Peter Obi Leads Charge to Halt Controversial Tax Law Amid 'Critical Flaws'

Former Presidential Candidate and political leader Peter Obi has called for an immediate pause on Nigeria’s new tax law, citing a detailed review by global accounting firm KPMG that highlighted 31 critical issues, including drafting errors, policy contradictions, and administrative gaps. Obi stressed that taxation represents a fundamental social contract between the government and its citizens, one that must be clearly understood, trusted, and justified by tangible public benefits. He argued that enforcing a complex tax system without public comprehension or visible returns undermines this social contract and erodes trust.

Obi criticized the current narrative in Nigeria, which focuses on how much the government seeks to extract from citizens rather than what it delivers in return. He contrasted this with international best practices, where tax policies undergo months, sometimes years, of consultation with businesses, workers, and civil society to ensure clarity and legitimacy. According to Obi, the absence of such consultations has left Nigerians in the dark about their obligations and the benefits of their contributions, especially as many continue to bear the burden of subsidy removals, rising prices, and declining purchasing power.

He warned that introducing a new tax regime riddled with inconsistencies and flagged by KPMG without building national consensus is irresponsible governance. Obi emphasized that without trust, taxation feels like punishment; without clarity, it breeds confusion; and without evident public value, it amounts to extortion. He urged the government to engage citizens transparently and prioritize consensus-building as the only viable path to meaningful reform, economic growth, and shared prosperity.

In a related initiative, Obi highlighted the transformative power of education for Nigeria’s future. At the foundation-laying ceremony for Sacred Heart Primary and Secondary School in Ozubulu, he pledged a monthly subvention to ensure timely completion and access to quality education, particularly for disadvantaged children. He described education as essential for shaping society, empowering young minds, and enabling national progress, framing both his advocacy for tax reform and educational investment as central to his broader vision of “A New Nigeria” rooted in inclusion, development, and collective responsibility.

You may also like...

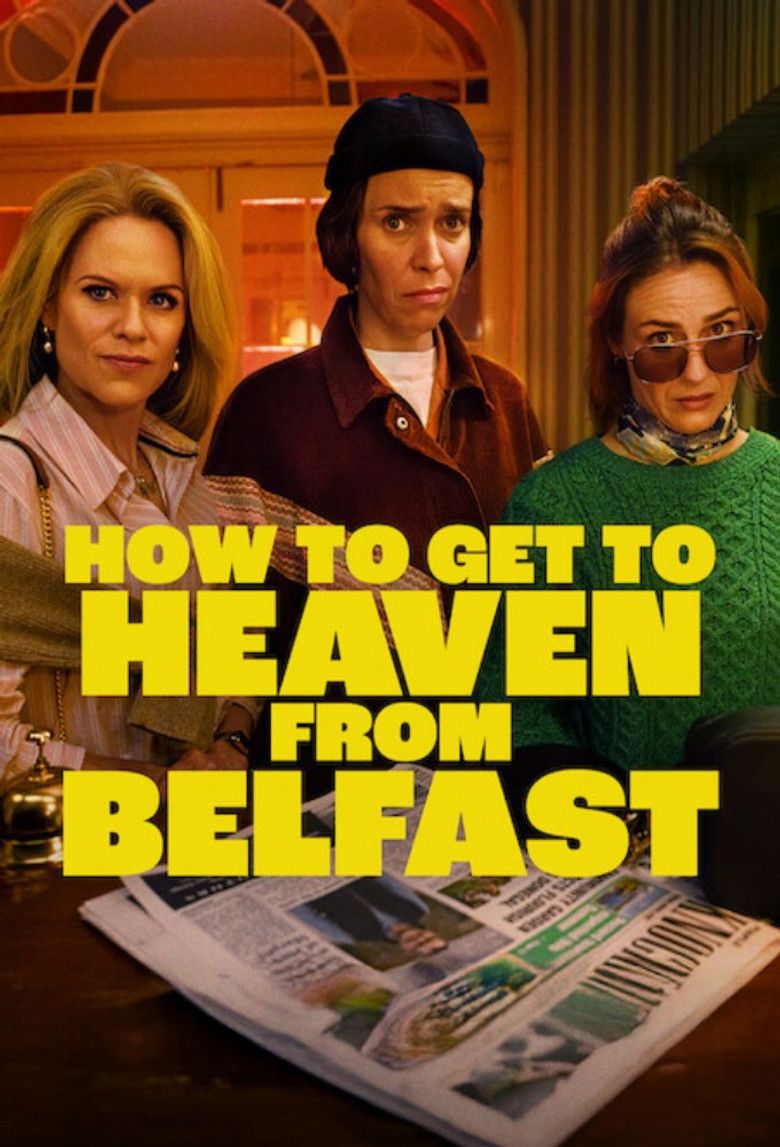

Binge-Worthy 8-Episode Thriller Masterpiece Lands on Netflix!

Lisa McGee, creator of "Derry Girls," brings "How To Get To Heaven From Belfast" to Netflix, a gripping comedy thriller....

Blockbuster Oscar Nominee Hits Netflix After Raking In Millions!

<i>Jurassic World Rebirth</i> redefines the beloved franchise by exploring scientific overreach and humanity's evolving ...

Little Mix's Leigh-Anne Reveals Dream Collaboration with Manon and Normani!

Leigh-Anne Pinnock expressed her desire to collaborate with Manon Bannerman and Normani, a wish that carries significant...

Music Star Thomas Rhett & Lauren Akins Announce Arrival of First Son!

Country music star Thomas Rhett and his wife, Lauren Akins, have welcomed their fifth child and first son, Brave Elijah ...

Bridgerton Stars Unveil Game-Changing Season 4 Death

An interview with the stars of Bridgerton Season 4 Part 2 delves into the tragic death of John Stirling and its aftermat...

Shocking Recruitment Scandal: Kenyan Faces Charges for Sending Youths to Ukraine War

A Kenyan man has been arraigned in court over alleged human trafficking, accused of recruiting 22 youths for the Russia-...

Angola Under Fire: Billion-Dollar Contracts Awarded Without Public Tender

A comprehensive review of Angolan presidential decrees has uncovered that at least US$61.5 billion in public spending wa...

Pentagon Declares AI Heavyweight Anthropic a Supply Chain Risk

The Trump administration has ordered federal agencies to cease using Anthropic products following a dispute over the com...