Michael Saylor Defies Crypto Carnage: 'Don't Stop Believin' Amidst $20 Billion Bitcoin Plunge!

The cryptocurrency market recently experienced a significant downturn, witnessing an estimated $20 billion in liquidations within a mere 36 hours. This market correction led to substantial price drops across various digital assets. SUI, for instance, saw an 80% collapse, while XRP plummeted 53% from its recent peak. Solana also faced a notable disruption, with its price on Binance futures printing $141 while spot markets still traded around $168, illustrating the severe impact of cascading sales on order books.

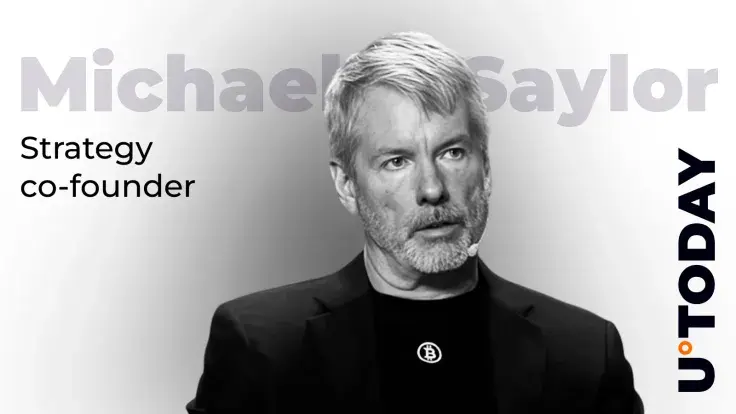

Amidst this market turmoil, Michael Saylor, a prominent American businessman and one of the world's largest Bitcoin holders, maintained a steadfast resolve. Contrary to what some might expect, he did not mark the occasion with another Bitcoin purchase for his strategy last week. Instead, Saylor took to social media, sharing a screenshot accompanied by the encouraging four words: "Don’t Stop ₿elievin’."

Saylor's firm, MicroStrategy, holds a substantial Bitcoin stack of 640,031 BTC. At an average entry price of $73,983, this holding was valued at approximately $71.71 billion. Even after the market dip, Saylor and MicroStrategy boasted an impressive unrealized profit of nearly 51.44%, or $24.35 billion.

However, the recent market movements did impact the paper value of these holdings. When Bitcoin had traded near $122,000 earlier in the month, Saylor’s stack was valued at around $78.1 billion. With current prices hovering near $112,000, the firm’s Bitcoin book experienced a paper loss of approximately $6.4 billion in just a few days. It is crucial to note that this represents an unrealized loss, a brutal cut from the top valuation, rather than a realized one.

On the stock market side, MicroStrategy (MSTR) trades with a basic market cap of $87 billion, which rises to $97 billion on dilution, and an enterprise value of $101 billion. Significantly, more than 66% of MicroStrategy’s value is directly attributable to its Bitcoin holdings. Despite the $20 billion market bleed and the $6.4 billion paper loss on his own holdings, Saylor’s stance remains clear: he still sits $24 billion ahead and continues to advocate for unwavering belief in Bitcoin.

You may also like...

India Claims 2030 Commonwealth Games Host Rights, Outbidding Nigeria

)

India is set to host the 2030 Commonwealth Games, with Ahmedabad chosen as the host city, marking the second time in 20 ...

Yahaya's Hat-Trick Heroics Lead Flamingos to Thrilling Pre-World Cup Win, 50th Goal Milestone Achieved

Nigeria's U-17 women's national team, the Flamingos, concluded their pre-World Cup preparations with a decisive 3-2 win ...

Apple TV's Sci-Fi Sensation Defies Gravity on Streaming Charts

Apple TV+ continues to impress with original content, highlighted by the enduring popularity of its heartwarming comedy ...

Playboi Carti Electrifies LA with Surprise Kendrick Lamar and A$AP Rocky Appearances

Playboi Carti's Antagonist 2.0 Tour took center stage in Los Angeles, featuring explosive surprise performances from A$A...

Barack Obama Honors Music Legend D’Angelo, Calling Him 'One of a Kind'

Neo-soul icon D’Angelo has passed away at 51 after a courageous battle with cancer, prompting an outpouring of tributes ...

Sarah Ferguson Forced to Relinquish Lavish £1.5M Gift

Discover the story of Birch Hall, a lavish Surrey estate gifted by Queen Elizabeth II to Sarah Ferguson after her divorc...

Katie Price Names Alleged Rapist, Shocks British TV World

Katie Price has sensationally named a British TV star she claims raped her over two decades ago during a live show on he...

Unveiling the Unknown: Science Reveals Near-Death Experience Secrets!

A new University of Virginia study reveals a critical lack of support for millions of Americans who have had near-death ...