Senior Living and Long-Term Care Sector Challenges

The healthcare and senior living sectors in the United States are currently navigating a complex landscape marked by significant policy changes, financial pressures, operational challenges, and ongoing regulatory scrutiny. At the forefront of these concerns are proposed Medicaid cuts, which threaten to profoundly impact millions of individuals and the very infrastructure of care across states. In Michigan, for instance, a proposed federal bill under consideration in the U.S. Senate is anticipated to lead to over 700,000 people losing their Medicaid coverage out of the state's 2.5 million enrollees. Experts like Dr. Abdul El-Sayed, former director of the Department of Health, Human, and Veterans Services for Wayne County, highlight that 80% of Michigan's mental health infrastructure and many special needs services for children in schools rely on Medicaid. These cuts are viewed as a detrimental measure designed to facilitate tax cuts for the wealthy, raising anxieties for families like Megan Callahan's, whose mother was recently diagnosed with dementia and will depend on specific Medicaid programs.

Nationally, the Senate's proposed 10-year budget reconciliation bill, if passed, would implement $930 million in Medicaid cuts, including reductions to provider taxes starting in 2028. The Congressional Budget Office projects these cuts will force states to freeze and likely reduce reimbursement rates for various providers. A new analysis by Brown University’s Vincent Mor identified 579 nursing homes at an “elevated risk” of closure, particularly those with 85% or more of their residents relying on Medicaid. These facilities include for-profit, non-profit, and government-held entities, some with low-star ratings or occupancy. Examples of providers facing vulnerability include Green House Cottages at Walnut Ridge, a quality showcase for American nursing homes, and PruittHealth-Monroe, which might be the only nursing home within a 50-mile radius. The Center for Innovation’s CEO, Susan Ryan, noted that the closure of St. John’s Living in New York due to Medicaid underfunding was “staggering” and a blow to quality care. An American Health Care Association (AHCA) survey revealed that 27% of nursing homes would be forced to close their doors in the face of such cuts, underscoring the critical nature of ongoing Senate debates, which also include discussions on delaying the nursing home staffing mandate until 2034.

Amidst these policy shifts, the financial health of real estate investment trusts (REITs) specializing in skilled nursing and senior living is showing signs of recovery from the COVID-19 pandemic. Fitch Ratings reports a neutral outlook for healthcare REITs, supported by long-term demographics and industry fundamentals. Some REITs, like CareTrust REIT, have seen upgrades, while others such as National Health Investors, Omega Healthcare Investors, and Sabra Health Care REIT maintain stable outlooks. However, operator risks persist, as evidenced by Genesis HealthCare Inc.'s nonpayment of rent to Omega Healthcare Investors. The unpredictable effects of proposed Medicaid cuts remain a significant concern for REITs, as reduced reimbursement for operators could directly impact their ability to pay rent. Diversification across geographic footprints and high portfolio granularity are cited as strategies supporting cash flow stability and reducing earnings volatility. Post-pandemic, rental risk remains an issue, with instances of rent deferrals, restructuring, and collectability issues, compounded by nurse shortages and elevated wages pressuring operator expenses. Access to capital is crucial for REITs, given their mandate to pay out 90% of taxable income; fortunately, Fitch-rated healthcare REITs generally have adequate access to capital markets.

Operational challenges also plague the senior living sector, particularly in marketing and sales. Despite increased digital traffic and inquiry volume, many communities are failing to convert interest into residents due to slow response times, limited follow-up, and staffing shortages. Bild & Co. CEO Jennifer Saxman noted that 92% of web inquiries go unanswered within 24 hours, and 80% go unanswered entirely, often requiring three calls for a prospect to reach a sales associate. This indicates a “bandwidth issue,” with sales teams being pulled into other tasks. The influx of “garbage leads” from third-party paid referrals further dilutes sales efforts, making it challenging for salespersons to effectively manage over 100 digital leads per month. Saxman recommends centralizing the inquiry process through sales technology platforms or dedicated call centers to ensure a positive and prompt first impression, emphasizing that speed is a competitive necessity and that organic leads from community websites should be prioritized.

Furthermore, the healthcare industry continues to face rigorous enforcement against fraud and mismanagement. The 2025 National Health Care Fraud Takedown, led by the Justice Department, resulted in criminal charges against 324 defendants nationwide, involving more than $14.6 billion in intended losses. Notable cases include Centers Health Care agreeing to pay over $6 million for false statements in Medicare cost reports across 44 skilled nursing facilities and a $4.5 million resolution with Villa Financial Services LLC, Villa Olympia Investment LLC, and six Michigan nursing homes for systematically failing to provide or providing substandard services between 2018 and 2021. The Centers for Medicare and Medicaid Services (CMS) also played a crucial role, preventing over $4 billion in fraudulent payments and suspending or revoking the billing privileges of 205 providers. Enforcement efforts also targeted fraudulent use of amniotic wound allografts, leading to $1.1 billion in claims and illegal kickbacks, often targeting vulnerable elderly patients receiving hospice care. CMS Administrator Mehmet Oz credited advanced data analytics and real-time monitoring for the success of these enforcement actions.

Finally, systemic issues extend to federal rental assistance programs crucial for affordable senior housing. LeadingAge recently urged the Office of Management and Budget (OMB) and the Department of Housing and Urban Development (HUD) to address “seriously” delayed rental assistance payments. Approximately 1,000 monthly payments to affordable housing communities were late for June and are projected for July, affecting tens of thousands of households. These delays jeopardize housing stability, erode confidence in HUD as a public-private partner, and could impact fundamental pillars of the country’s housing system. LeadingAge has requested clarity on the cause of these delays, remaining issues, and steps HUD and OMB are taking to support housing providers and prevent future shortfalls, raising concerns about potential staffing capacity issues impacting payments.

You may also like...

Behind The Scenes Series(Part 8): Sarz, The Accidental Architect of Afrobeats

.jpeg)

How much do you really know about the voice behind your favorite sound: "Sarz On the Beat"

Can Comedy Save Africa?

It is often said that laughter is the best medicine, but is that all it is?

Who Is To Blame For Floods in Nigeria?

From local government budgets to digital tools tracking public spending, explore the root causes of flooding in Nigeria—...

The Nilotes: Africa’s Tallest and Darkest-Skinned People

This deep-dive unpacks their striking physiques, ancient migrations, and enduring cultural traditions. From cattle pasto...

From Skit to Screen: How Instagram Comedians Are Taking Over Nollywood

Instagram comedians like Layi Wasabi, Taooma, and Lasisi Elenu are redefining Nollywood stardom. From short skits to maj...

Beyond the Headlines: Decoding Africa's Self-Determined Evolution

Forget outdated narratives. Africa is forging its own future, driven by youth, tech, and a powerful reclamation of ident...

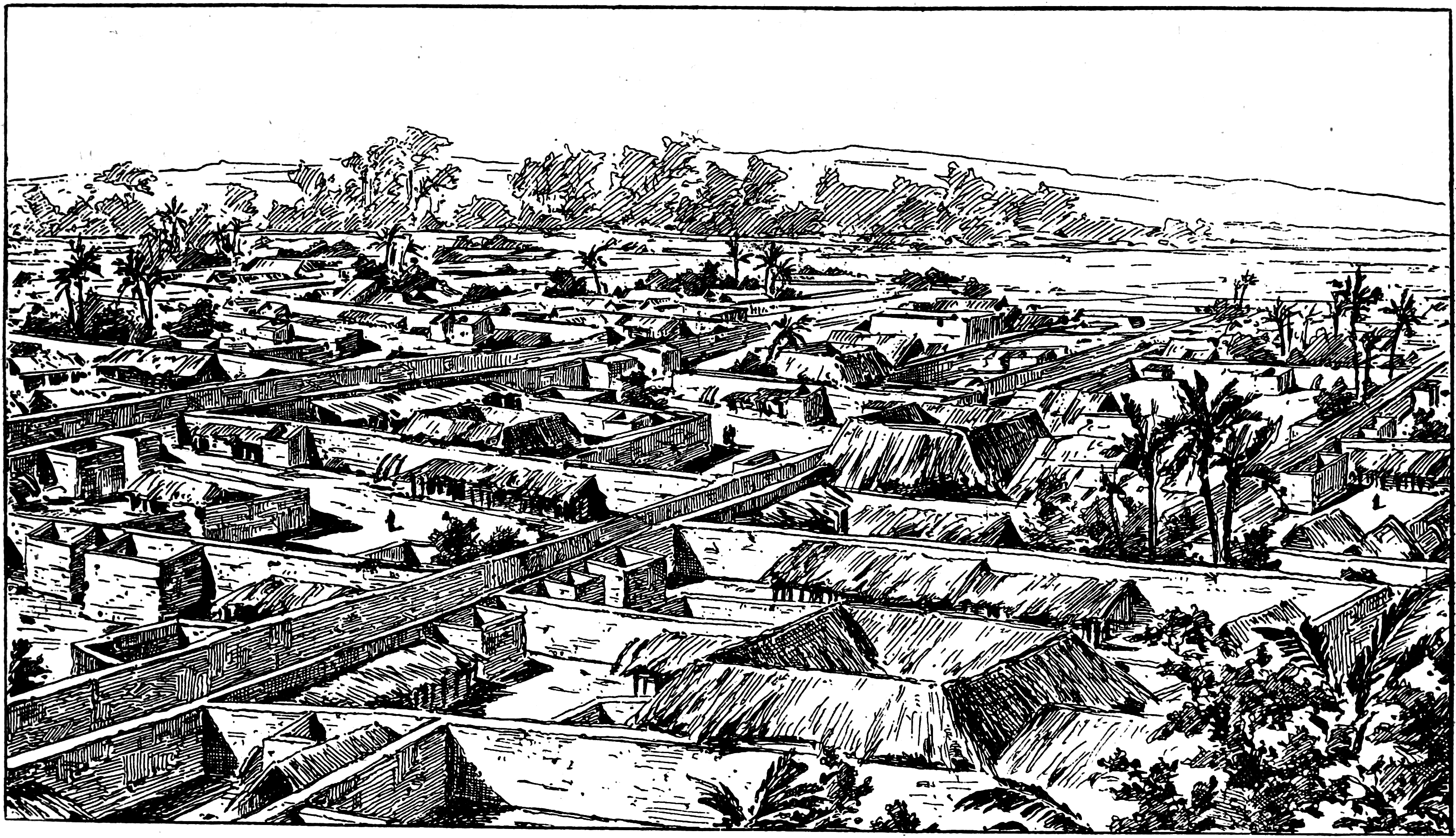

The Bini Empire Had Streetlights Before London: What We Were Before We Were Colonized

Before colonization, the Benin Empire was a thriving civilization with urban planning, advanced politics, and even stree...

Who Sold Nigeria? A Journey into the Royal Niger Company and the Auctioning of a Nation

The Royal Niger Company "sold" Nigeria to the British government for £865,000 in 1899. This transaction marked the trans...