Bitcoin Rockets to $117K as Crypto Treasury Stocks Crumble!

The aftermath of what has been dubbed the "paper bitcoin summer delusion" has arrived with a stark and painful reality for bitcoin treasury companies, even as the price of Bitcoin itself continues its steady ascent, pushing towards $117,000. The true impact is not reflected in Bitcoin’s calm upward tick, but rather in the precipitous decline of the stock prices of these treasury-holding entities. Companies such as $MSTR, Metaplanet, $NAKA, H100, and Smarter Web Company have all exhibited a similar trajectory: a "shitcoin-style pump into the heavens," followed by a prolonged and often severe decline, bringing them back to or even below their starting valuations.

For a period, Wall Street, alongside many others, operated under the belief that financial markets could be easily arbitraged. The strategy seemed straightforward: issue shares at a value exceeding their intrinsic worth, then use the proceeds to acquire Bitcoin, and repeat the process. During this "vertiginous summer fling," investors were seemingly willing to pay more than a dollar for a dollar's worth of Bitcoin held by these companies, leading to widespread optimism and perceived easy gains. However, this period of perceived easy arbitrage has concluded, and the consequences are now manifesting dramatically across the market.

The struggles of these companies are particularly evident in specific cases, such as $NAKA, which experienced a staggering 50% fall after its S3 PIPE shares restriction period ended. This significant drop came after the stock had already plummeted approximately 87% from its peak during a May "pump-and-dump." This event vividly illustrates a fundamental market principle: a massive increase in the outstanding, tradeable float of shares—reportedly 50x overnight—coupled with a lack of corresponding demand, inevitably leads to a collapsing price. As bitcoin treasury company analyst Adam Livingston succinctly put it, "And you get a perfect physics lesson here: add mass, you lose altitude."

Despite these significant downturns for treasury companies, not all market participants share the same bearish outlook. David Bailey, a proponent of the treasury strategy, challenges critics who claim "Treasury mania is over!" Bailey asserts that the "treasury play is just getting started," suggesting that current critics lack the vision to see its future potential, just as they missed it previously. This optimistic view stands in contrast to Bitcoin's immediate indifference, as it jumped almost 2% on the same day, unaffected by the turmoil among treasury companies and continuing its pattern around $116,000.

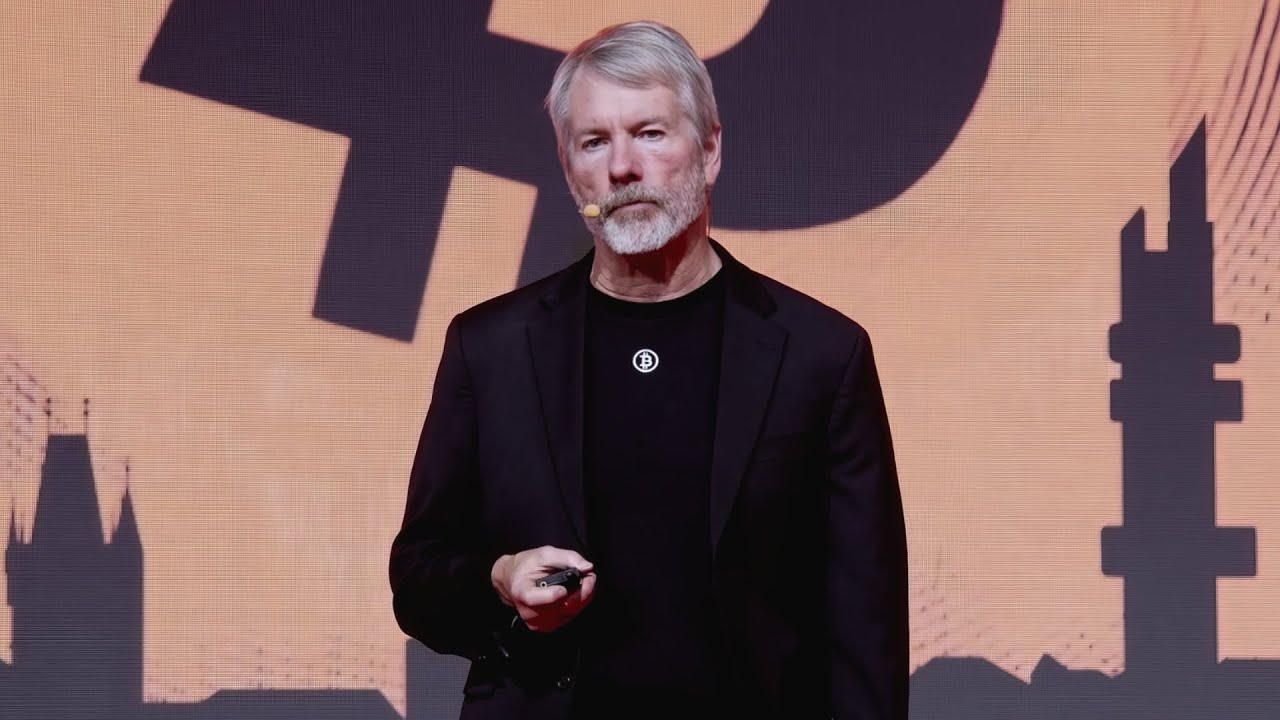

Interestingly, while the treasury companies face severe headwinds, Bitcoin itself has largely remained unaffected. It continued its upward movement, demonstrating a resilience independent of the struggles of these corporate entities. Bitcoin Magazine Pro’s Matt Crosby noted in a recent video that the bitcoin price is "poised for breakout," contrasting sharply with the bleak outlook for the treasury companies. Even Saylor’s Strategy ($MSTR), often considered best-in-class, is grappling with challenges. Despite actively acquiring hundreds of coins, its market-adjusted Net Asset Value (mNAV) continues to compress, hitting an unadjusted yearly low of 1.27.

The increasing compression of mNAV indicates that the stock premium—the very source of "magic" for treasury companies—is rapidly diminishing. This trend suggests that these companies risk devolving into expensive, glorified Exchange Traded Funds (ETFs), trading closer to their book value. The critical question then becomes, as posed by Joakim Book, "If you're a bank, shouldn't you trade like a bank? (i.e., at around 1 book value)." The illusion that issuing an "infinite number of copiable paper against a non-credible bitcoin strategy" could lead to a different outcome has now shattered.

The consequences for companies that prioritized "high finance" over a sound Bitcoin strategy are clear. As Livingston elaborated regarding the September 15 crash, "It was the predictable result of half a billion discounting shares stampeding through an order book designed for a few million: supply floods, the price sinks, and the physics lesson is complete." The era of "everlasting upward magic" for money-share printing bitcoin treasury companies has ended. These companies are now compelled to demonstrate genuine value-add beyond simply holding corporate-wrapped coins, or perhaps, the market will revert to Bitcoin's original intent: de-financializing the economy.

You may also like...

Man Utd's Staggering Financial Hit: Amorim Sacking Could Cost Millions!

Manchester United faces a complex situation with manager Ruben Amorim, whose job security is tied to a hefty £12 million...

Global Hoops Revolution: NBA's European League Targets 2027 Launch!

The NBA and FIBA are actively collaborating to launch a new European basketball league, targeting a start between 2027 a...

Chaos Before the Cha-Cha: ‘Dancing With the Stars’ Season 34 Rocked by Drama and Judge Absence

Season 34 of “Dancing With the Stars” kicks off with Carrie Ann Inaba's absence due to illness and pre-season drama invo...

Hollywood Mourns Legend: Robert Redford Dies at 89, Tributes Pour In

Hollywood mourns the loss of Robert Redford, who passed away at 89. Remembered for his iconic acting career, Oscar-winni...

Hilda Baci's Jollof Rice Triumph: Guinness World Record Certified!

Nigerian celebrity chef Hilda Baci has secured another Guinness World Record, this time for preparing the 'Largest Servi...

Cena vs. Lesnar: WWE WrestlePalooza Gears Up for Epic Farewell Showdown!

WWE introduces its new premium live event, Wrestlepalooza, streaming globally on September 20, and live on Netflix in th...

Ex-Council Leader Martin Dowey Cleared in Leaked Tape Scandal!

Former South Ayrshire Council Leader Martin Dowey has been cleared of criminal action following a police investigation i...

Snack Time Shocker: The Definitive Way to Eat Cheese on Toast Unveiled!

Experts from Lea & Perrins reveal that many cheese on toast lovers are incorrectly applying Worcestershire sauce. The co...