Bitcoin Titan Michael Saylor's Billionaire Rise & Strategy's S&P 500 Snub Rock Market

Michael Saylor, the prominent Bitcoin advocate and co-founder of Strategy (formerly MicroStrategy), has consistently championed Bitcoin, recently employing AI visuals to illustrate its vast potential. His latest endeavor, an AI-made video depicting a 'Station ₿'—a Bitcoin-powered space station—symbolizes the decentralized network's capabilities. Saylor, acting as a tour guide in the video, highlights Bitcoin's power for low-cost, seamless financial transactions and a range of new Bitcoin-based products, aptly concluding that 'Bitcoin is the energy that powers the future.' This vision aligns with the sentiment that Bitcoin could be a 'station' for surviving potential fiat monetary system collapses.

Beyond advocacy, Strategy has significantly advanced its Bitcoin treasury strategy, leading to substantial financial gains and increased shareholder value. The company's Bitcoin holdings have reached an impressive 636,505 BTC, acquired at an average price of $73,765 per Bitcoin, representing a stunning gain of about 50% on its portfolio, valued at approximately $70.47 billion. This strategic accumulation has enabled Strategy to increase its annual dividend rate from 9.0% to 10.0% on September 2nd, demonstrating robust operational and financial performance and boosting investor confidence. A recent acquisition of 4,048 BTC for around $449.3 million further solidified its position, with the firm's year-to-date BTC yield surging to 25.7%.

Despite its financial triumphs, Strategy faced a notable setback with its rejection from the S&P 500 index on September 5th, even though it met various eligibility criteria like market cap and liquidity. This decision, made by a secretive selection committee that considers qualitative factors, was a 'snub' for the company. Michael Saylor reacted to this by posting an infographic showcasing MSTR's significant outperformance compared to the S&P 500 (SPY) and even Bitcoin itself, with MSTR showing a 92% surge against SPY's 14% and Bitcoin's 55% annualized growth during the 'Bitcoin Standard Era.' While MSTR shares initially dropped 2% following the news, Strategy's official stance remains an unwavering commitment to its Bitcoin path, contrasting with Robinhood's inclusion in the index.

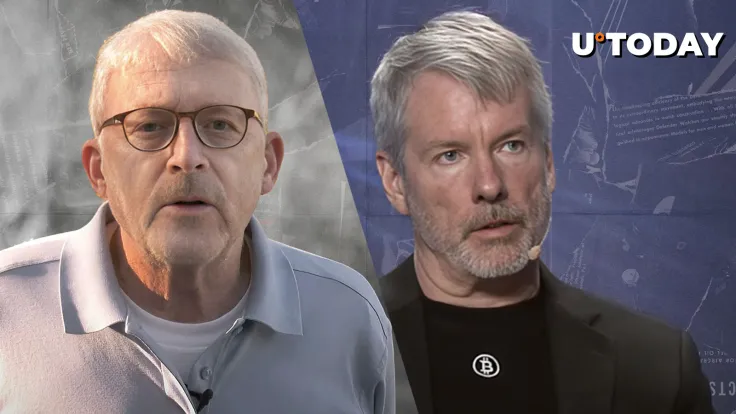

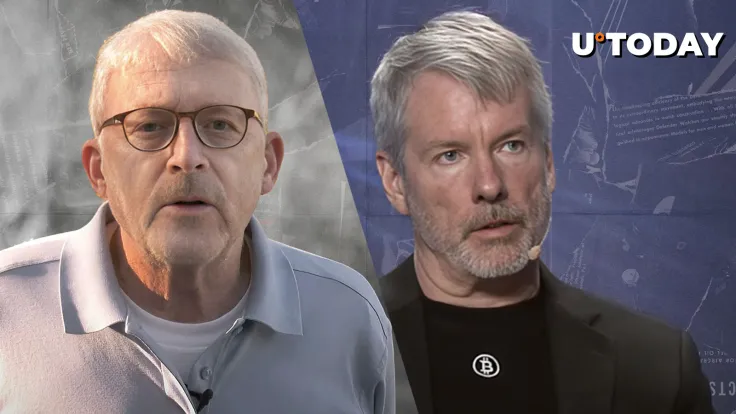

The MSTR stock performance has also drawn close inspection. Legendary trader Peter Brandt questioned whether the stock, which has traded between $330 and $480 since January and recently sat at $330.26, was signaling a final top or merely a pause before another upward movement. The correlation between Bitcoin and MSTR remains critical, with the stock acting as a pure Bitcoin proxy on traditional exchanges. Flattened moving averages and compressed volatility indicate a period of market deliberation regarding Strategy's valuation.

The success of Strategy's Bitcoin-centric approach has not only impacted the company but also significantly boosted Michael Saylor's personal wealth. For the first time, Saylor entered the Bloomberg Billionaires Index on September 7, 2025, ranking 491st with an estimated net worth of $7.37 billion. His net worth saw a recent increase of $167 million, underscoring the lucrative nature of his long-term Bitcoin bet, which began in August 2020 and has seen Strategy's value multiply nearly 26 times since late 2022. This milestone places him alongside other prominent crypto figures like Coinbase CEO Brian Armstrong and Binance founder Changpeng 'CZ' Zhao, further cementing his legacy as a leading figure in the cryptocurrency space.

Recommended Articles

XRP Takes Over Times Square with Massive Ad Blitz

The crypto market is bustling with Gemini's new XRP card promotion, while Ray Dalio offers critical insights into the de...

Saylor's Bitcoin Strategy Suffers S&P 500 Snub, Ignites Market Doubts

Michael Saylor's Strategy (MSTR) is under scrutiny as its Bitcoin-tied stock performance sees critical analysis and a no...

Saylor's Bitcoin Gambit Rocked: MicroStrategy Snubbed from S&P 500, Sparks Market Turmoil

Michael Saylor's Strategy (MSTR) faces close inspection amid its strong Bitcoin correlation and recent S&P 500 index rej...

Bitcoin Giant's S&P 500 Dream Crushed: MicroStrategy Rejection Sends Shockwaves

Michael Saylor's Strategy (MSTR) was rejected from the S&P 500 index despite outperforming it and Bitcoin. This decision...

MicroStrategy Faces S&P 500 Snub: Saylor Reacts to Index Exclusion

Strategy (MSTR), the Bitcoin treasury company led by Michael Saylor, was rejected from the S&P 500 index despite its str...

You may also like...

From Otedola to Ajibade: Love, Legacy, and the Politics of a Name

Temi Otedola has changed her surname to Temi Ajibade after marrying Mr Eazi, sparking a nationwide debate on feminism, l...

Boxing World Erupts! Canelo vs. Crawford Super-Fight Set to Define Legacies

Boxing history is set to be made on September 13 as two pound-for-pound greats, Canelo Alvarez and Terence Crawford, col...

Nigeria's Super Falcons Reign Supreme! Historic 10th WAFCON Title Ignites National Pride

)

Nigeria's Super Falcons clinched their record-extending 10th Women's Africa Cup of Nations title with a dramatic 3-2 com...

Conjuring: Last Rites Dominates Box Office, Unleashing Horror Havoc!

The alleged finale of "The Conjuring" franchise, "Last Rites," has shattered box office records, becoming the highest-gr...

Who Will Be the Next 007? James Bond Speculation Heats Up!

Speculation surrounding the next James Bond is intensifying, with British actor Mike Dickman emerging as a surprise fron...

2025 MTV VMAs Electrifies Audiences: Full List of Performers, Winners & Record Viewership Revealed!

The 2025 MTV Video Music Awards, broadcast for the first time on CBS, achieved record viewership and social media engage...

African Music Royalty Reigns: Burna Boy & Davido Dominate AFRIMA 2025 Nominations!

The All Africa Music Awards (AFRIMA) 2025 nominations have been announced, following a record-breaking 10,717 entries an...

Fatherhood Dream: Pete Davidson and Elsie Hewitt Expecting First Child

Comedian Pete Davidson and model Elsie Hewitt are expecting their first child, a joyful announcement Hewitt made on Inst...