Bitcoin's Wild $115K Close: Bears Seize Control After Major Crash!

Bitcoin experienced a highly volatile week, characterized by a significant price pullback and a subsequent chaotic recovery. Early last week, a modest correction was observed, but a dramatic turn occurred on Friday morning when discussions about raising tariffs on China by Trump triggered a market crash. This geopolitical development caused liquidity to dry up, sending Bitcoin's index price plummeting to a low of $105,617. On some leveraged exchanges, the price dipped even further, reaching as low as $102,000 and in some instances, $100,000. Following this sharp decline, Bitcoin managed a notable bounce, closing the week at $115,128. Despite this rebound, the market sentiment remains bearish, with sellers, or 'bears,' firmly in control as long as the price stays below the $118,350 mark.

In the aftermath of Friday's dive, Bitcoin's price breached several recent support levels, which are price points where buying interest is expected to prevent further decline. However, the critical $105,000 support level proved its resilience, providing a temporary floor for the price. Moving forward, 'bulls,' or buyers expecting prices to rise, will be keen to see this low hold. Should this crucial level be lost, attention will turn to the $96,000 level as the next significant support. A sustained close below $96,000 would signal a potential end to the current bull market for the foreseeable future. Utilizing a Fibonacci Retracement tool, drawn from the recent high of $126,219 to the low of $105,617, reveals key resistance levels. For bulls to regain momentum, they would need to retake resistance levels above the 0.618 Fibonacci Retracement at $118,350. Furthermore, closing a couple of days above the 0.786 Fibonacci Retracement at $121,800 would open the door for new highs.

Looking ahead into the current week, the significant bounce observed after such a steep sell-off was largely anticipated, making the immediate outlook uncertain. Oscillators, which are technical indicators that vary over time to identify overbought or oversold conditions, on the daily chart still exhibit a bearish bias, though not excessively so, suggesting bulls still have an opportunity to recover. In the short term, bulls must avoid closing any day below the 0.236 Fibonacci Retracement at $110,500, as this would expose the $105,000 low once again. Conversely, bears will aim to keep the price suppressed below the 0.618 Fibonacci Retracement resistance at $118,350. Breaching this level would shift the short-term bias back in favor of the bulls, though it represents a challenging uphill battle. A neutral zone exists between $112,000 and $118,350, with $115,630 acting as the dividing line for bullish or bearish bias within this range. Consequently, Bitcoin may consolidate within this zone over the next few days.

Considering the next few weeks, an intriguing development is that Friday's low price touched the lower trend line of a broadening wedge pattern on the daily chart. A broadening wedge is a chart pattern where upper and lower trend lines diverge, indicating expanding price volatility with typically higher highs and lower lows. It remains plausible that the price could rebound all the way back to the upper trend line of this pattern, which is around $127,000. However, traders must remain cautious, as a breakdown of this broadening wedge pattern is also a possibility, potentially forming a long-term market top. Bulls will critically want to avoid any daily closes below the lower trend line of this pattern, as such a breakdown would likely lead to a drop into the low $80,000 range at a minimum. Regaining the upper trend line would reignite bullish hopes for a breakout from this pattern. The market anticipates a period of extreme caution for bulls, as they must prevent any significant price action near $105,000 again and will face considerable pressure to push the price above $122,000.

Recommended Articles

Wall Street Fear Factor: Jamie Dimon Claims 'Death Threats' for Bitcoin Comments

JPMorgan CEO Jamie Dimon, a well-known Bitcoin skeptic, announced he will no longer comment on the cryptocurrency, citin...

Crypto Crossroads: Bitcoin Price Plunges to $110,000 Amidst Surging Corporate Adoption

Bitcoin holds steady in the $110,000 range following recent all-time highs and market volatility. Corporate interest in ...

GOP Unleashes New Bill to Lock In Trump's Pro-Bitcoin 401(k) Stance

Rep. Troy Downing is introducing the "Retirement Investment Choice Act" to codify President Trump's August executive ord...

Massive $19 Billion Crypto Liquidation Rocks Markets, Dogecoin Founder Breaks Silence

The cryptocurrency market experienced a severe downturn on Friday, marked by significant price drops across major digita...

JPMorgan Clients Plunge Into Bitcoin & Crypto Trading!

JPMorgan has re-confirmed its strategy to allow clients to trade Bitcoin and other cryptocurrencies, while actively expa...

You may also like...

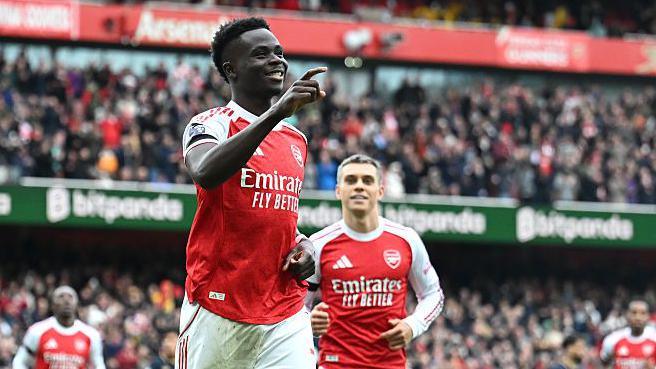

Hidden Truths: Premier League Performances Go Deeper Than Just Results!

Beyond the Premier League table, Expected Goals (xG) offers a crucial metric for evaluating team performance, revealing ...

Netflix Renews 'Splinter Cell: Deathwatch' for Season 2 After Uncertain Start

Netflix has officially renewed “Splinter Cell: Deathwatch” for a second season, confirming an earlier two-season order f...

Ice Spice Shakes Up Paris Fashion Week With 'Baddie Baddie' Twerk Video

Ice Spice has unveiled her new "Baddie Baddie" music video, featuring supermodel Anok Yai and Olympic gymnast Suni Lee. ...

Selena Gomez's Raw Confession: Why She 'Sobbed' After Marrying Benny Blanco

Selena Gomez opened up at Fortune’s Most Powerful Women conference about her persistent irrational fears, despite her re...

Heartbreak After Death: Liam Payne's Secret 'Goodbye' Letter Discovered

Liam Payne's girlfriend, Kate Cassidy, recently discovered a heartfelt goodbye note from the late singer days before the...

Britney Spears Unleashes Fury: Denies Shocking Knife Allegations

Kevin Federline's forthcoming memoir contains startling allegations about Britney Spears's behavior, including claims of...

West Africa's Tech Future Unfolds: Registration Opens for NITDA Co-Create Exhibition

The NITDA Co-Create West Africa Tech Exhibition is set to showcase cutting-edge innovations and trends across diverse te...

KingsChat's Explosive Growth: Christ Embassy's Social App Surpasses 2 Million Users

KingsChat, a Nigerian social media app owned by Christ Embassy, is quietly dominating the app market with over 2 million...