. Askwar Hilonga’s NanoFilter, a Tanzanian nanotech invention, is transforming access to safe drinking w...

The Myth of the Strong African Mother

Parenting burnout is becoming an unspoken crisis among African mothers. The pressures of motherhood, cultural expectatio...