National Debt Alert: Reps Swiftly Approve Tinubu's $2.35 Billion Borrowing Request

The Nigerian House of Representatives has officially approved President Bola Ahmed Tinubu’s request to raise a total of $2.35 billion from the international capital market. This significant external borrowing is intended to partially finance the 2025 budget deficit and to refinance Nigeria’s maturing Eurobonds. The decision was reached during a plenary session, presided over by Speaker Tajudeen Abbas, following the consideration and adoption of a report submitted by the House Committee on Aids, Loans, and Debt Management, chaired by Hon. Abubakar Hassan Nalaraba.

The approved borrowing plan specifies that $1.23 billion will be allocated to fund the 2025 budget deficit, while the remaining $1.12 billion is designated for refinancing Eurobonds that are set to mature in November 2025. The Committee’s recommendations, which the House endorsed, authorize the Federal Government to proceed with the external borrowing component of the 2025 Appropriation Act, amounting to N1.84 trillion (equivalent to approximately $1.23 billion) at the budget exchange rate of N1,500 to a dollar. The funds are expected to be accessed through various financial instruments, including Eurobond issuance, loan syndication, bridge finance facilities, or direct borrowing from international financial institutions, depending on prevailing market conditions.

In addition to the main borrowing, lawmakers also granted approval for President Tinubu’s proposal to issue Nigeria’s first-ever Sovereign Sukuk of up to $500 million in the international capital market. This debut sovereign sukuk aims to fund infrastructure projects, diversify Nigeria’s financing sources, and deepen the government securities market. The President indicated that 25 percent of the proceeds from the sukuk might be utilized to repay existing high-cost debts, with the balance channeled into critical infrastructure development across the country. The issuance may proceed with or without a credit guarantee from the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), a member of the Islamic Development Bank (IsDB) Group.

President Tinubu had earlier explained in his communication to the National Assembly that the borrowing plan was imperative to bridge the gap between projected revenue and planned expenditure for the 2025 fiscal year, ensuring the government’s ability to meet its obligations as existing debts mature. He emphasized that the external borrowing is backed by the provisions of sections 21(1) and 27(1) of the Debt Management Office (Establishment) Act, 2003, which mandate legislative approval for new loans and refinancing arrangements. The Federal Government anticipates that the pricing for new Eurobonds will align with current yields on Nigeria’s existing bonds in the international market, which typically range between 6.8 percent and 9.3 percent, depending on maturity.

Recommended Articles

Nigeria's Debt Bomb Ticks Louder: Public Debt Soars to Trillions

Nigeria's public debt continues its sharp ascent, reaching N152.40 trillion by June 2025, driven by local borrowing and ...

National Assembly Launches Probe into NFF's Alleged Misuse of $25M FIFA, CAF Grants

The Nigerian House of Representatives has launched an investigation into the alleged mismanagement of $25 million receiv...

Explosive Scandal: House Of Reps Launches Probe Into NFF's $25M FIFA, CAF Grants

The Nigerian House of Representatives has launched a probe into the alleged mismanagement of $25 million in grants recei...

Reps Launch Fiery Probe Into Jonathan's $460M Abuja CCTV Project Amid Insecurity Uproar

Nigeria’s House of Representatives launches a high-profile probe into former President Goodluck Jonathan’s $460 million ...

Shockwaves in Benue: PDP Lawmaker Jumps Ship to APC for Stability

Hon. Ojema Ojotu, the sole PDP lawmaker from Benue State in the House of Representatives, has defected to the ruling APC...

You may also like...

Barcelona Blow: Pedri Sidelined for Crucial Chelsea Showdown Due to Injury

)

Barcelona's star midfielder Pedri has suffered a significant muscle injury, sidelining him for an estimated six to seven...

Trae Young's Injury Scare: Hawks Star Avoids ACL Tear, Awaits MRI Results

Atlanta Hawks star Trae Young sustained a right knee sprain, confirmed not to be an ACL injury, during a recent game aga...

Hollywood Beef Erupts: 'Road House' Director Clashes With Amazon Over Disconnected Sequel

A fierce battle for the future of the 'Road House' franchise is underway, as director Doug Liman, frustrated with Amazon...

Anime Shockwave: 'One Piece' Ends 27-Year Tradition With Major 2026 Overhaul

Toei Animation has announced a monumental shift for the <em>One Piece</em> anime beginning in 2026, transitioning from a...

Music & Mayhem: F1 Las Vegas Grand Prix Secures Superstar Lineup with Louis Tomlinson, Kane Brown

The 2025 Formula 1 Heineken Las Vegas Grand Prix is set to feature a star-studded musical lineup, with Louis Tomlinson, ...

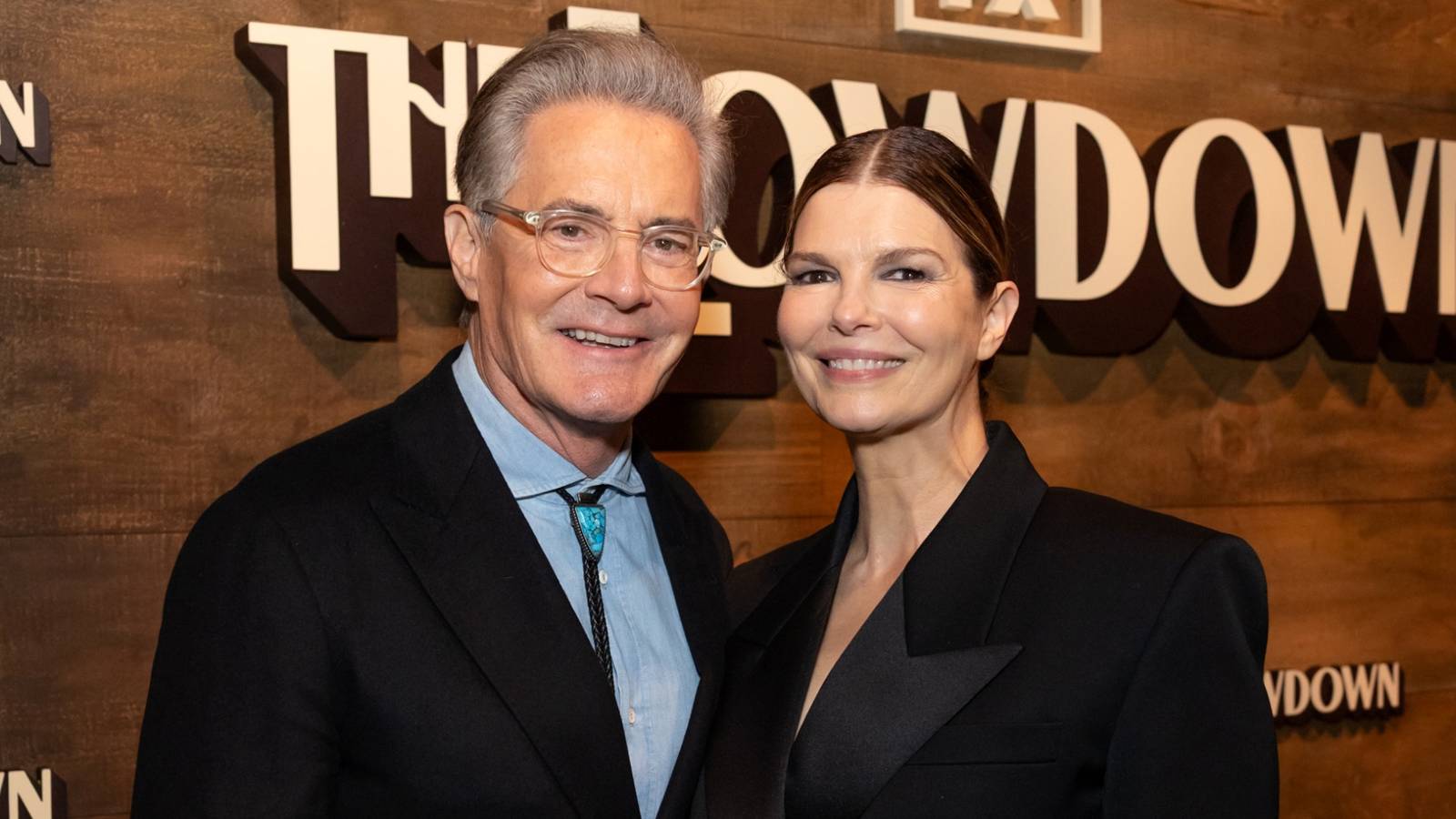

Kyle MacLachlan Unpacks 'Twin Peaks' & 'The Lowdown' Similarities

From 'Reservation Dogs' creator Sterlin Harjo, the FX series 'The Lowdown' is a moody mystery set in Tulsa, Oklahoma, ex...

Richard Linklater's 'Nouvelle Vague' FYC Event: A Director's Profile

Collider and Landmark Theatres are partnering for a special FYC screening of Richard Linklater’s "Nouvelle Vague," an ho...

Political Shockwave in Liberia: President Boakai's Sudden Purge Rocks Nation

President Joseph Boakai has initiated a wave of unexplained dismissals across his Liberian administration, creating an a...