India Fintech Market Research Reports 2025: Industry Size, Share, Growth Trends, Key Players, Forecast & Opportunities by 2033

2024

2025-2033

2019-2025

USD Million

USD 121.4 Billion

USD 550.9 Billion

%

As indicated in the latest market research report published by IMARC Group, titled “” this report provides an in-depth analysis of the industry, featuring insights into the market. It encompasses competitor and regional analyses, as well as recent advancements in the market.

The India fintech market size was valued in 2024. By 2033, this figure is projected to reach around , with a over the forecast period (2025-2033).

The India Fintech Market is undergoing rapid changes owing to the use of new technologies, growing adoption of digital services, and favorable government initiatives. The increase in the volume of digital payments is among the most striking changes and is made possible due to the adoption of UPI (Unified Payments Interface) which transformed person-tomerchant and person-to-person payments. Also, the proliferation of neobanks and lending startups is redefining the banking sector as they offer finservices that are instant, paperless, and seamless. In addition, the provision of finance is nosediving as embedded finance (where payments are integrated into nonfinance services such as ecommerce, or ride-hailing) is becoming popular due to its added customer ease.

Another notable development is the adoption of blockchain and AI technologies enhancing security, fraud detection and tailored financial advice. Also, the innovation policy of RBI through regulatory sandboxes is allowing Fintech companies to innovate by testing within constraining boundaries fintech products. The passing of the smartphone as well as inexpensive internet have also accelerated the taking hold of Fintech academical in rural and semi urban areas. In addition, the focus on inclusion gaps by means of technology is narrowing gaps in the provision of credit, insurance and even investment to the deprived people. With these trends, India Fintech Market is now ready to transform the financial services industry by providing the same at lower cost, greater efficiency and better customer service.

https://www.imarcgroup.com/india-fintech-market/requestsample

The India Fintech Market is poised for robust growth due to the gaping opportunity of an unbanked population, growing disposable income levels, and a younger demographic that is comfortable with technology. One of the rapidly expanding segments is digital lending, where fintechs are serving individuals and SMEs with non-existent credit profiles through alternative data and AI-based underwriting. In addition, the insurance technology (InsurTech) industry is growing at a remarkable pace as it provides off-the-shelf insurance products on a pay-as-you-go basis via digital channels. Furthermore, wealth-tech platforms are increasingly popular due to rising demand from Indians for automated and low-cost investment services offered by robo-advisors and micro-investment apps.

In addition, the government’s drive for a cashless economy, Digital India initiative, and Jan Dhan Yojana have all accelerated the adoption of fintech’s services. Moreover, the collaboration of conventional banks with fintech firms bring together trust and innovation, improving the quality of service provision. There is increasing foreign direct investment and venture capital in Indian fintech, signifying the confidence in the opportunities this market offers. Strengthening cyber security and data privacy laws in India is also increasing trust among consumers, making it easier to sustain growth. The India Fintech Market will keep advancing in meeting the diverse financial needs of consumers in urban and rural areas while penetrating deeper into emerging economies as a result of innovation, favorable policies, and a diverse range of services.

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

https://www.imarcgroup.com/request?type=report&id=10442&flag=C

Why Choose IMARC Group:

- Tailored Solutions to Meet Client Needs

- Commitment to Strong Client Relationships and Focus

- Timely Project Delivery

- Cost-Effective Service Options

Note: Should you require specific information not included in the current report, we are pleased to offer customization options to meet your needs.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

Americas: +1 631 791 1145 | Africa and Europe: +44-702-409-7331 | Asia: +91-120-433-0800

You may also like...

How Technology, Equity, and Resilience are Reshaping Global Healthcare

The global healthcare system is undergoing a profound transformation, driven by technological leaps, a renewed focus on ...

A World Unwell: Unpacking the Systemic Failures of Global Health

From recurring pandemics to glaring inequities, the global health system is under immense strain. This article explores ...

Sapa-Proof: The New Budget Hacks Young Nigerians Swear By

From thrift fashion swaps to bulk-buy WhatsApp groups, young Nigerians are mastering the art of sapa-proof living. Here ...

The New Age of African Railways: Connecting Communities and Markets

(5).jpeg)

African railways are undergoing a remarkable revival, connecting cities, boosting trade, creating jobs, and promoting gr...

Digital Nomadism in Africa: Dream or Delusion?

For many, networking feels like a performance — a string of rehearsed elevator pitches and awkward coffee chats. But it ...

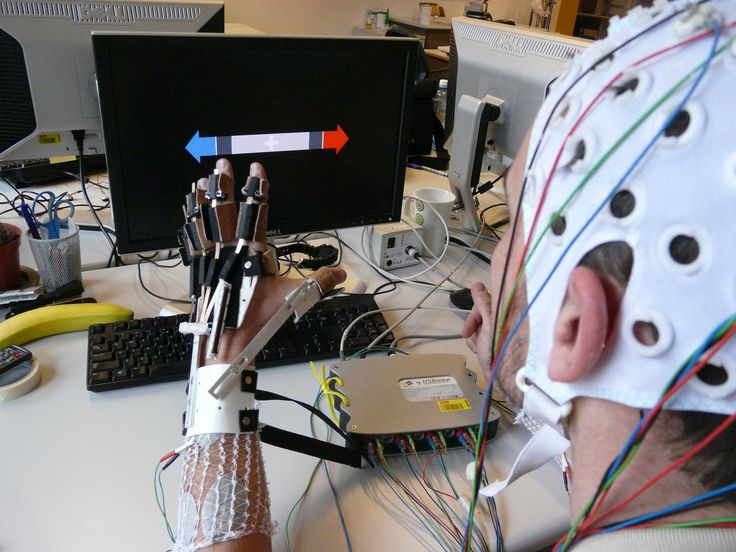

The Ethics of Brain-Computer Interfaces: When Technology Meets the Mind

This piece redefines networking as a practice rooted in curiosity, generosity, and mutual respect, sharing stories from ...

Carthage: The African Power That Challenged Rome

Long before Rome became the undisputed master of the Mediterranean, it faced a formidable African rival whose power, wea...

Africa’s Oldest Seat of Learning: The Story of al-Qarawiyyin

Long before Oxford or Harvard opened their doors, Africa was already home to a seat of learning that would shape global ...