Ghana's Cedi at 60: Government Vows Stability Amidst Economic Turnaround

Ghana is commemorating the 60th anniversary of its national currency, the Cedi, with celebrations beginning on Tuesday, October 28, 2025. The milestone is marked by a series of national events themed “Sovereignty, Stability, and Economic Resilience,” with the official launch held at the Accra International Conference Centre. The anniversary serves as a crucial moment for reflection and a national call to safeguard Ghana's monetary independence and economic sovereignty. Distinguished leaders, including Vice President Professor Naana Jane Opoku-Agyemang, Governor of the Bank of Ghana Dr. Johnson Asiama, and Minister for Finance Dr. Cassiel Ato Forson, have underscored the Cedi's enduring significance as a symbol of national identity and resilience.

Before Ghana's independence, the West African Currency Board (WACB) was responsible for issuing currency, with the West African pound, shillings, and pence serving as legal tender until July 1958. Following independence, the newly established Bank of Ghana assumed its role as the nation’s monetary authority. On July 14, 1958, Ghana issued its first national currency, comprising Ghana pounds, shillings, and pence, thereby officially taking over currency issuance from the WACB.

A pivotal moment in Ghana’s monetary history occurred in early 1965 when the nation transitioned from the British colonial monetary structure to the decimal system. On July 19, 1965, the Cedi notes and Pesewa coins were introduced, replacing the Ghana pounds, shillings, and pence. The initial Cedi was valued at eight shillings and four pence (8s 4d) and prominently featured the portrait of then-President Dr. Kwame Nkrumah. The name "Cedi" originates from the word "sedie," meaning cowrie, a shell historically used as currency in parts of West Africa, while "Pesewa" represented the smallest unit of value during the gold-dust trading era, replacing the British penny.

Following the overthrow of the Convention People’s Party (CPP) government in 1966, the military administration introduced the "New Cedi" (N¢) on February 17, 1967, which replaced the old Cedi at a rate of ¢1.20 to N¢1.00 and removed Nkrumah's portrait. This currency reverted to being simply called the Cedi in March 1973. A demonetisation exercise took place on March 9, 1979, with the introduction of new Cedi notes that replaced existing ones at a discount, effective 30% for amounts up to ¢5,000 and 50% for amounts exceeding ¢5,000. New denominations included ¢1, ¢2, ¢5, ¢10, ¢20, and ¢50. Between 1965 and 2002, the Bank of Ghana progressively issued a wider range of denominations, from ¢1 to ¢5,000 for notes and from ½P to ¢500 for coins, with higher-value notes like ¢10,000 and ¢20,000 introduced by 2002 to accommodate inflation and larger transactions.

In a significant currency reform in July 2007, the Bank of Ghana redenominated the Cedi, introducing the Ghana Cedi (GH¢) at a rate of GH¢1 to ¢10,000. This move aimed to simplify transactions, reduce the volume of cash in circulation, and restore public confidence in the currency. New notes in denominations of GH¢1, GH¢5, GH¢10, GH¢20, and GH¢50 were introduced, alongside coins of 1Gp, 5Gp, 10Gp, 20Gp, and 50Gp. This modern version of the Cedi remains Ghana’s legal tender today, with additional denominations such as GH¢100 and GH¢200 notes later introduced to facilitate higher-value transactions in an expanding economy. Throughout its history, the Cedi has undergone continuous transformation, integrating advanced security features, commemorative notes, indigenous Adinkra symbols, and portraits of national heroes, reflecting Ghana’s story of resilience, innovation, and pride.

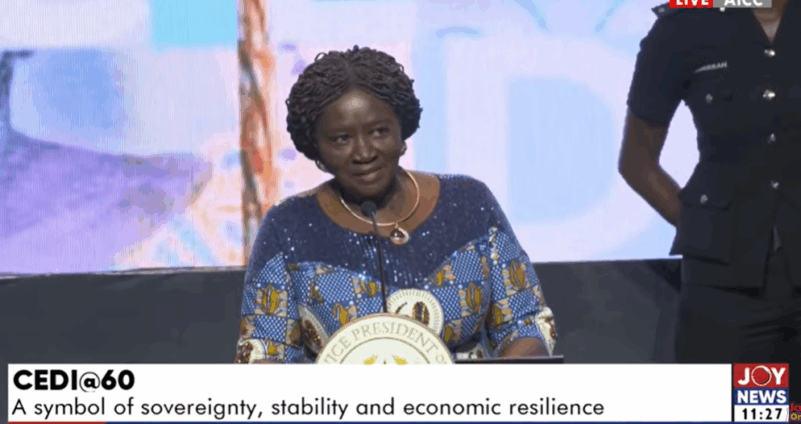

Vice President Professor Naana Jane Opoku-Agyemang has strongly urged Ghanaians to safeguard the independence of the Bank of Ghana, deeming it essential for macroeconomic stability and preserving the value of the Cedi. She emphasized that the central bank’s autonomy is crucial for maintaining economic confidence and sustaining progress, stating, “We must protect the independence of the central bank. The Bank of Ghana must remain a steward of stability.” The Vice President also lamented the increasing practice of quoting goods and services in foreign currencies, stressing the importance of upholding the Cedi’s legal tender status: “If you earn in cedis, you must be able to transact in cedis.” She commended the Bank of Ghana for its regulatory efforts concerning virtual asset service providers, promotion of fintech innovations, and the rollout of the eCedi. Furthermore, she called for deeper collaboration between the Bank of Ghana, commercial banks, and the business community to make Cedi transactions more seamless and accessible, both domestically and across borders, and to sustain gains in currency stabilization. Professor Opoku-Agyemang also urged the Ministry of Finance to maintain strict fiscal responsibility, highlighting that "monetary stability can only be effective when supported by sound fiscal policies."

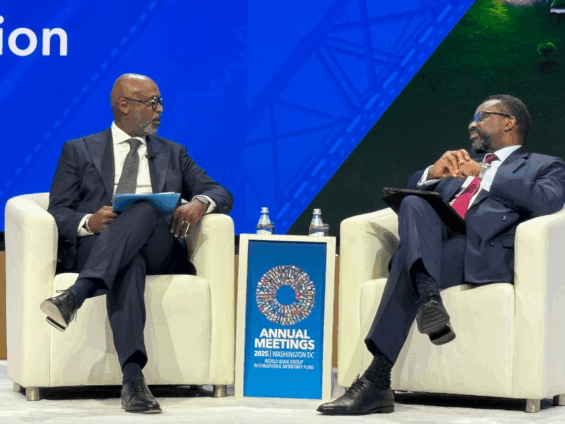

Dr. Johnson Asiama, Governor of the Bank of Ghana, declared that Ghana must intensify efforts to defend the Cedi and uphold its monetary independence, asserting that the Cedi@60 anniversary is a national call to protect hard-won economic sovereignty. He highlighted significant progress in restoring economic stability, presenting compelling evidence of recovery, including a continuous decline in headline inflation and a strong appreciation of the Cedi by 37 percent as of October 17, 2025. Dr. Asiama affirmed the Bank’s unwavering commitment to sustaining these gains through prudent and forward-looking policy interventions aimed at maintaining price stability, strengthening the Cedi, and fostering overall economic growth. He emphasized that the Cedi is far more than just a currency; it is a "trusted store of value and a daily emblem of Ghana’s collective confidence and determination to shape its own destiny."

Dr. Cassiel Ato Forson, the Minister for Finance, reaffirmed the government’s commitment to maintaining the stability of the Ghana Cedi and urged citizens to actively support efforts to protect it from undermining practices. He emphatically stated that the Ghana Cedi remains the nation's sole legal tender, cautioning against the prevalent trend of pricing goods and services in foreign currencies, particularly the US dollar. According to Dr. Forson, such practices weaken confidence in the Cedi, distort the local market, and fuel exchange rate pressures. "Let me use this opportunity to once again stress that as Ghanaians, the Ghana Cedi remains the only legal tender; the US dollar is not our currency; the Cedi is our only currency," he declared. He stressed that while the government is implementing fiscal discipline to strengthen the Cedi, citizens bear a responsibility to "maintain the sanctity of the Cedi as legal tender by preserving it with dignity and protecting it jealously." The Minister called for patriotism, urging all citizens, traders, and institutions to reinforce the Cedi's use in daily economic activity and to "talk about the Cedi with pride not as a burden."

You may also like...

How to Navigate a Career Switch Without Starting Over

Changing careers doesn’t have to mean losing progress. With the right strategy, it’s possible to move into a new field c...

Top Skills That Will Future Proof Your Career

In a fast-changing world of work, staying relevant takes more than talent, it takes the right skills to future proof one...

The Tragic Case of Ochanya Elizabeth Ogbanje: From Abuse to Death and the Fight for Justice

The story of 13-year-old Ochanya Elizabeth Ogbanje: Her years of alleged sexual abuse, death in October 2018, how the ca...

Redefined Career Paths: The State of Work Across Africa in Late 2025.

From entrepreneurial partnerships to digital startups, millions of young people are redefining what it means to have a c...

Digital Banking Platforms and the Financial Future of African Freelancers and Remote Workers

There is a revolution in the African Digital Economy. With a new generation of remote workers, digital banking platforms...

Breaking Barriers: How Women-Centered FinTech is Empowering Africa’s Entrepreneurs

Women-centered Fintechs in Nigeria and across Africa have taken the initiative in transforming the idea of financial inc...

A Wired Decade: Africa Rebuilt Itself Through Technology 2015–2025

Over the past decade, Africa has quietly assembled one of the most dynamic digital ecosystems in the world.

AI Tokens: The New Spoiler in the Crypto Market Drama

AI tokens were once the hottest trend in crypto until they led a sudden market pullback. This article explores how hype,...