Digital Banking Platforms and the Financial Future of African Freelancers and Remote Workers

In recent years, Africa’s digital economy has experienced a silent revolution, one powered not by governments or large corporations, but by a new generation of freelancers and remote workers. These professionals, designing graphics from Lagos, coding from Nairobi, or offering voice-over services from Accra, are part of a global workforce that transcends borders. Yet, for many years, one challenge held them back, getting paid easily and securely in foreign currency.

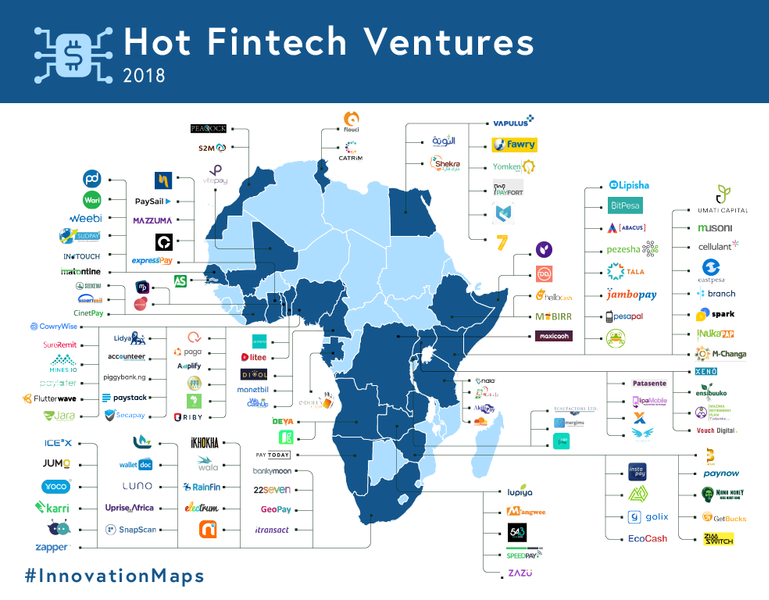

This gap is what digital banking platforms like Cleva, Grey, Lemonade Finance, and Raenest formerly Geegpay are now bridging, marking a turning point in Africa’s fintech story.

The Rise of Fintech for Freelancers

According to theWorld Bank’s 2024 Remittance Report, Africa receives over $100 billion annually in remittances and cross-border payments. However, freelancers and remote workers, a growing segment of this inflow have long faced difficulties accessing USD accounts, high transaction fees, and unfavorable exchange rates.

Traditional banks were never built to serve them. Setting up a foreign currency account required excessive paperwork and time, while receiving payments from international clients often involved delays or blocked transactions.

Enter the new generation of digital banking platforms. These fintech innovators provide virtual USD, GBP, and EUR accounts that allow users to receive international payments directly, just like a local bank account abroad. Platforms like Cleva and Grey offer transparent exchange rates, instant transfers, and integrations with PayPal, Upwork, and Deel. “Cleva was built to give African remote workers and freelancers the freedom to earn and save in USD,” says Cleva co-founder Akinyemi Odejimi, in an interview with TechCabal (2024). “We are solving the problem of financial inequality one transaction at a time.”

How These Platforms Work

Digital banking platforms leverage fintech infrastructure and partnerships with global financial institutions to create borderless financial systems. Through APIs, digital KYC verification, and virtual card issuance, users can open accounts in minutes.

For instance:

Cleva provides USD accounts and debit cards with access to global merchants.

Grey allows conversion between USD, GBP, and NGN seamlessly.

Lemonade Finance supports instant transfers across multiple African countries.

Each transaction is encrypted and regulated under international anti-money laundering (AML) standards, with compliance supervised by regional fintech regulators such as the Central Bank of Nigeria (CBN) and the Financial Conduct Authority (FCA) in the UK.

This is good for;

1. Financial Inclusion: Millions of Africans who previously had no access to global financial systems can now receive payments without intermediaries.

2. Economic Empowerment: Freelancers and entrepreneurs can now participate in the global gig economy confidently.

3. Reduced Brain Drain: Remote work powered by fintech allows skilled Africans to work for international companies without leaving the continent.

4. Boost to Local Economies: More foreign currency inflows strengthen local purchasing power and entrepreneurial growth.

The African Development Bank (AfDB) projects that digital payments could contribute $300 billion annually to Africa’s GDP by 2025 if adoption continues at this pace.

Regulation and Future Challenges

While these fintech platforms are solving key financial problems, regulatory uncertainty remains a major concern. Many African countries still operate with outdated financial frameworks that don’t fully accommodate cross-border digital banking.

In 2025, the Nigerian House of Representatives proposed a Fintech Regulatory Commission Bill, aimed at balancing innovation with consumer protection, a move applauded by industry leaders. Once passed, it could provide clearer rules for data protection, currency conversion, and platform accountability.

With over 40% of Africa’s workforce projected to engage in freelance or remote work by 2030 (according to GSMA Intelligence, 2024), digital banks will play a critical role in the continent’s economic transformation.

Platforms like Cleva and Grey are expanding beyond Nigeria into Ghana, Kenya, and Uganda. The goal is not just to simplify payments but to build a financial ecosystem, one where African talent can earn globally, save intelligently, and invest locally.

The fintech revolution in Africa is no longer a prediction, it is happening now. For freelancers, creators, and remote professionals, digital banking platforms represent freedom, fairness, and financial access. They are not just apps; they are bridges to a new financial future, one that is borderless, empowering, and distinctly African.

You may also like...

How to Navigate a Career Switch Without Starting Over

Changing careers doesn’t have to mean losing progress. With the right strategy, it’s possible to move into a new field c...

Top Skills That Will Future Proof Your Career

In a fast-changing world of work, staying relevant takes more than talent, it takes the right skills to future proof one...

The Tragic Case of Ochanya Elizabeth Ogbanje: From Abuse to Death and the Fight for Justice

The story of 13-year-old Ochanya Elizabeth Ogbanje: Her years of alleged sexual abuse, death in October 2018, how the ca...

Redefined Career Paths: The State of Work Across Africa in Late 2025.

From entrepreneurial partnerships to digital startups, millions of young people are redefining what it means to have a c...

Digital Banking Platforms and the Financial Future of African Freelancers and Remote Workers

There is a revolution in the African Digital Economy. With a new generation of remote workers, digital banking platforms...

Breaking Barriers: How Women-Centered FinTech is Empowering Africa’s Entrepreneurs

Women-centered Fintechs in Nigeria and across Africa have taken the initiative in transforming the idea of financial inc...

A Wired Decade: Africa Rebuilt Itself Through Technology 2015–2025

Over the past decade, Africa has quietly assembled one of the most dynamic digital ecosystems in the world.

AI Tokens: The New Spoiler in the Crypto Market Drama

AI tokens were once the hottest trend in crypto until they led a sudden market pullback. This article explores how hype,...