JPMorgan Clients Plunge Into Bitcoin & Crypto Trading!

JPMorgan Chase has unequivocally re-affirmed its commitment to the burgeoning digital asset space, announcing that it will permit clients to engage in the trading of Bitcoin and other cryptocurrencies. This strategic move aligns with the bank's expanding blockchain initiatives, as it actively explores how digital assets can be seamlessly integrated into its extensive global markets strategy.

Scott Lucas, JPMorgan’s global head of markets digital assets, elucidated the bank’s nuanced approach in a recent CNBC interview. He articulated an “and” strategy, which seeks to judiciously balance the robust existing financial infrastructure with the transformative opportunities presented by emerging blockchain technologies. Regarding the trading of cryptocurrencies, Lucas explicitly stated, “Jamie [Dimon] was pretty clear during investor day that we were going to be involved in the trading of that, but custody is not on the table at the moment.” While immediate custody services are not being offered, the bank is actively investigating suitable custodians to support its growing business footprint in this domain.

A key area of JPMorgan's innovation lies in its experimentation with deposit tokens and stablecoins. These instruments are designed to facilitate cash-like digital assets on distributed ledgers, streamlining financial processes. Lucas highlighted JPMD, the bank's proprietary deposit token, which currently exists as a prototype in the U.S. This platform is envisioned to underpin potential client services and sophisticated cash management solutions. Stablecoins also remain a significant focus, though Lucas clarified that any future issuance of such assets would likely originate from the bank’s payments business, rather than its markets division. Nevertheless, JPMorgan’s trading clients are empowered to leverage stablecoins to execute transactions and explore novel financial workflows, signifying the bank’s dedication to bridging traditional markets with blockchain-based infrastructure.

Lucas further acknowledged the escalating importance of public blockchains within capital markets. While JPMorgan continues to maintain its proprietary internal platforms for certain operations, there is an anticipation that an increasing proportion of market activity will transition towards public networks, underscoring a forward-looking perspective on the evolution of financial ecosystems.

Beyond its direct involvement in digital assets, JPMorgan earlier announced a monumental $1.5 trillion, decade-long “Security and Resiliency Initiative.” This extensive program is designed to bolster critical U.S. industries, encompassing energy, manufacturing, and defense. As part of this initiative, the bank committed to investing up to $10 billion in equity and venture capital, specifically targeting domestic companies that are driving innovation and strategic manufacturing capabilities.

In a separate but equally significant development earlier this month, JPMorgan research presented a compelling analysis suggesting that Bitcoin might be undervalued when compared to gold. The bank's analysts posited a substantial potential upside for Bitcoin, particularly if the prevailing “debasement trade” continues. Based on volatility-adjusted comparisons with gold, their estimates indicated that Bitcoin could potentially surge to $165,000, representing an approximate 450% increase from current levels. This optimistic outlook is further supported by the observation that Bitcoin is becoming increasingly attractive relative to gold as the bitcoin-to-gold volatility ratio continues to fall below 2.0.

Demonstrating its progressively inclusive stance towards digital assets, JPMorgan Chase was reportedly considering a policy earlier this year to lend directly against clients’ Bitcoin and cryptocurrency holdings. This potential move would mark a significant first for the bank in accepting digital assets—distinct from ETFs—as loan collateral. Furthermore, earlier in 2025, JPMorgan had already begun allowing clients to utilize Bitcoin ETFs as collateral and initiated the inclusion of crypto holdings in net worth evaluations alongside traditional assets, signaling a broader acceptance and integration of digital wealth into its financial services framework.

You may also like...

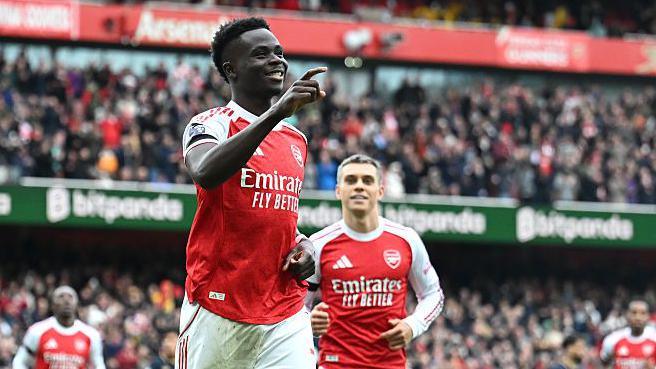

Hidden Truths: Premier League Performances Go Deeper Than Just Results!

Beyond the Premier League table, Expected Goals (xG) offers a crucial metric for evaluating team performance, revealing ...

Netflix Renews 'Splinter Cell: Deathwatch' for Season 2 After Uncertain Start

Netflix has officially renewed “Splinter Cell: Deathwatch” for a second season, confirming an earlier two-season order f...

Ice Spice Shakes Up Paris Fashion Week With 'Baddie Baddie' Twerk Video

Ice Spice has unveiled her new "Baddie Baddie" music video, featuring supermodel Anok Yai and Olympic gymnast Suni Lee. ...

Selena Gomez's Raw Confession: Why She 'Sobbed' After Marrying Benny Blanco

Selena Gomez opened up at Fortune’s Most Powerful Women conference about her persistent irrational fears, despite her re...

Heartbreak After Death: Liam Payne's Secret 'Goodbye' Letter Discovered

Liam Payne's girlfriend, Kate Cassidy, recently discovered a heartfelt goodbye note from the late singer days before the...

Britney Spears Unleashes Fury: Denies Shocking Knife Allegations

Kevin Federline's forthcoming memoir contains startling allegations about Britney Spears's behavior, including claims of...

West Africa's Tech Future Unfolds: Registration Opens for NITDA Co-Create Exhibition

The NITDA Co-Create West Africa Tech Exhibition is set to showcase cutting-edge innovations and trends across diverse te...

KingsChat's Explosive Growth: Christ Embassy's Social App Surpasses 2 Million Users

KingsChat, a Nigerian social media app owned by Christ Embassy, is quietly dominating the app market with over 2 million...