Trump's Sweeping Tax & Spending Bill Passes House

The One Big Beautiful Bill Act (OBBBA), signed into law by President Donald Trump on July 4, 2025, has been heralded by supporters as a significant tax overhaul aimed at stimulating the U.S. economy and providing financial relief to American families and businesses. This legislation, which passed the House by a narrow 218-214 vote and the Senate with a tie-breaking vote from Vice President JD Vance, marks a major political victory for Trump in his second term. Critics, however, including some Republican lawmakers, have voiced strong concerns, particularly regarding its potential impact on the middle class and social safety net programs.

The OBBBA is presented as an expansion of Trump’s 2017 Tax Cuts and Jobs Act (TCJA), which cut corporate and individual tax rates. However, studies indicated the TCJA ballooned the deficit and disproportionately benefited the wealthy. The new bill extends and makes permanent key TCJA provisions, including lower individual tax rates and business deductions. It also introduces new temporary tax breaks, such as a deduction for interest on U.S.-made vehicles, tip income, and overtime pay. Furthermore, it expands or modifies existing tax credits, increasing the child tax credit and employer-provided childcare credits, and introduces a new senior deduction. The federal estate tax exemption is maintained at a higher, permanent level. Conversely, the bill reduces or eliminates certain clean energy tax credits, tightens rules for other deductions, and implements new work requirements and more frequent eligibility checks for Medicaid and SNAP (food assistance). It also establishes tax-deferred child savings accounts, increases the federal deficit by an estimated $3.3 trillion over a decade, and raises the debt limit by $4 to $5 trillion. Student loan provisions include capping federal loan amounts, ending subsidized loans, increasing repayment periods, and restricting payment pauses.

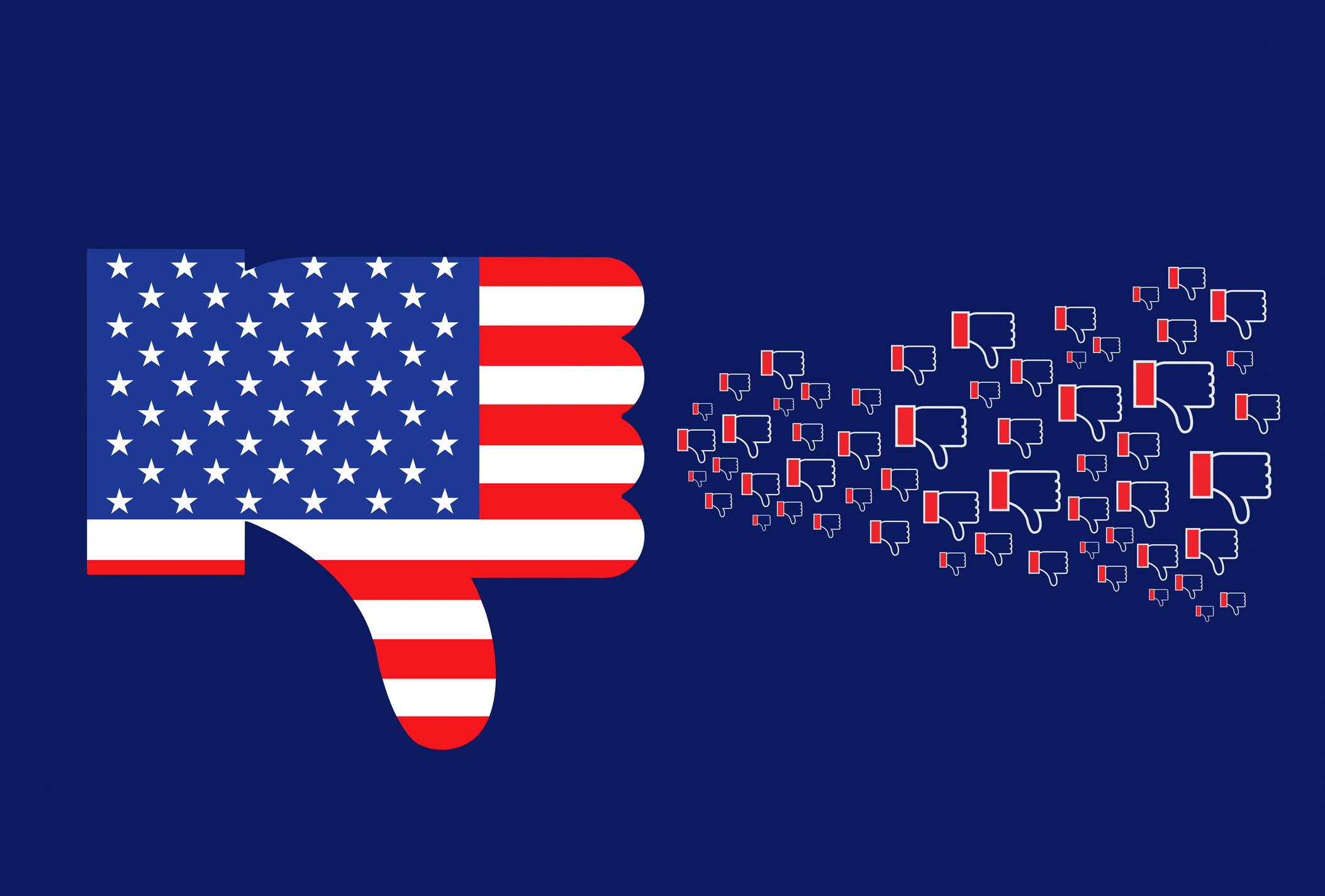

The passage of the OBBBA was met with intense political debate. House Democratic Leader Hakeem Jeffries delivered the longest floor speech in House history, speaking for over eight hours in opposition, characterizing the bill as a “reverse Robin Hood scheme” that benefits the rich at the expense of the poor, predicting rural hospital and nursing home closures due to Medicaid cuts. Public opinion, according to recent polls from Pew Research Center and Kaiser Family Foundation, largely runs against the bill, with a majority believing it will hurt the middle class and primarily benefit the wealthy and corporations.

Prominent figures like Elon Musk, CEO of Tesla and SpaceX, emerged as vocal critics, denouncing the bill as “utterly insane and destructive,” warning it would “destroy millions of jobs in America and cause irreparable harm to our energy and technology sectors” due to provisions that cut tax breaks for solar, wind, and EV purchases. Following the bill's signing, Musk announced the creation of a new political group, the “America Party.” Republican Senator Thom Tillis also expressed concerns about Medicaid reductions, announcing he would not seek re-election after voting against the bill. Several other Republican senators, including Susan Collins, Josh Hawley, Rand Paul, Ron Johnson, Jim Justice, and Lisa Murkowski, also raised issues with the Medicaid cuts.

While the OBBBA offers some short-term relief, especially for middle-class taxpayers, through provisions like the permanently increased standard deduction and new temporary tax credits, many organizations note that its long-term benefits disproportionately favor higher earners. Estimates from the Yale Budget Lab and the Congressional Budget Office (CBO) suggest that the top 20% of earners could gain significantly more annually, while the poorest 20% might see a decrease in their income. The White House, however, projects a substantial average increase in take-home pay for hardworking Americans.

The bill’s impact on Financial Independence, Retire Early (FIRE) seekers is nuanced. While lower taxes and expanded deductions could provide more capital for investment and increased flexibility, there’s a greater risk of losing affordable health insurance due to reduced enhanced Affordable Care Act (ACA) tax credits, especially for those with incomes exceeding 400% of the Federal Poverty Level. This could lead to significantly higher premiums for early retirees. However, the bill does offer several beneficial tax provisions for FIRE followers, including an increased child tax credit (to $2,200), expanded 529 plan uses (now covering K-12 and postsecondary credentialing), a raised SALT deduction cap ($40,000 from $10,000 temporarily), permanent Alternative Minimum Tax (AMT) relief, and new tax-advantaged “Trump Accounts” for children with a potential government seed contribution. Temporary deductions for tip income, overtime pay, and car loan interest (for U.S.-assembled vehicles) also provide short-term perks. The permanent federal estate tax exemption increase to $15 million per person is a significant win for those aiming for generational wealth.

For business owners, key provisions supporting financial independence include the permanent 20% Pass-Through Deduction (Section 199A), an increased Section 1202 Stock Gains Exclusion cap ($15 million), and permanent 100% Bonus Depreciation. These measures encourage entrepreneurship, startup investment, and stronger business cash flow.

A controversial aspect involved a July 3 email from the Social Security Administration (SSA) to millions of beneficiaries, stating the OBBBA would “eliminate federal income taxes on Social Security benefits for most beneficiaries.” This message was widely criticized as misleading. In reality, the OBBBA introduces a temporary, income-based bonus over-65 tax deduction ($6,000 for individuals earning up to $75,000; $12,000 for married couples filing jointly earning up to $150,000), which phases out at higher incomes. This deduction can reduce taxable income for many seniors, potentially leading to no federal tax liability on their Social Security benefits. However, it does not directly change the underlying Social Security taxation rules, nor is it a permanent repeal of taxes on benefits. Many seniors already pay little to no taxes on their benefits, so the actual relief for the typical retiree may be marginal, and it excludes those under 65 or with higher incomes. Critics also noted that the bill's changes to Social Security are prohibited from directly altering the program's core structure due to the budget reconciliation process used for its passage.

In conclusion, while the OBBBA provides some modest incentives for saving and wealth building, particularly for those on the path to financial independence and business owners, its impact on the federal deficit and social programs remains a significant point of contention. The legislation's long-term effects on taxpayers and the economy will continue to unfold, sparking further debate and analysis.

You may also like...

Should There Really Be More Women in Africa's Parliaments?

Is there actually a need for women to contribute to policies and laws in African parliaments?

Eye in the Sky: Which African Countries Own Their Own Satellites?

Which African Countries Are in Space, and Why?

The Murder of Stephen Amoah: Lessons From Ghana in Crime Scene Investigation

What progress has been made in Africa in crime scene investigation, and what can the Stephen Amoah murder case in Ghana ...

Revolution vs Reform: What Africa Really Needs

This powerful piece explores the continent’s youth-led demands for dignity, accountability, and impact. From Burkina Fas...

The Next Silicon Valley? The Rise of Africa's Digital Creator Economy

A new wave of African entrepreneurs is leveraging social media platforms, digital art, and online communities to build b...

Africa’s Unity; A Lie We Like to Tell Ourselves?

Despite decades of Pan-African rhetoric, visa restrictions, xenophobia, and protectionism continue to divide the contine...

The African Podcast Boom: How Storytelling is Redefining Media Across the Continent

.png)

African podcasts are reshaping storytelling, blending tradition with digital innovation. Explore how creators amplify vo...

Youth Rising in Nairobi: The Protest Over a Life Taken Too Soon

A new sound is rising from the streets of Nairobi—not of political slogans dictated from podiums, but of chants shaped b...