Maha Bank Races Against Time with ₹2,000 Cr Stake Sale to Meet SEBI Mandate

State-owned Bank of Maharashtra (BoM) is poised to meet the minimum public shareholding (MPS) norm of 25 percent, with Managing Director & CEO Nidhu Saxena expressing confidence that one more fundraising tranche in the current fiscal year will achieve this goal. This strategic move aims to bolster the bank's capital adequacy while simultaneously reducing the government's stake. The directive comes from the finance ministry, which has mandated five public-sector banks to increase public shareholding to 25 percent by August 1, 2026, aligning with the Securities Contract Rules issued by the Securities and Exchange Board of India (SEBI). SEBI has provided forbearance to CPSEs and public sector financial institutions until August 2026 to comply with this requirement.

Currently, the government holds a substantial 79.6 percent stake in the Pune-headquartered bank. According to Saxena, a fundraising effort of approximately ₹2,000-2,500 crore, based on the bank's current market capitalization, would effectively bring the government's holding below the 75 percent threshold. To ensure flexibility and security, BoM has already secured approval to raise ₹7,500 crore through a combination of debt and equity. A significant step in this direction was taken in October, when the bank successfully raised ₹3,500 crore via a Qualified Institutional Placement (QIP), which saw public shareholding increase from 13.5 percent at the end of September to 20.4 percent.

The specific mechanism for the upcoming fundraising—whether through another qualified institutional route or an offer for sale—is still under evaluation by the bank. Bank of Maharashtra is considered to be in a relatively favorable position compared to the other four public-sector banks that also need to reduce government stake. For context, the government holds 94.6 percent in Indian Overseas Bank, 93.9 percent in Punjab & Sind Bank, 91 percent in UCO Bank, and 89.3 percent in Central Bank of India.

In terms of financial performance, Bank of Maharashtra reported a net profit of ₹1,593 crore in the June quarter, marking a 23 percent increase, primarily driven by growth in interest income. Saxena also noted that, similar to its industry peers, BoM is not overly concerned about a potential fall in treasury income during the July-September quarter. Furthermore, he mentioned that transactions on the Reserve Bank of India's Unified Lending Interface are showing an upward trend, albeit at a gradual pace, with expectations for improved volumes over time.

Recommended Articles

Bank of Maharashtra Faces Urgent ₹2,000 Cr Stake Sale to Dodge SEBI's Public Holding Rule

State-owned Bank of Maharashtra aims to meet the 25% minimum public shareholding norm through a new fundraising round th...

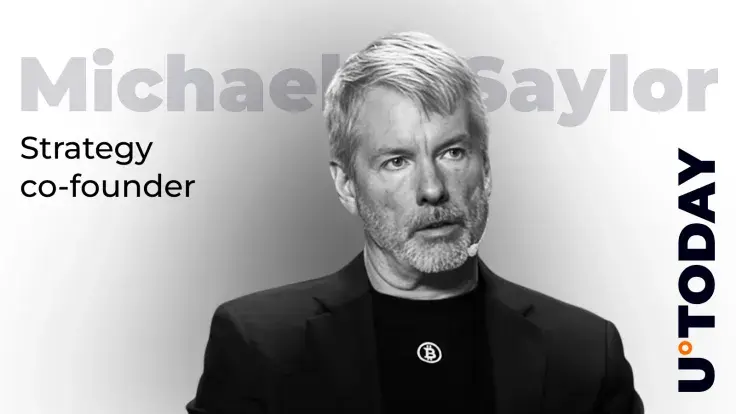

Bitcoin Titan Michael Saylor's Billionaire Rise & Strategy's S&P 500 Snub Rock Market

Michael Saylor and Strategy continue to make headlines with their unwavering commitment to Bitcoin, despite a recent S&P...

Wall Street Stunner: Jane Street Shatters Records with $10.1 Billion Trading Haul

Jane Street Group posted a record $10.1 billion in net trading revenue in the second quarter, surpassing major Wall Stre...

North American Banks Soar: BMO & Scotiabank Defy Odds with Surprise Profit Surge!

Bank of Montreal (BMO) and Bank of Nova Scotia (Scotiabank) have exceeded quarterly earnings estimates, thanks to smalle...

Adult Content Empire: OnlyFans Rakes In Staggering $7.2 Billion, Reveals Owner's Jaw-Dropping Earnings

OnlyFans' owner, Leonid Radvinsky, received a massive $701 million in dividends as the adult-content social network expl...

You may also like...

From Otedola to Ajibade: Love, Legacy, and the Politics of a Name

Temi Otedola has changed her surname to Temi Ajibade after marrying Mr Eazi, sparking a nationwide debate on feminism, l...

Boxing World Erupts! Canelo vs. Crawford Super-Fight Set to Define Legacies

Boxing history is set to be made on September 13 as two pound-for-pound greats, Canelo Alvarez and Terence Crawford, col...

Nigeria's Super Falcons Reign Supreme! Historic 10th WAFCON Title Ignites National Pride

)

Nigeria's Super Falcons clinched their record-extending 10th Women's Africa Cup of Nations title with a dramatic 3-2 com...

Conjuring: Last Rites Dominates Box Office, Unleashing Horror Havoc!

The alleged finale of "The Conjuring" franchise, "Last Rites," has shattered box office records, becoming the highest-gr...

Who Will Be the Next 007? James Bond Speculation Heats Up!

Speculation surrounding the next James Bond is intensifying, with British actor Mike Dickman emerging as a surprise fron...

2025 MTV VMAs Electrifies Audiences: Full List of Performers, Winners & Record Viewership Revealed!

The 2025 MTV Video Music Awards, broadcast for the first time on CBS, achieved record viewership and social media engage...

African Music Royalty Reigns: Burna Boy & Davido Dominate AFRIMA 2025 Nominations!

The All Africa Music Awards (AFRIMA) 2025 nominations have been announced, following a record-breaking 10,717 entries an...

Fatherhood Dream: Pete Davidson and Elsie Hewitt Expecting First Child

Comedian Pete Davidson and model Elsie Hewitt are expecting their first child, a joyful announcement Hewitt made on Inst...