Meta's Profit Crushed by Staggering $16 Billion Tax Hit, Linked to Trump-Era Bill

Meta Platforms Inc. recently reported a significant financial impact in its third quarter, recording a nearly $16 billion one-time charge attributed to US President Donald Trump’s "Big Beautiful Bill." This substantial charge sharply diminished the social media giant's quarterly earnings, leading to approximately a 6% drop in its shares after the announcement. Had this charge been excluded, Meta stated its net income would have reached $18.64 billion, a stark contrast to the reported $2.71 billion, highlighting the magnitude of this financial adjustment.

In parallel with this earnings setback, Meta announced a sharp increase in its capital expenditure forecasts. The company raised its full-year capital expenditure outlook to a range of $70–72 billion, an increase from its previous projection of $66–72 billion. Furthermore, Meta indicated that spending in 2026 is anticipated to be "notably larger." Susan Li, Meta's CFO, explained that the company’s compute needs have expanded significantly, necessitating aggressive investment in both proprietary infrastructure development and partnerships with third-party cloud providers. Li also identified employee compensation costs, particularly those associated with securing top AI talent, as the second-largest driver of these escalating expenses.

This surge in spending is primarily driven by Meta's continued and intensified focus on artificial intelligence. The company is actively pursuing its ambitious long-term objective of achieving superintelligence, a state where machine reasoning capability could surpass human intelligence. Following senior staff departures and a less-than-enthusiastic reception for its Llama 4 model, Meta reorganized its AI initiatives in June under a newly formed "Superintelligence Labs" unit. CEO Mark Zuckerberg has personally spearheaded a vigorous hiring campaign to attract leading AI experts, underscoring his commitment. Zuckerberg previously stated the company's readiness to "spend hundreds of billions to build the world’s most advanced AI infrastructure." A testament to this commitment is the recent $27 billion financing deal secured with Blue Owl Capital, designated to fund a massive data center project in Louisiana, codenamed "Hyperion."

Despite these extensive investments, Meta made a surprising move last week by announcing approximately 600 job cuts within its AI division. This decision was framed as a strategic measure to streamline decision-making processes and enhance accountability across its teams. Even with these personnel reductions, the company's substantial investments in AI infrastructure continue to mount, creating short-term cost pressures. However, Meta anticipates that these strategic outlays will ultimately lead to long-term growth and significant efficiency gains.

Beyond infrastructure, Meta is actively leveraging its expansive user base of 3.2 billion daily active users to boost ad revenue, with AI playing a crucial role. Its AI-optimized ad platform automates campaign delivery, generates personalized visual content, and improves the quality of video advertisements. The company has also expanded its advertising reach by launching ads on platforms like WhatsApp and Threads, positioning itself in direct competition with Elon Musk’s X. Concurrently, Instagram Reels continues to challenge dominant players such as TikTok and YouTube Shorts in the burgeoning short-video market, further integrating AI for content optimization and user engagement.

Meta’s aggressive investment strategy in AI reflects a broader trend across the technology industry. According to an analysis by Morgan Stanley, major tech firms including Alphabet, Amazon, Meta, Microsoft, and CoreWeave are collectively projected to spend an astonishing $400 billion on AI infrastructure in 2025. This unprecedented level of aggressive capital outlay, especially amidst prevailing economic uncertainties, has raised concerns about the potential formation of an "AI bubble." Consequently, there is heightened pressure for these companies to demonstrate measurable returns on their AI investments, leading to increased scrutiny of executive decisions. (With Reuters inputs)

You may also like...

Wolves vs Chelsea: Arokodare and Gitten's Late Drama Secures Blues' Advance

)

In a thrilling EFL Cup clash, Chelsea secured a dramatic 4-3 victory over Wolves, despite a spirited second-half comebac...

WB Fights Back: Lawsuit Accusing 'The Pitt' of 'ER' Plagiarism Denied!

HBO's medical drama "The Pitt" faces an ongoing lawsuit from the "ER" creator's estate, alleging it's an uncredited rebo...

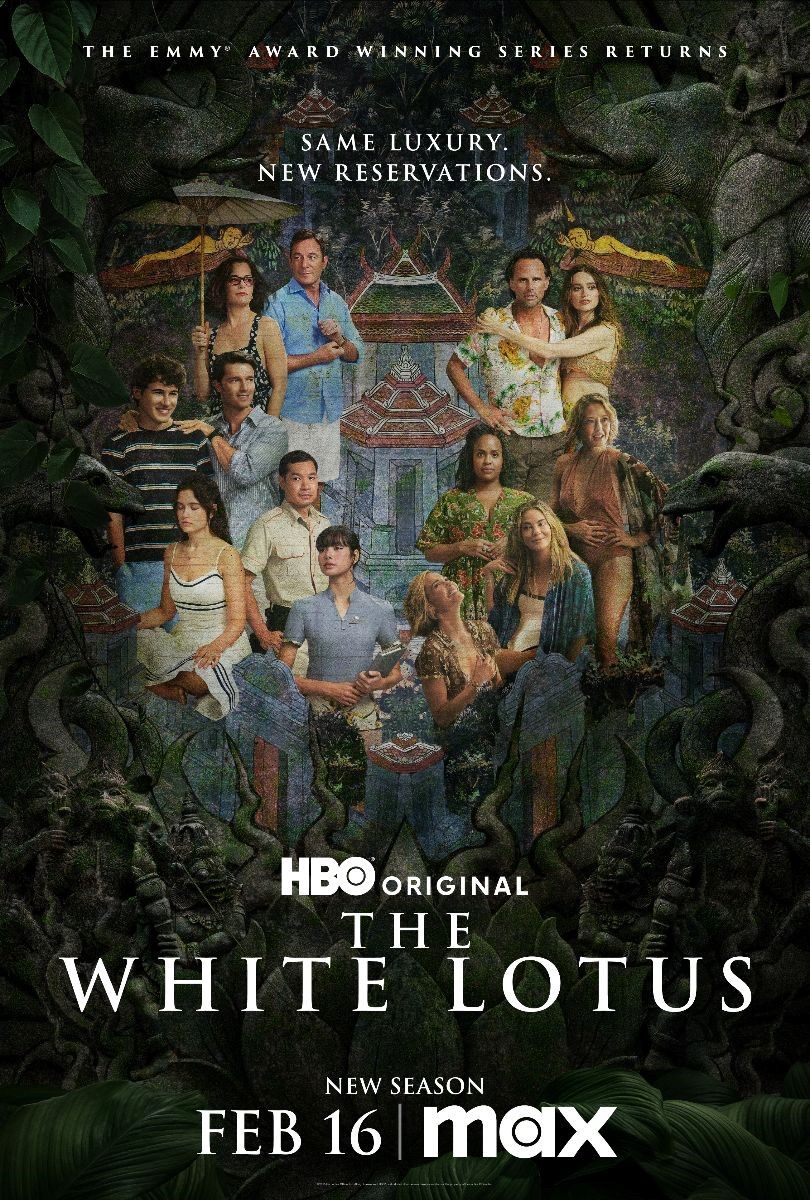

White Lotus Season 4's Luxurious European Filming Locations Revealed!

"The White Lotus" Season 4 is reportedly heading to France, with creator Mike White scouting locations in Paris and the ...

Tim McGraw Reveals Devastating Health Crisis Nearly Ended Music Career

Country music icon Tim McGraw recently revealed that extensive health issues, including multiple back surgeries and knee...

Giovanny Ayala Rockets to the Top with Historic First Billboard No. 1!

Giovanny Ayala celebrates his first No. 1 on the Regional Mexican Airplay chart with “No Estaba Hablando En Serio,” mark...

Ancient Scottish Castle Unveiled as Europe's Top Hidden Gem

As Halloween approaches, a new analysis reveals Europe's most magical castle destinations, categorizing them by seclusio...

Heartwarming Tale: Groom's Grand Gestures Bring Ijaw Bride to Tears of Joy!

Discover the unique Ijaw wedding tradition known as the ‘buying of mouth,’ where a bride playfully frowns until appeased...

BellaNaija's Omotunde Heads to Cape Town, Buzzing for AWIEF 2025!

A traveler shares her excitement about arriving in Cape Town for the first time, captivated by its beauty and vibrant en...