The Climate Dilemma: Can Nigeria and South Africa Afford to Keep Their Green Pledges?

Nigeria and South Africa face a brutal dilemma, and it affects us all. The industries that power their economies — oil, gas, and coal — are the same ones accelerating climate breakdown. Both nations have made ambitious green pledges to the world, yet both are planning massive expansions in fossil fuel production.

These are not abstract policy debates. Nigeria needs revenue to lift millions out of poverty. South Africa needs energy to keep the lights on.

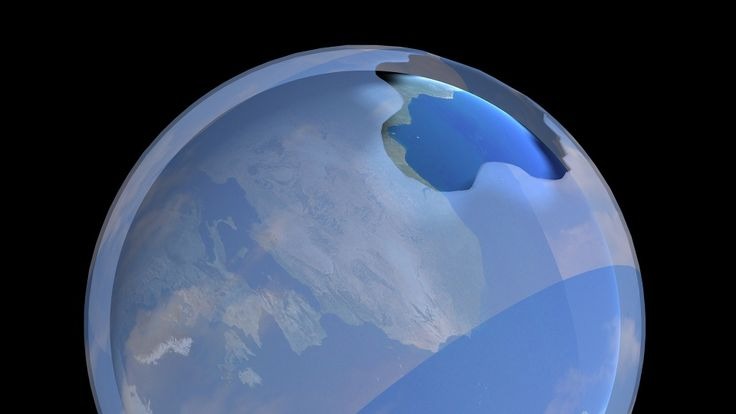

But the fossil fuels they are banking on release greenhouse gases that trap heat in the atmosphere, driving the droughts, floods, and heat waves already devastating their own populations.

So when a country's economic survival seems tied to industries destroying the climate, can its leaders realistically choose environmental goals over immediate growth? Or is the entire framework of "green pledges" fundamentally broken for developing nations?

The Promises They Made

At COP26 in Glasgow, Nigeria committed to reaching carbon-neutrality by 2060. South Africa pledged to peak its emissions by 2025 and achieve carbon-neutrality by 2050, backed by an $8.5 billion international climate finance package.

Both countries submitted detailed plans outlining how they would transition to renewable energy, phase down coal, and protect their forests.

The commitments won praise from climate advocates worldwide. Finally, major African emitters were joining the global effort. Finally, the continent most vulnerable to climate change would help lead the solution.

But there was always fine print. Nigeria's plan assumed continued oil and gas extraction, framed as a "transition fuel" strategy. South Africa's coal phase-down timeline stretched decades into the future, accommodating the reality that coal generates 80% of its electricity. The pledges were ambitious, but built on shaky foundations.

The Reality on the Ground

Fast forward to today, and the gap between promise and practice has widened.

Nigeria is doubling down on the production of oil. The government aims to increase production from 1.4 million barrels per day to 2.5 million, even as global demand signals suggest fossil fuels may become stranded assets within decades. The country is also pushing ahead with natural gas expansion, marketing itself as Africa's energy supplier. Oil accounts for 90% of Nigeria's export revenue. Without it, the economy collapses.

South Africa faces an even starker dilemma. Eskom, the state power utility, is in crisis. Rolling blackouts plague the nation, crippling businesses and frustrating citizens.

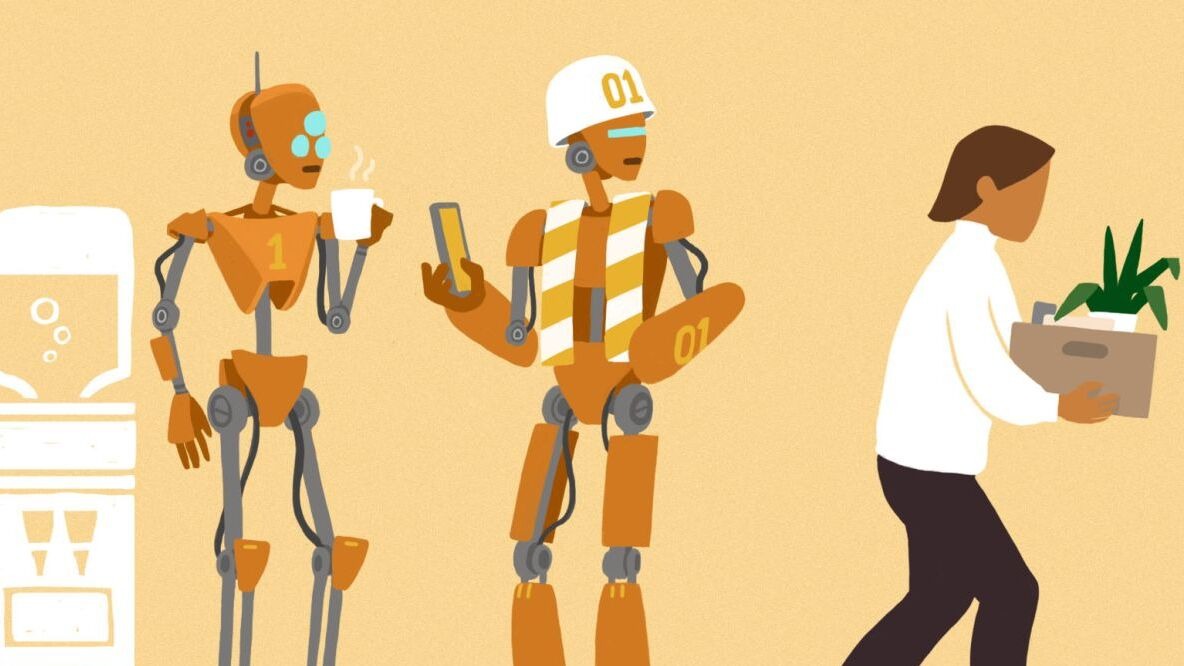

The coal plants that could provide stable power are aging and breaking down, but they are still the backbone of the grid. Meanwhile, the renewable energy transition requires massive upfront investment that the government simply does not have. Coal mining also employs tens of thousands of workers in regions with few alternative industries.

Both countries argue they need fossil fuel revenue to fund their own green transitions which is a circular logic that climate activists call a dangerous stalling tactic, but which government officials insist is pragmatic realism.

Why the Math Doesn't Add Up

Uncomfortable reality? The climate does not negotiate. The atmosphere does not care about national debt or unemployment rates or fiscal constraints.

Scientists warn that to limit warming to 1.5°C above pre-industrial levels, global emissions must fall by 45% by 2030. Every new oil well, every new coal mine, every expansion of fossil fuel infrastructure makes that target harder to reach.

And Africa, despite contributing just 3% of historical emissions, will bear the worst consequences of failure. Nigeria already faces desertification in the north and coastal erosion in the south. South Africa is experiencing its worst droughts in a century.

The economic argument for fossil fuel expansion also crumbles under scrutiny. Renewable energy costs have plummeted as solar and wind are now cheaper than coal in most markets.

The International Energy Agency projects that global oil demand will peak this decade, meaning countries investing heavily in fossil fuel infrastructure risk being left with worthless assets. Nigeria and South Africa could be locking themselves into yesterday's economy just as the world moves on.

A System Designed to Fail Them

Yet the blame cannot rest solely on Nigeria and South Africa. The international community promised developing nations financial support to transition away from fossil fuels. That support has been woefully inadequate.

Wealthy countries pledged $100 billion annually in climate finance by 2020. They did not deliver until 2022, and much of what arrived came as loans rather than grants, adding to debt burdens.

South Africa's $8.5 billion package sounds impressive until you realize the country needs an estimated $250 billion for a full energy transition. Nigeria has received even less support relative to its needs.

The system places impossible choices before developing nations: suffer economically now to prevent climate catastrophe later, or pursue growth today and deal with environmental collapse tomorrow.

It is a false choice imposed by decades of wealthy nations burning fossil fuels to develop their own economies, then demanding poorer countries skip that step without providing adequate alternatives.

What Happens Next

Nigeria and South Africa stand at a crossroads, but they are not alone. This dilemma plays out across the developing world, from Indonesia to Brazil to India. The question is not just whether these two countries can afford to keep their green pledges, it is whether the global system can afford to keep making pledges that set developing nations up to fail.

Real solutions require more than promises. They require massive transfers of technology and finance, debt relief tied to climate action, and honest acknowledgment that asking countries to choose between their people's immediate welfare and the planet's future is morally bankrupt policy.

Until that changes, pledges will remain just words and the climate crisis will continue to accelerate, devastating the very countries being asked to sacrifice the most.

You may also like...

Champions League R16 Draw Shakes Up European Football Landscape

Mikel Arteta discusses Arsenal's quadruple aspirations and excitement following the Champions League draw, where the Gun...

Super Eagles Coach Chelle's Contract Drama Unfolds Amidst Explosive Leaks

Super Eagles coach Eric Chelle's proposed contract extension and significant salary increase, detailed in a leaked docum...

Lisa Rinna Alleges Fentanyl Drugging at 'Traitors' Premiere Party

Lisa Rinna claims she was drugged with fentanyl and amphetamines at "The Traitors" Season 4 premiere party, sparking a b...

Paramount Triumphs in Warner Bros. Bidding War, Industry Reacts to Consolidation

Netflix has withdrawn its bid for Warner Bros. Discovery, paving the way for Paramount Skydance's acquisition, a develop...

Metal Mayhem Down Under! Iron Maiden & Megadeth Announce Joint Australian Tour

Iron Maiden has announced their 'Run For Your Lives World Tour' Australia dates for November, marking their eighth visit...

Rihanna Sends Fans Into Frenzy With Studio Tease: New Music Imminent?

A recent video from Rihanna offers an intense look into her 24-hour lifestyle, balancing her Savage X Fenty empire, late...

Violet Bridgerton's Bold New Path: Star Teases Shocking Season 5 Direction!

Ruth Gemmell, who plays Violet Bridgerton, delves into her character's impactful journey in Bridgerton Season 4, discuss...

Bill Lawrence Reveals Why 'Scrubs' Revival Defies 'Shrinking' & 'Ted Lasso' Reboot Formula!

The classic comedy series Scrubs makes a comeback after a decade, reuniting J.D., Turk, and Elliot at a new Sacred Heart...