Kenya's Risky Insurance Gamble Provides Africa's Crypto Market with a Safety Net.

Ask any young African crypto trader what his worst nightmare is, and chances are that he will not say volatility. He will say the ghost-wallet hack, the exit-scam exchange, or the worst moment when a platform suspends their funds.

These traders trade in the virtual Wild West, betting not only on the value of assets but on whether the platforms that they trade from are safe.

Kenya is on the verge of becoming the sheriff. Nairobi regulators are drafting a plan to launch digital asset insurance which is an insurance cover that would insure crypto users and exchanges against hacking, fraud, and theft.

If approved, it would be Africa's first, a colossal, game-altering leap toward safe participation in the continent's growing digital economy.

Why Kenya, Why Now?

Kenya has been the fintech hub of Africa for decades. From the M-Pesa revolution to its current position as a hotspot for crypto-remittances and trading, the nation paces digital adoption every step of the way. That dynamism comes at a price, a risk premium.

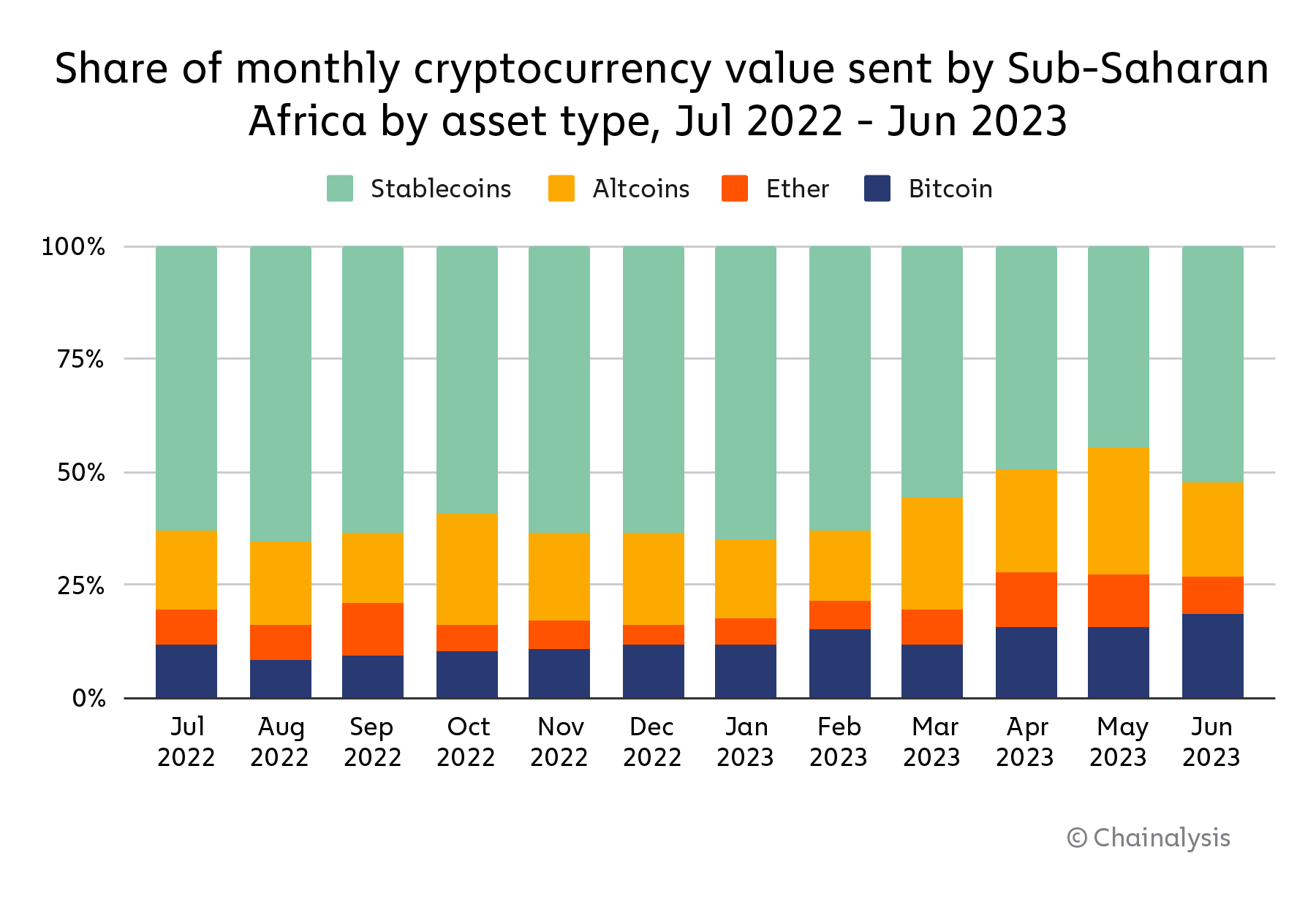

The market has moved beyond a niche hobby. Over 6 million Kenyans are projected to hold or trade digital assets, Chainalysis 2025 statistics indicate, making it one of Africa's most active crypto markets.

With that expansion comes an explosion of scams, exchange breaches, and catastrophic custodial losses, creating a crisis of confidence. To tell people to 'do your own research' when systemic risk is at play is inadequate.

Globally, the idea of a totally regulated crypto-insurance is an exception. There are some scattered experiments, but a structured national system in a big emerging economy like Kenya would be a new regulator maturity level.

From Policing to Protection

The structure is being guided by the Insurance Regulatory Authority (IRA) in collaboration with the Capital Markets Authority (CMA). They wish to regulate the crypto space, but institutionalize another layer of protection as well.

The proposed digital asset insurance will cover against several significant points of failure:

Exchange Hacking and Wallet Breaches: Protect against unauthorized access and theft from central platforms or custodian services.

Fraudulent Schemes Loss: Insurance where a user is fraudulent by a certified platform or service provider (even though it will be hard to establish the parameters of this).

Custody Failures: Asset loss owing to operational failure or insolvency of a regulated crypto platform.

This is not a policy yet; this is a draft that will be subject to a public consultation period prior to industry players and consumer organizations being able to offer their inputs on the nuance of risk pricing and enforcement.

This consultative process is a demonstration of awareness that in an open market like crypto, regulation has to be a dialogue.

A New Precedent for the African Digital Economy

This is a bold statement. It is the first official recognition of crypto assets in insurance law on the continent.

By insuring, Kenyan regulators are by implication stepping beyond the initial shock of flat bans or severely limiting digital assets. They are transitioning from being policemen to custodians of an asset class.

This regulatory guarantee could be the tipping point for institutional investors and mainstream fintechs that are reluctant to enter the market due to the high, unregulated risk.

Further, a successful case in Nairobi would naturally create pressure and impetus on regulators of other high-adoption African nations like Nigeria, South Africa, and Ghana to follow suit.

The Implementation Hurdle: Pricing the Unpredictable

The largest challenge is that crypto is actuarial in nature. How do you quantify the risk of an asset that is moving up or down 20% in a single day, or a security breach in a distributed system which exists everywhere in the world?

"The information is the issue," says a Nairobi financial analyst. "Insurance relies on past frequency and severity of loss. For crypto, there is not much data available, it is siloed, and the technology is always evolving. Insurers will need to be highly innovative and conservative initially in their models for risk."

Crypto exchange operators, while welcoming the additional trust which the policy will enable, are also keenly aware of the cost.

The premiums to get adequate cover will be steep, and these will ultimately pass through to the consumer. But for a business which wants to raise capital and to be able to reassure clients, that premium is a fair marketing and compliance expense.

Kenya's Unique Stance

While countries like the US, Singapore, and Japan have already begun piloting small, private-sector crypto insurance products, Kenya's is unique in that it is regulation-driven and consumer- and system-protection oriented at a national level.

This is a deviation from the focus by much of the global regulation on placing Anti-Money Laundering (AML) and investor accreditation first. Kenya is, in essence, saying: we see you, we are aware that you're dealing, and we're providing a security blanket around you.

If Kenya succeeds in proposing a successful model for covering digital assets, then it will have written the first page of the book on sound crypto regulation for emerging markets.

For the future of Africa's digital economy, where protection trails behind innovation, harmony between blistering growth and greater security might be just everything.

Recommended Articles

You may also like...

If Gender Is a Social Construct, Who Built It And Why Are We Still Living Inside It?

If gender is a social construct, who built it—and why does it still shape our lives? This deep dive explores power, colo...

Be Honest: Are You Actually Funny or Just Loud? Find Your Humour Type

Are you actually funny or just loud? Discover your humour type—from sarcastic to accidental comedian—and learn how your ...

Ndidi's Besiktas Revelation: Why He Chose Turkey Over Man Utd Dreams

Super Eagles midfielder Wilfred Ndidi explained his decision to join Besiktas, citing the club's appealing project, stro...

Tom Hardy Returns! Venom Roars Back to the Big Screen in New Movie!

Two years after its last cinematic outing, Venom is set to return in an animated feature film from Sony Pictures Animati...

Marvel Shakes Up Spider-Verse with Nicolas Cage's Groundbreaking New Series!

Nicolas Cage is set to star as Ben Reilly in the upcoming live-action 'Spider-Noir' series on Prime Video, moving beyond...

Bad Bunny's 'DtMF' Dominates Hot 100 with Chart-Topping Power!

A recent 'Ask Billboard' mailbag delves into Hot 100 chart specifics, featuring Bad Bunny's "DtMF" and Ella Langley's "C...

Shakira Stuns Mexico City with Massive Free Concert Announcement!

Shakira is set to conclude her historic Mexican tour trek with a free concert at Mexico City's iconic Zócalo on March 1,...

Glen Powell Reveals His Unexpected Favorite Christopher Nolan Film

A24's dark comedy "How to Make a Killing" is hitting theaters, starring Glen Powell, Topher Grace, and Jessica Henwick. ...