Metaplanet's Multi-Million Dollar Bitcoin Shopping Spree Fuels Price Stability Above $116,000

Metaplanet, a company listed on the Tokyo Stock Exchange, has successfully concluded a significant $1.4 billion fundraise through an international share offering. This substantial capital infusion is earmarked primarily for the acquisition of Bitcoin, signaling a robust institutional embrace of Bitcoin treasury operations, especially as Bitcoin's price consistently trades above $116,000.

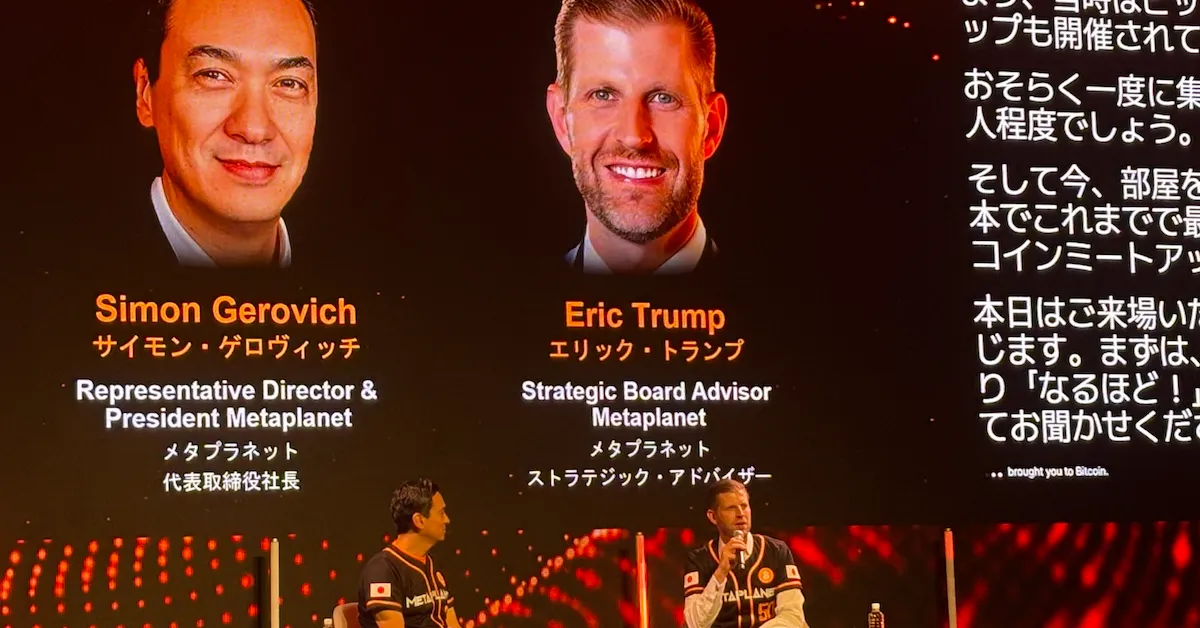

Alongside the fundraise, Metaplanet announced a series of strategic initiatives designed to bolster its presence in the global Bitcoin ecosystem. These include the establishment of new subsidiaries in both the United States and Japan, further expanding its operational footprint. Additionally, the company has secured the premium domain name Bitcoin.jp, positioning itself as a central hub for Bitcoin-related activities in Japan.

The international share offering attracted considerable interest from a diverse group of global institutional investors, including several sovereign wealth funds. This broad participation underscores the increasing mainstream acceptance and strategic importance of incorporating Bitcoin into corporate treasury strategies. Metaplanet intends to deploy the newly raised capital for Bitcoin purchases between September and October 2025. A portion of the funds will also be allocated to expand the company's Bitcoin income generation business, moving beyond simple treasury management to more sophisticated financial operations.

Metaplanet's aggressive expansion aligns with a broader industry trend where corporations are increasingly adding Bitcoin to their treasury holdings. This trend has seen corporate Bitcoin holdings surpass 1 million BTC, accounting for approximately 5% of Bitcoin's total circulating supply, with new companies entering this space on a daily basis.

Detailing its new ventures, Metaplanet's U.S. subsidiary, Metaplanet Income Corp., will be headquartered in Miami, Florida, with an initial capital of $15 million. This entity will focus on advanced Bitcoin income generation and derivatives operations, representing a significant strategic diversification. In Japan, the newly formed Bitcoin Japan Inc., operating from Tokyo's prestigious Roppongi Hills complex, will manage media, events, and various services related to Bitcoin, leveraging the newly acquired Bitcoin.jp domain to solidify its market position.

The Japanese market presents unique advantages for Bitcoin treasury operations. A favorable low interest rate environment and tax benefits available to individual investors through NISA accounts make it particularly attractive. When combined with Japan's standing as the world's second-largest capital market, these factors create compelling opportunities for the growth and integration of Bitcoin within financial strategies.

Metaplanet’s strategic moves highlight the growing competition within the Bitcoin treasury sector, as corporations increasingly recognize Bitcoin holdings as an essential component of their long-term financial planning. The $1.4 billion fundraise represents one of the largest capital deployments into Bitcoin by a publicly listed company in 2025. Institutional investors have also noted Metaplanet’s future potential to issue Bitcoin-backed preferred shares, with its expanded Bitcoin Net Asset Value (BTC NAV) serving as a solid foundation for innovative financial products.

To demonstrate a commitment to long-term value creation, Metaplanet has implemented a 60-day lock-up period for its management and major shareholders. As Bitcoin continues to trade above $116,000, Metaplanet’s ambitious expansion underscores the escalating institutional appetite for Bitcoin exposure through publicly listed vehicles. The company’s multi-faceted strategy, which integrates direct Bitcoin acquisition with income-generating activities, sets a potential precedent for future institutional adoption and an evolution in corporate Bitcoin strategy.

You may also like...

Champions League Madness: Europe's Elite Deliver Drama, Goals, and Controversy

The Champions League returned with intense clashes as Liverpool secured a dramatic 3-2 victory over Atletico Madrid, hig...

Boxing World Grieves: Stars Pay Emotional Tributes to Legend Ricky Hatton

The boxing world mourns the loss of 'The Hitman' Ricky Hatton, who passed away at 46. Tributes have poured in from sport...

Critics Hail 'One Battle After Another' as a Paul Thomas Anderson Masterpiece!

Paul Thomas Anderson's latest film, <i>One Battle After Another</i>, is hailed as an instant masterpiece, blending actio...

South Park Stunner: Creators Announce Last-Minute Episode Delay!

The latest episode of South Park Season 27 has been delayed, with creators Trey Parker and Matt Stone citing production ...

Sabrina Carpenter's Star Power Ignites Civic Action, Driving 30,000 Engagements in Just Half a Day!

Pop star Sabrina Carpenter is partnering with HeadCount to drive voter engagement during her Short n’ Sweet Tour, offeri...

Horror in Music World: Missing Teen Found Dead in D4vd's Car

The body discovered in a Tesla registered to musician D4vd has been identified as 15-year-old Celeste Rivas, who was rep...

Ed Sheeran's Candid Revelation: The Price of Fame and the Pursuit of True Happiness

Ed Sheeran opens up about his newfound happiness, attributing it to a balanced life focused on family and his music care...

Pop Icon Robbie Williams Delays New LP Fearing Threat to Historic Record Bid

The music industry is alive with new developments as Robbie Williams delays his album to avoid clashing with Taylor Swif...