Streaming Giant's Power Play: Netflix-Warner Bros. Deal Imperils DStv

Victoria from Techpoint shares several significant updates impacting the African tech and media landscape. Key developments include a major content crisis for MultiChoice's DStv and Showmax due to Netflix's bid for Warner Bros. Discovery, the inspiring journey of Richard Eradiri into the AI sector, and a strict new directive from the Corporate Affairs Commission (CAC) for Nigerian Point-of-Sale (POS) agents.

Netflix's colossal $72 billion bid to acquire Warner Bros. Discovery has sent reverberations across Africa’s pay-TV market, posing an immediate threat to MultiChoice. Announced last Friday, this deal is critical because Warner Bros. Discovery is MultiChoice’s primary provider of premium international content. The acquisition, coupled with already strained content renewal negotiations and MultiChoice's aggressive cost-cutting under its new owner Canal+, has plunged DStv and Showmax into one of their most severe content crises in years. Before Netflix's intervention, MultiChoice had informed subscribers about the potential loss of 12 popular channels, including CNN, Cartoon Network, and HGTV, by the end of December 2025, due to stalled talks over renewal fees. According to MyBroadband, the Netflix announcement on December 4, 2025, completely altered the negotiation dynamics.

The situation worsens for DStv and Showmax as, if the deal is finalized—expected in the third quarter of 2026—Netflix will integrate Warner Bros. and HBO's extensive content library into its platform. This means highly sought-after titles like "Game of Thrones," "The Sopranos," "The Big Bang Theory," "House of the Dragon," "The Last of Us," and the entire DC Universe could become Netflix exclusives, content that currently defines Showmax's premium offering. While Netflix plans to spin off Warner’s linear TV business into a separate entity, Discovery Global, potentially offering MultiChoice a chance to retain some live channels, the major contest lies in on-demand streaming. As of December 7, Showmax’s "Best of HBO" section alone featured 191 series, and losing even a portion of this catalogue would significantly diminish its value. Adding to MultiChoice's woes, DStv is also set to lose four other channels—BET Africa, CBS AMC Networks, CBS Justice, and MTV Base—by year-end due to Paramount Africa's shutdown. Industry observers suggest that this content blow could trigger a wave of cancellations if MultiChoice fails to respond swiftly, with predictions ranging from immediate discounts to a full package restructuring in early 2026. Ultimately, Netflix's strategic move has placed MultiChoice in its most precarious position in recent memory, with the coming months being crucial in determining the full extent of the impact.

In another notable development, Richard Eradiri, co-founder and CEO of AI Examiner, shares his "accidental" path into the tech world. A Zoology graduate from the University of Ibadan, Richard initially had no plans for a career in technology. However, a profoundly negative experience in 2019, where a developer absconded with approximately $8,000 for a product idea without delivering, prompted him to self-teach coding. His early inclination for technology was evident from childhood, where he would explore the family desktop and upload videos to YouTube by age nine. In secondary school, he built websites and assisted classmates with assignments for payment. After graduating in 2020, he dedicated six months to learning, followed by an internship, and rapidly ascended in the tech industry. Within a few years, Richard was leading teams responsible for developing internal tools for major Nigerian banks like Zenith Bank and First Bank. A standout project involved a withholding tax application for Zenith Bank, which processed over $1 million in the past year alone. His extensive experience building high-security applications alongside bank security teams provided him with a rigorous masterclass in developing reliable systems, skills that proved instrumental in the launch of AI Examiner. His journey from a Zoology background to creating bank-grade software and ultimately AI tools is both unconventional and highly inspiring.

Finally, Nigeria's Corporate Affairs Commission (CAC) has issued a stern warning to all Point-of-Sale (POS) operators, mandating them to register their businesses by January 1, 2026. Non-compliance will lead to the confiscation or shutdown of unregistered terminals. This directive, outlined in a public notice on December 6, 2025, addresses the proliferation of unregistered POS operators, which the CAC deems a clear violation of the Companies and Allied Matters Act (CAMA) 2020 and the Central Bank of Nigeria’s (CBN) agent banking regulations. The commission criticized some fintechs for enabling "reckless" practices that endanger citizens' funds. This latest warning reinforces earlier efforts, such as the April 2024 order for POS agents to register with the CAC, which saw insufficient compliance. With over 1.9 million agents and transactions totaling ₦10.51 trillion in Q1 2025 alone, and more than five million active terminals by March 2025, the sector's rapid expansion has outpaced regulatory oversight. To enforce this, the CAC announced that security agencies would conduct nationwide enforcement, with unregistered terminals facing seizure and non-compliant fintechs being reported to the CBN and placed on a watchlist. This move also follows the CBN's prior restriction of POS terminals to a 10-meter radius of their registered addresses, intensifying pressure on fintechs to enhance KYC procedures, combat fraud, and improve overall oversight of their agent networks. With January 2026 fast approaching, the industry is under immense pressure to comply.

You may also like...

How Samrawit Fikru Turned a Safety Problem into Ethiopia’s Ride-Hailing Giant

Samrawit Fikru built Ethiopia’s most popular ride-hailing platform, RIDE, using SMS before smartphones dominated. Read a...

The Top 10 Most Indebted Countries in the World in 2026

Which countries owe the most in 2026? A data-driven look at the world’s top 10 most indebted nations and their debt-to-G...

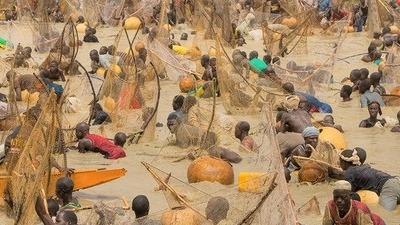

Argungu Fishing Festival 2026: The Grand Return of Nigeria's Most Iconic Cultural Spectacle

The 2026 Argungu Fishing Festival returns in spectacular fashion, blending chaos, culture, and competition while reaffir...

Man City Star Trafford's Surprise Donnarumma Revelation

James Trafford, Manchester City's new goalkeeper, expressed surprise at his current backup role behind Gianluigi Donnaru...

Critics Crown 'Best Sci-Fi of 2010s' Set for Free Streaming Debut!

Alex Garland's acclaimed AI thriller, "Ex Machina," is coming to free streaming on Tubi from March 1. The film, which wo...

Tom Hardy's Sci-Fi Masterpiece Defies Time, Dominates Streaming Decades On!

Christopher Nolan's mind-bending sci-fi thriller, <i>Inception</i>, is experiencing a major streaming resurgence, curren...

Red Carpet Royalty: Celebrities Dazzle in Fiery Valentine's Day Looks

This Valentine's Day, celebrities offered a wealth of style inspiration, transforming the celebration of love into a fas...

Stan Nze & Blessing Obasi-Nze Get Candid: Unveiling Their Marriage and Parenting Secrets

Stan Nze and Blessing Obasi–Nze share an intimate look into their marriage, work-life balance in Nollywood, and the true...