Nigeria's Future Unveiled: FEC Greenlights Massive N58.47 Trillion 2026 Budget

The Federal Executive Council (FEC) recently convened a special session to approve the N58.47 trillion draft 2026 appropriation bill, setting the stage for President Bola Tinubu to transmit the comprehensive spending proposal to the National Assembly. This significant fiscal development occurred in a meeting presided over by Vice-President Kashim Shettima, marking his first time chairing a FEC meeting since the inauguration of the Bola Tinubu administration on May 29, 2025. The approval clears the path for the formal presentation of the budget estimates to a joint session of the Senate and the House of Representatives.

During the special session, convened specifically to consider and pass the fiscal document, presentations were made by key economic officials. Senator Abubakar Atiku Bagudu, the Minister of Budget and Economic Planning, and Dr. Tanimu Yakubu, the Director-General of the Budget Office of the Federation, provided detailed insights into the proposed budget. Minister Bagudu confirmed that the Council also endorsed crucial amendments to the Medium-Term Expenditure Framework (MTEF), which included a proposed adjustment of the benchmark exchange rate. The exchange rate was revised from N1,512/$ to N1,400/$, an adjustment that directly impacts the overall budget size.

The approved N58.47 trillion aggregate expenditure represents a six percent increase over the 2025 estimates. This substantial figure encompasses various spending components designed to address Nigeria's economic and developmental needs. Specifically, the total includes N4.98 trillion allocated for spending by government-owned enterprises (GOEs) and N1.37 trillion earmarked for grants and donor-funded projects. This comprehensive framework aims to ensure prudent management of public funds while driving essential development initiatives.

Further breakdown of the expenditure projection reveals significant allocations across key sectors. Statutory transfers are set at N4.1 trillion, while debt service obligations are projected to reach N15.52 trillion. This debt service figure includes N3.39 trillion specifically set aside for a sinking fund, intended to retire maturing local debts owed to contractors and other creditors. Personnel costs, including pensions, are projected at N10.75 trillion, reflecting a seven percent increase compared to the 2025 provision, and include N1.02 trillion allocated to government-owned enterprises. Overhead costs are estimated at N2.22 trillion.

Capital expenditure for the 2026 budget stands at N25.68 trillion, which is a 1.8 percent reduction from the 2025 capital provision. Dr. Tanimu Yakubu explained that this marginal reduction signifies a more cautious capital planning strategy, emphasizing the completion of ongoing projects and ensuring optimal value for money. Key capital allocation priorities include N11.3 trillion for ministries, departments, and agencies (MDAs), N2.05 trillion for multilateral and bilateral project loans, and N1.8 trillion representing the capital component of the development levy.

Yakubu further articulated that the 2026 budget is meticulously designed to strike a delicate balance between macroeconomic stabilisation and development imperatives, aligning with the administration's Renewed Hope Agenda. The budget is built upon conservative and realistic underlying assumptions, particularly concerning oil price, exchange rate, and dividends from government-owned enterprises. A notable structural shift away from crude oil dependence is evident, as non-oil revenues are now projected to account for approximately two-thirds of total government receipts. Corporate income tax, value-added tax (VAT), customs duties, and independent revenues have been identified as the government's strongest fiscal anchors.

Expenditure pressure, according to Yakubu, is largely driven by debt servicing, wages, and pensions, rather than discretionary spending. He clarified that the small contraction in capital votes is aimed at ensuring value for money and the timely completion of inherited and ongoing projects. The wider fiscal deficit, he added, reflects "legacy rigidities rather than policy loosening." To bridge this gap, the government plans to rely mainly on domestic borrowing, complemented by concessional multilateral loans, thereby ensuring fiscal stability and sustained development efforts.

You may also like...

Leeds United Smashes Nottingham Forest! Farke Hails 'Massive Win' Amid Aina's Disappointing Milestone

)

Leeds United secured a vital 3-1 victory against Nottingham Forest at Elland Road, climbing nine points clear of the Pre...

Studio Shake-Up: DC and Warner Bros. Announce Major Release Date Reshuffles

The DC film "Clayface," featuring a shapeshifting Batman villain, has moved its release date from September 11 to Octobe...

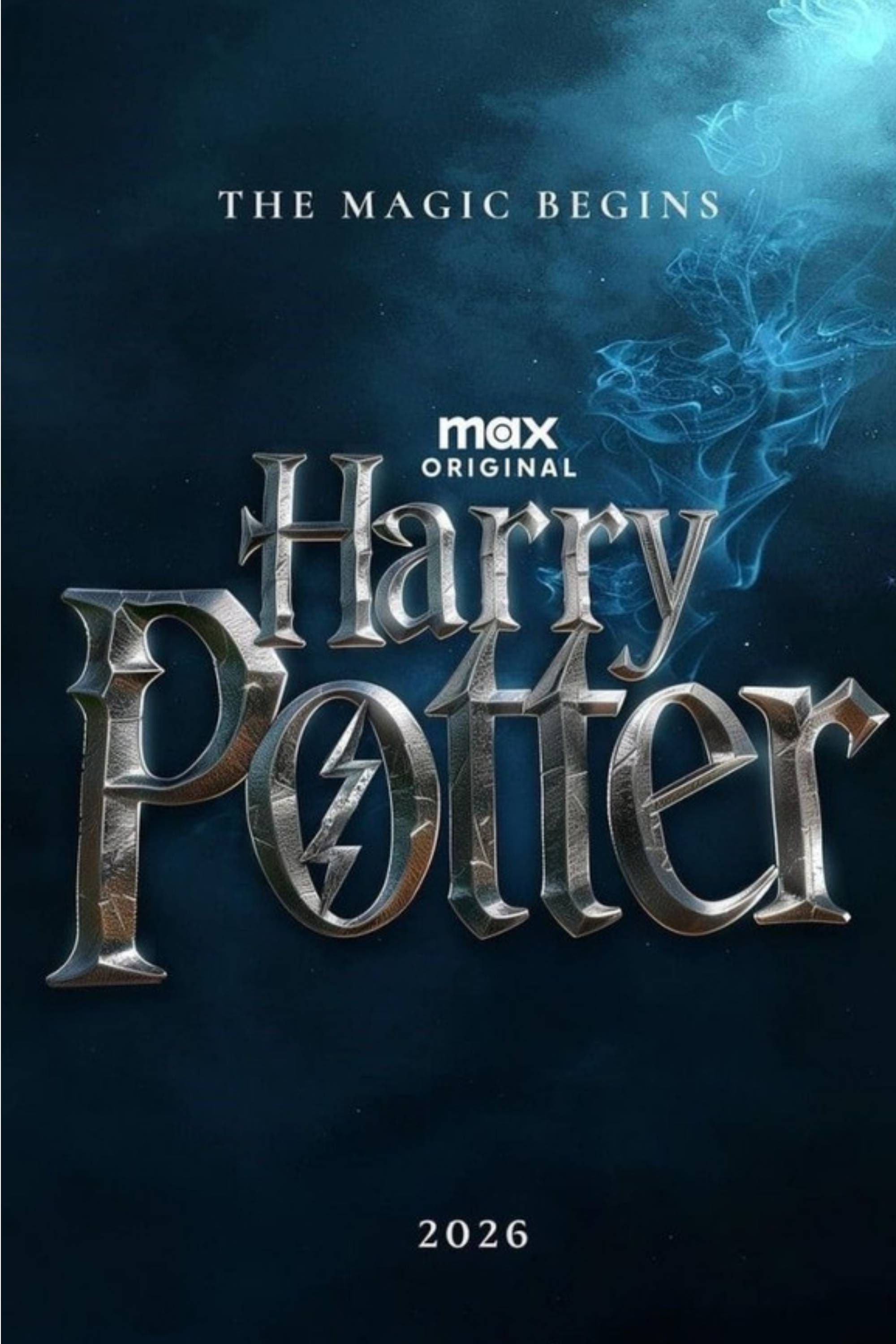

Magical Revival: HBO Max Unleashes Reimagined 'Harry Potter' Universe

HBO Max's upcoming Harry Potter series is rebuilding Hogwarts from the ground up, with new set images revealing detailed...

Joburg's Historic Drill Hall Transformed into Vibrant Arts Sanctuary!

The historic Drill Hall in Joburg's city centre, once a site of the 1956 Treason Trial and later a prosthetic limb facto...

New 'Queen of Africa' Reality Show Offers Grand $50,000 Prize!

"Queen of Africa" has launched as a pan-African reality TV show to champion women's leadership, cultural identity, and a...

OpenAI's GPT-4o Retirement Sparks Outrage: The Unseen Perils of AI Companions

OpenAI's upcoming retirement of its GPT-4o model has sparked intense user backlash, highlighting the profound emotional ...

Unveiling 'SuperCool': A Deep Dive into the Reality of Autonomous Creation

SuperCool redefines creative workflows by acting as an AI 'execution partner' that bridges the gap between raw ideas and...

Microsoft and Women in Tech SA Launch Massive AI Training Initiative Across Africa

The ElevateHer AI programme, a collaboration between Women in Tech South Africa, Absa Group, and Microsoft Elevate, is e...