Bank of Maharashtra Faces Urgent ₹2,000 Cr Stake Sale to Dodge SEBI's Public Holding Rule

State-owned Bank of Maharashtra (BoM) is confident of achieving the mandated 25 percent minimum public shareholding norm after undertaking one more tranche of fundraising within the current fiscal year. Managing Director & CEO Nidhu Saxena confirmed this on Monday, highlighting that an additional round of share sales would not only enhance the bank's capital adequacy but also help in reducing the government's stake.

The Ministry of Finance has instructed five public-sector banks, including BoM, to increase their public shareholding to 25 percent by August 1, 2026. This directive is in adherence to the Securities Contract Rules issued by the Securities and Exchange Board of India (SEBI), which stipulate that all listed companies, including public sector entities, must maintain a minimum public shareholding of 25 percent. SEBI has granted forbearance to Central Public Sector Enterprises (CPSEs) and public sector financial institutions until August 2026 to comply with this regulation.

Currently, the government holds a significant 79.6 percent stake in the Pune-headquartered bank. BoM's public shareholding recently increased to 20.4 percent from 13.5 percent at the end of September, following a successful Qualified Institutional Placement (QIP) in October that raised ₹3,500 crore. According to Saxena, if the bank raises approximately ₹2,000-2,500 crore, based on its current market capitalization, the government's holding would fall below the 75 percent mark. The bank has already secured approval for a broader ₹7,500 crore fundraise, encompassing both debt and equity, to ensure it has sufficient headroom.

The exact mechanism for the upcoming fundraising is still under evaluation, with the bank considering either a qualified institution route or an offer for sale route. BoM is considered relatively well-positioned among the five public-sector banks tasked with reducing government stake. Other banks facing similar mandates include Indian Overseas Bank (government holding 94.6 percent), Punjab & Sind Bank (93.9 percent), UCO Bank (91 percent), and Central Bank of India (89.3 percent).

In terms of financial performance, Bank of Maharashtra reported a net profit of ₹1,593 crore in the June quarter, marking a 23 percent increase, primarily driven by a rise in interest income. Saxena also noted that the bank is not overly concerned about a potential fall in treasury income during the July-September quarter, an sentiment shared by many of its peers. Furthermore, transactions on the Reserve Bank of India's Unified Lending Interface are showing signs of picking up, albeit at a slower pace initially, with expectations for improvement over time.

You may also like...

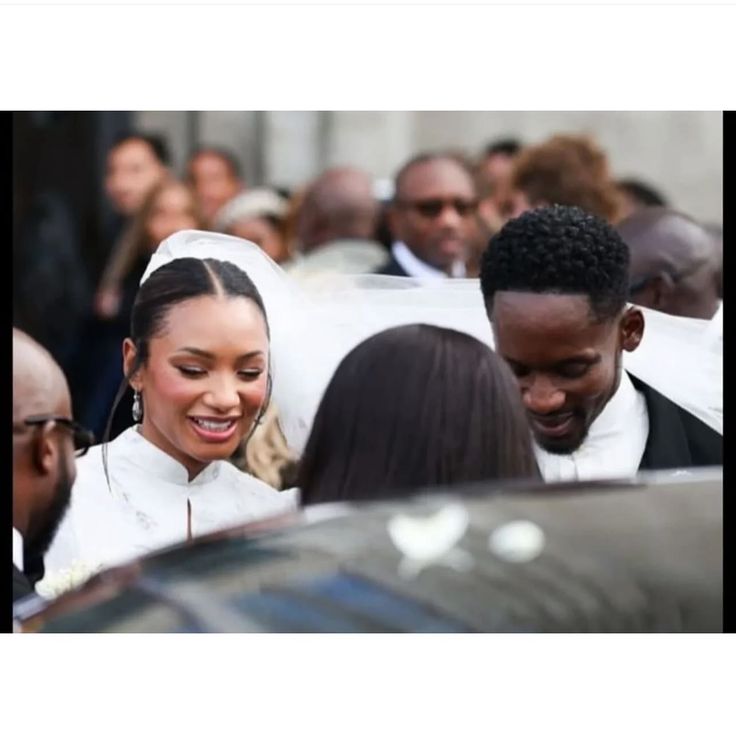

From Otedola to Ajibade: Love, Legacy, and the Politics of a Name

Temi Otedola has changed her surname to Temi Ajibade after marrying Mr Eazi, sparking a nationwide debate on feminism, l...

Boxing World Erupts! Canelo vs. Crawford Super-Fight Set to Define Legacies

Boxing history is set to be made on September 13 as two pound-for-pound greats, Canelo Alvarez and Terence Crawford, col...

Nigeria's Super Falcons Reign Supreme! Historic 10th WAFCON Title Ignites National Pride

)

Nigeria's Super Falcons clinched their record-extending 10th Women's Africa Cup of Nations title with a dramatic 3-2 com...

Conjuring: Last Rites Dominates Box Office, Unleashing Horror Havoc!

The alleged finale of "The Conjuring" franchise, "Last Rites," has shattered box office records, becoming the highest-gr...

Who Will Be the Next 007? James Bond Speculation Heats Up!

Speculation surrounding the next James Bond is intensifying, with British actor Mike Dickman emerging as a surprise fron...

2025 MTV VMAs Electrifies Audiences: Full List of Performers, Winners & Record Viewership Revealed!

The 2025 MTV Video Music Awards, broadcast for the first time on CBS, achieved record viewership and social media engage...

African Music Royalty Reigns: Burna Boy & Davido Dominate AFRIMA 2025 Nominations!

The All Africa Music Awards (AFRIMA) 2025 nominations have been announced, following a record-breaking 10,717 entries an...

Fatherhood Dream: Pete Davidson and Elsie Hewitt Expecting First Child

Comedian Pete Davidson and model Elsie Hewitt are expecting their first child, a joyful announcement Hewitt made on Inst...