Mastercard Drops $2 Billion Bomb: Crypto Startup Acquisition Ignites Industry

Payments giant Mastercard is reportedly in the final stages of negotiations to acquire Zerohash, a prominent cryptocurrency infrastructure and settlement company, for a total of $2 billion. This potential acquisition marks a significant move by Mastercard to bolster its presence in the rapidly evolving digital asset space.

Zerohash, co-founded by CEO Edward Woodford and Brian Liston, specializes in providing essential infrastructure for various financial entities including fintechs, banks, brokerages, and payment companies. Its platform enables seamless integration of a wide array of cryptocurrency features, such as staking, custody services, on/off ramping between crypto and fiat currencies, and even non-fungible token (NFT) transfers. The company boasts an impressive roster of partners, including industry leaders like Interactive Brokers, DraftKings, and Stripe, highlighting its critical role in facilitating mainstream crypto adoption.

The company itself has seen substantial growth, having raised an additional $104 million in a funding round in September, which propelled its valuation to $1 billion. This strong financial backing and strategic partnerships underscore Zerohash's technological capabilities and market positioning.

Mastercard's strategic interest in Zerohash is widely seen as a significant bet on the burgeoning stablecoin sector. Zerohash functions as a crucial stablecoin infrastructure provider, supporting various regulated dollar-backed tokens, including PYUSD. This aligns with Mastercard's recent initiatives in the crypto space; in April, the payments behemoth enabled its consumers to spend stablecoins and allowed merchants to accept them. The following month, Mastercard further expanded its crypto offerings by announcing a partnership with MoonPay, facilitating the linking of branded Mastercard cards to users’ stablecoin balances.

The company's increased comfort and confidence in the nascent stablecoin sector have been partly attributed to the passage of the GENIUS Act, which has introduced much-needed regulatory clarity for stablecoins in the United States. While Mastercard is making aggressive moves, it also faces increasing competition from long-time rival Visa, as well as emerging crypto-native players. Despite these strategic advancements into digital assets, Mastercard has recently clarified that it has no intentions of launching its own proprietary blockchain.

You may also like...

Wolves vs Chelsea: Arokodare and Gitten's Late Drama Secures Blues' Advance

)

In a thrilling EFL Cup clash, Chelsea secured a dramatic 4-3 victory over Wolves, despite a spirited second-half comebac...

WB Fights Back: Lawsuit Accusing 'The Pitt' of 'ER' Plagiarism Denied!

HBO's medical drama "The Pitt" faces an ongoing lawsuit from the "ER" creator's estate, alleging it's an uncredited rebo...

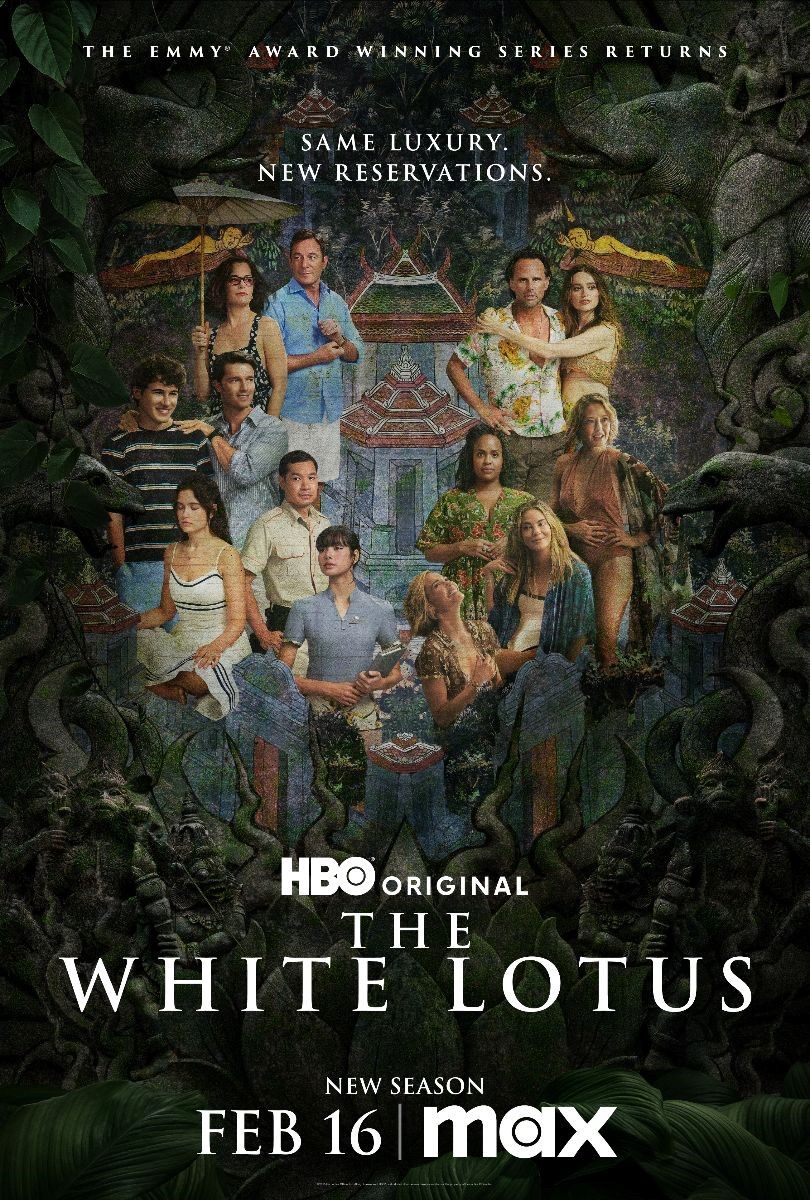

White Lotus Season 4's Luxurious European Filming Locations Revealed!

"The White Lotus" Season 4 is reportedly heading to France, with creator Mike White scouting locations in Paris and the ...

Tim McGraw Reveals Devastating Health Crisis Nearly Ended Music Career

Country music icon Tim McGraw recently revealed that extensive health issues, including multiple back surgeries and knee...

Giovanny Ayala Rockets to the Top with Historic First Billboard No. 1!

Giovanny Ayala celebrates his first No. 1 on the Regional Mexican Airplay chart with “No Estaba Hablando En Serio,” mark...

Ancient Scottish Castle Unveiled as Europe's Top Hidden Gem

As Halloween approaches, a new analysis reveals Europe's most magical castle destinations, categorizing them by seclusio...

Heartwarming Tale: Groom's Grand Gestures Bring Ijaw Bride to Tears of Joy!

Discover the unique Ijaw wedding tradition known as the ‘buying of mouth,’ where a bride playfully frowns until appeased...

BellaNaija's Omotunde Heads to Cape Town, Buzzing for AWIEF 2025!

A traveler shares her excitement about arriving in Cape Town for the first time, captivated by its beauty and vibrant en...